With the first presidential debate behind us, it’s safe to say election season is in full swing. While last week’s debate was light on economic policies, the future of tax policy (along with potential efforts to arrest elevated federal deficits) could have broad implications for the municipal (muni) market — some good, some not so good. With the Tax Cuts and Jobs Act (TCJA) set to sunset in 2025, the election will go a long way in determining the future of tax policy in the U.S. And for muni securities and their unique tax-exemption characteristics, the election will go a long way in determining future demand for the asset class. But with the Federal Reserve (Fed) embarking on a rate cutting cycle likely starting this week, the next few months could be the last “best time” to buy munis, regardless of changes to tax policy.

Spending > Income = Deficits

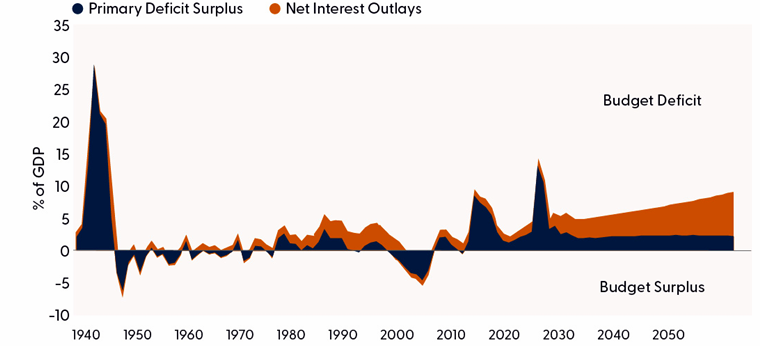

While there are still several months until the election is decided, the expectation is that regardless of who ultimately becomes our 47th president, the biggest loser could be the fiscal deficit. Per the Congressional Budget Office (CBO), the U.S. government is expected to run sizable deficits over the next decade — to the tune of 5% – 7% of gross domestic product (GDP) each year. According to the CBO, the deficit increases significantly in relation to GDP over the next 30 years, reaching 8.5% of GDP in 2054. That growth results from rising interest costs and large and sustained primary deficits. CBO deficit projections assume the personal tax cuts within the TCJA will expire at the end of 2025, so deficits are likely to be even higher assuming either Kamala Harris or Donald Trump will extend most, if not all, of the tax cuts. If tax cuts are fully extended, budget deficits are expected to be in the 7%–8% range of GDP over the next decade. Deficits will remain elevated regardless of who is in the White House in 2025, even without new spending or tax cuts due to higher spending on Medicare and Social Security plus the (growing) interest expense on the (growing) debt pile.

Deficit Spending Expected to Stay Elevated

Source: LPL Research, CBO, 08/21/24

Past performance is no guarantee of future results.

Any forecasts set forth may not develop as predicted.

The reason? Mandatory spending now makes up 62% of total outlays (as of 2023) with interest expense on existing debt an additional 10% of spending. That results in roughly only 28% of federal outlays that could seemingly be reduced. However, defense outlays fall within that 28% discretionary spending bucket as well, so the ability to seriously reduce outlays is limited. According to the CBO and the Committee for a Responsible Federal Budget, to balance the federal budget by 2033, 85% of all spending (excluding defense, veterans, Social Security, and Medicare) would need to be cut. Seems unlikely. But regardless of the party composition of Congress or the White House, the deficit will likely remain broadly unchanged in coming years — and even increase a bit if the TCJA tax cuts are extended at the end of 2025.

TCJA on the Cutting Block?

The TCJA, which became law in 2018, is set to sunset in 2025. Similar to other “temporary” laws, the TCJA will need to be renewed through legislative action. The TCJA legislation reduced top marginal income tax rates, expanded tax brackets, and encouraged corporate capital investment. If Donald Trump wins the election and Congress is controlled by Republicans, many TCJA provisions are more likely to be extended. If Democrats control the government, it becomes more likely that portions of the legislation will be allowed to expire or be modified.

The TCJA reduced the top marginal income tax rate for individuals to 37% from 39.6%. If the TCJA sunsets, the highest marginal tax rate would revert to 39.6%. Including the 3.8% Affordable Care Act (ACA) tax, the top marginal rate would increase to 43.4% (from 40.8% currently).

While tax law doesn’t necessarily impact index yields, it does impact the tax-equivalent yield of an index or individual bond. The current yield on the Bloomberg Municipal Bond Index is around 3.4%. However, using existing tax rates, the tax-equivalent yield for the muni bond index is around 5.7%, which is above longer term averages. If the TCJA were to expire and marginal tax rates increased to 43.4% (including the ACA tax), the tax-equivalent yield on the index would increase to closer to 6%. A muni bond’s taxable-equivalent yield increases as tax rates rise. In other words, the tax exemption on muni bonds is more valuable for individuals who pay higher taxes. As such, we would expect increased demand for munis in a higher tax environment, all else equal.

Tax-Equivalent Yields are Above Longer-Term Averages

*Assumes tax rate of 40.8%

Source: LPL Research, Bloomberg, 09/06/24

All indexes are unmanaged and cannot be invested into directly.

Past performance is no guarantee of future results.

While the personal income tax component of the TCJA is important, there are other provisions that could impact the demand for munis as well.

- Alternative Minimum Tax (AMT) Eligibility: The TCJA enacted a higher AMT exemption and increased the income level at which the exemption begins to phase out. Estimates suggest the TCJA reduced the number of taxpayers subject to the AMT to just 200,000 in 2018 from more than 5 million in 2017. Projections now suggest that if the TCJA expires, the number of taxpayers subject to the AMT would significantly increase from the current level, still near 200,000, to 7.6 million taxpayers in 2026.

- State and Local Tax (SALT) Deductions: TCJA’s $10,000 limit on SALT deductions has generally made the tax-advantaged benefit of muni bonds more attractive, especially in states with higher property taxes. But without changes, the cap will sunset at the end of 2025 and the SALT deduction will become unlimited again, reducing the attractiveness of munis.

- Corporate Tax Rates: While retail investors are the predominate investor base, banks and insurance companies are also, at times, large investors in munis, so corporate tax rates matter as well. Harris has advocated to raise the corporate tax rate from the TCJA’s current 21% to 28%, whereas Trump recently proposed a 15% corporate tax rate but would be in favor of keeping the current 21% rate as well. Higher corporate tax rates would likely compel banks and insurance companies to increase their use of munis in portfolios.

- Muni Tax Exemption: As mentioned earlier, the U.S. government has a federal deficit problem. In an effort to offset lost revenue due to tax cuts, past tax discussions have included the repeal of the tax exemption status for munis. The cost to the U.S. Treasury of keeping muni bonds tax-exempt is estimated to be around $40 billion annually, or $400 billion over 10 years. Given the importance of the tax exemption for muni issuers and the paltry “savings” that would come from the elimination of the exemption, it is highly unlikely to be removed. But crazier things have happened with Congress.

Monetary Policy Is More Important than Potential Tax Law

All that said, while tax policy impacts the incremental demand for munis, monetary policy largely determines the level of yields associated with most fixed income markets, munis included. At this week’s Fed meeting, we expect a 0.25% rate cut (although it’s currently a coin flip that the Fed cuts by 0.50%) to take the fed funds rate back down to 5.25% (upper bound). Despite the recent soft payroll report, it likely wasn’t weak enough to prompt the Fed, in our view, to cut more aggressively at this meeting. Along with a slightly hotter inflation report last week, we think the Fed may be more methodical than what markets are currently expecting. However, recent news reports suggest that the Fed itself is still unsure whether to cut rates by 0.25% or 0.50%. The bond market has priced in a fairly aggressive rate cutting cycle, with over 1% of cuts expected this year and an additional 1.5% of cuts expected next year. If the Fed only cuts 0.25%, repricing out the overly dovish market expectations may put upward pressure on bond yields in the near term. But as the Fed embarks on its rate cutting campaign, muni bond yields will likely head lower from current levels.

Seasonal Headwinds on Tap

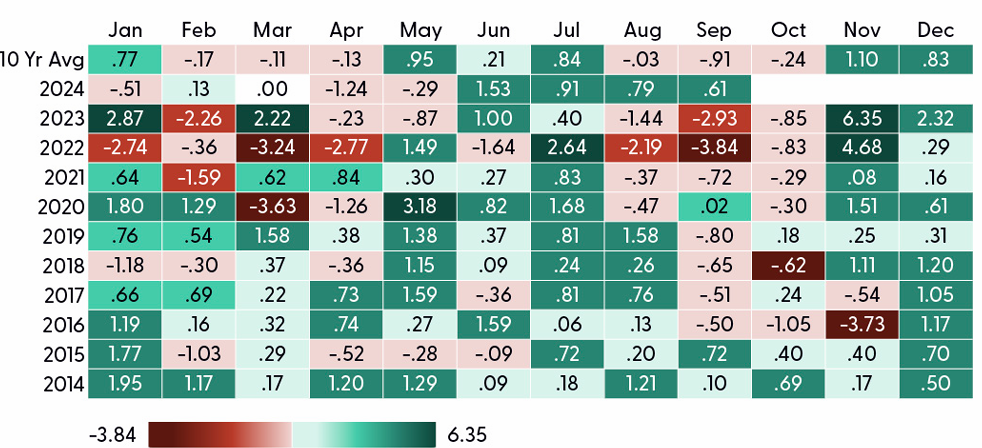

While we wait for the presidential election to play out, muni investors may have to wait a few more months before potential seasonal headwinds abate. Generally, after the summer doldrums, new issuance tends to pick up with September and October as heavy supply months. In the 10 years from 2014 to 2023, September and October ranked highest among average tax-exempt municipal supply months, as issuers sought to complete borrowing plans ahead of the winter holidays. The increase in supply has generally put downward pressure on prices (upward pressure on yields) with September being the most challenging month. Of the past 10 Septembers, only three have generated positive returns for the index. October has been slightly better, with four out of 10 Octobers generating positive returns. However, average tax-exempt supply typically falls to below-average levels from November to January. The reduction in supply has tended to be good for muni returns. Since 2014, the average return for the muni index has been positive from November through January. The silver lining? If history repeats, bond yields may stay elevated, giving muni investors another opportunity to lock in current yields before yields potentially fall throughout the Fed’s rate cutting cycle.

Unfavorable Seasonals May Keep Muni Yields Elevated

Bloomberg Municipal Bond Index Monthly Returns

Source: LPL Research, Bloomberg, 09/06/24

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

Conclusion

So, where does that leave us? It will be several months until we know for sure who the 47th president of the United States is and what their economic policy will entail. If Donald Trump wins the election and Congress is controlled by Republicans, many TCJA provisions are more likely to be extended. If Democrats control the government, it becomes more likely that portions of the legislation will be allowed to expire or be modified. Split government likely means some provisions expire and taxes may be heading higher as well. However, regardless of the occupant at 1600 Pennsylvania Avenue, the federal deficit is likely only going to grow. Mandatory spending programs and increasing interest payments make cutting spending a challenge. That mostly leaves higher tax rates as the “solution”. No one wants to root for higher taxes, but the tax-exempt status of munis become more attractive in those scenarios. Add in favorable fundamentals, still attractive starting yields, and the Fed about to embark on a rate cutting cycle, and we think the muni market is an attractive option for longer-term investors.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral stance on equities, though with a slightly negative bias in the very short term based on the technical setup near record highs on the S&P 500, historical seasonal weakness, and political and geopolitical uncertainty. The Committee expects volatility to remain elevated in the coming months as the market waits for more clarity on the economy, elections, and a better seasonal setup.

Within fixed income, the STAAC recommends an up-in-quality approach with benchmark-level interest rate sensitivity. We think munis are an attractive asset class and history suggests they should perform well in a Fed rate cutting cycle. Investors still concerned about rising Treasury yields and the subsequent spillover into the muni market may be better served by owning individual bonds and/or laddered muni portfolios.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Municipal bonds are subject to availability and change in price. They are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply. If sold prior to maturity, capital gains tax could apply.

All index data from Bloomberg.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0001819-0824W Tracking # 630158 (Exp. 09/25)