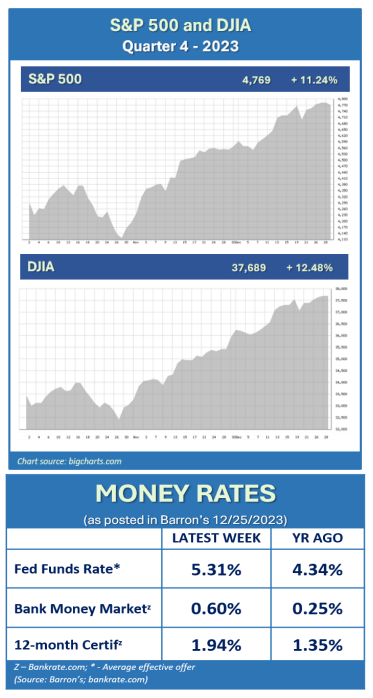

2023 is in the books and the last quarter left investors looking forward to a bright and happy new year. Historically, equities typically have advanced in the fourth quarter, and we can now add 2023 to that statistic. We entered the fourth quarter with strong momentum, including a healthy labor market and easing inflation pressures. The S&P 500 was up nine weeks straight in the fourth quarter and ended the year with a gain of more than 24%. The Dow Jones Industrial Average (DJIA) reached an all-time high and ended the quarter at 37,689, up more than 13% for the year. (Source: Barron’s 1/1/2024; cnbcnews.com, 12/29/23)

These increases were primarily attributed to the Federal Reserve signaling a pivot from its aggressive monetary position and indicating that interest rates could be cut several times in 2024. The Federal Reserve left interest rates unmoved in the fourth quarter due to the continued slowdown of inflation. “Inflation has eased from its highs, and this has come without a significant increase in unemployment. That’s very good news,” stated Fed Chair Jerome Powell during a news conference following the December FOMC meeting. Fed officials see core inflation finishing 2023 at 3.2%, and 2.4% in 2024, then to 2.2% in 2025, resting at a final destination of 2% in 2026. (Source: cnbc.com, 12/12/23)

The last quarter of 2023 could have been a pivoting point for equities. Over the past few years, the primary focus for investors has been inflation and interest rates, and many hunkered down with a focus on retention, not gains. If interest rates begin to stabilize, this could help support higher stock valuations and provide potential reentry points in 2024. A soft economic landing might come to fruition in the coming year. Inflation stabilizing or becoming stagnant, lower interest rates, a strong labor market, and confident consumer spending are all positive news. These are a few of the items investors can be grateful for. However, with optimism abounding and investors potentially beginning to come out of the shadows, this is not the time to throw caution to the wind. 2024 brings a presidential election, geopolitical unrest continues, and pandemic-era savings are dwindling.

As your financial professionals, we are committed to keeping you apprised of any changes and activity that could directly affect your unique situation. While 2023 rewarded our focus of being disciplined with our long-term equity investments, we enter 2024 with our continued mantra of “proceed with caution.” Now is a good time to review your investments and confirm they are still congruent with your time horizon, risk tolerance, and goals.

Click here to download a PDF of this report.