Interest rates are important to investors and they are currently at or near all-time lows. At this past June’s Federal Reserve meeting, interest rates were kept at a range of 0%-0.25% and it was indicated that they will remain near zero until the economy recovers from the effects of COVID-19. The central bank stated that the federal funds rates will remain near zero, “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” (Source: usatoday.com 7/29/20)

The discussion of more lockdowns and closures of “non-essential” businesses, surges in COVID-19 cases, and the concern that there is a lack of medical advancement to find a treatment or cure for the virus are still major factors affecting financial markets. With a fear that it will take a long time to return to “business as usual”, the Federal Reserve is anchored on keeping rates low. The Federal Open Market Committee stated, “The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.” The Committee expects to maintain this low target rate for quite some time. (Source: thebalance.com 6/10/20)

The Federal Reserve (Fed) determines the rates at which U.S. banks borrow money. Their changes can produce a ripple effect across the entire economy. As the Fed continues to keep interest rates low for the foreseeable future, investors need to reexamine their portfolios and return expectations.

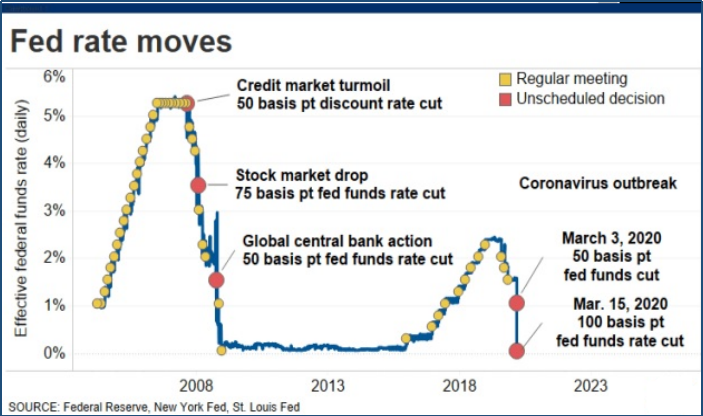

Investors should take note of interest rates as they can have both a positive and negative effect on markets. Central banks often move interest rates in response to economic activity. Historically, rates have been raised when the economy is excessively strong and reduced when the economy is slow.

The all-time low for the Fed Funds Rate is effectively zero. The Fed has only lowered their rate to a range of 0% to 0.25% twice. The first time, during the financial crisis of 2008. The second and most recent lowering was this past March to help lessen the blow of multi-state lockdowns and millions of job losses. After the 2008 lowering, the Fed did not start raising their rate until December 2015. (Source: The Balance, 3/30/20)

Low interest rates can make the yields on bonds less attractive to investors that need and seek returns. With interest rates at or near all-time lows, many investors cannot generate income or meet their long-term goals with a full portfolio of cash and bonds.

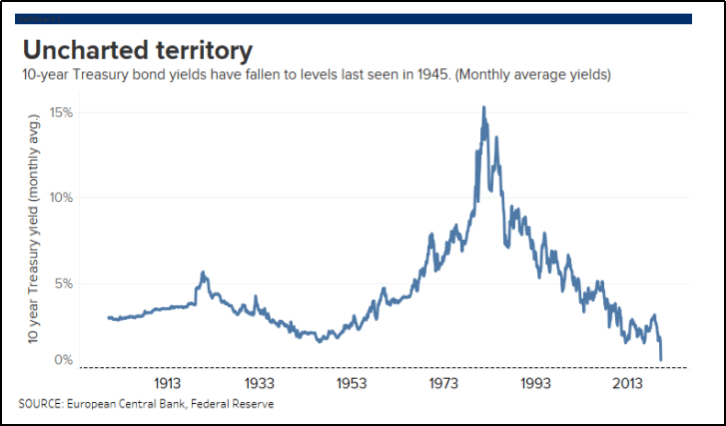

U.S. Treasury Yields

The 10-year U.S. Treasury enjoys a reputation as a “safer” investment for portfolios.

The 10-year U.S. Treasury yield on Wednesday, July 22, was 0.60%, continuing its trend of hitting all-time lows since March of this year. For perspective, on July 22, 2019, it was yielding 2.08%.

On August 1, in response to an overnight 10-year Treasury yield low of approximately 0.52%, Jim Reid, Deutsche Bank’s chief credit strategist said that, “The U.S. has been through depressions, deflations, wars, restrictive gold standard regimes, market crashes and many other major events and never before have we seen yields so low back to when the Founding Fathers formed the country.” With speculation that interest rates will remain low for quite a while, some investors are looking at the slightly better returns of 20-year and 30-year rates, which were also at historically low rates of 1.08-1.29%. (Source: MarketWatch, August 1, 2020)

Since the initial outbreak of the coronavirus in China on December 31, 2019, the 10-year rate has fallen more than 100 basis points. (Source: U.S. Department of Treasury, July 2020)

In an effort to stimulate the economy, the Fed also implied in their statement after their two-day meeting in July that they may also adjust its purchases of Treasury bonds and mortgage-backed securities, which may bring long-term rates even lower. (Source: usatoday.com 7/29/20)

Historically Low Mortgage Rates

Interest rates for 30-year mortgages can be linked with Treasury yields. Since November 2018, the 30-year mortgage rate has dropped by 2 percentage points, down to 2.98%. This is the lowest level it has ever been since Freddie Mac began tracking mortgage rates in 1971. The 15-year fixed mortgage rate fell to 2.48% in July. (Source: Washingtonpost.com 7/16/20)

Many borrowers are taking advantage of these record lows and banks are seeing an uptick in home purchasing and refinances.

Considerations

While many businesses can benefit from borrowing money at lower interest rates, historically, when interest rates are lowered, investors could see:

- Bond prices rising,

- Potential stock market rises,

- Lower interest rates on savings accounts and CDs, and

- Lower mortgage rates.

Conversely, when interest rates rise, investors should be watchful for:

- Bond prices falling,

- Potential stock market declines,

- Higher interest rates on savings accounts and CDs, and

- Mortgage rates rising.

With interest rates at historic lows, many investors subscribe to TINA, meaning There Is No Alternative to stocks – or that equities need to be heavily considered for an investor’s portfolio. For investors looking for more income or retirement cash flow, today’s bond yields are not providing equitable returns. While it is tempting to invest in more higher yielding stocks, equities today are not cheap and even the savviest of investors need to be considerate of risk.

COVID-19 and economic conditions are continuing to cause great uncertainty. However, during any low-interest rate environment, it is always wise to consider the following:

- Make sure your portfolio is properly balanced for your risk tolerance. While interest rates are low, that does not signal for an investor to automatically take on too much risk.

- Review all of your income-producing investments. As wealth managers, we help our clients review their income-producing investments. Our primary goal is to match your portfolio to your timelines and personal financial situation.

- Monitor your portfolio regularly. Investment accounts should be reviewed regularly. Interest rates can move quickly or slowly. We stay apprised of the Fed and its decisions on interest rates so we can suggest adjustments to your portfolio as needed in a timely and educated manner.

Conclusion

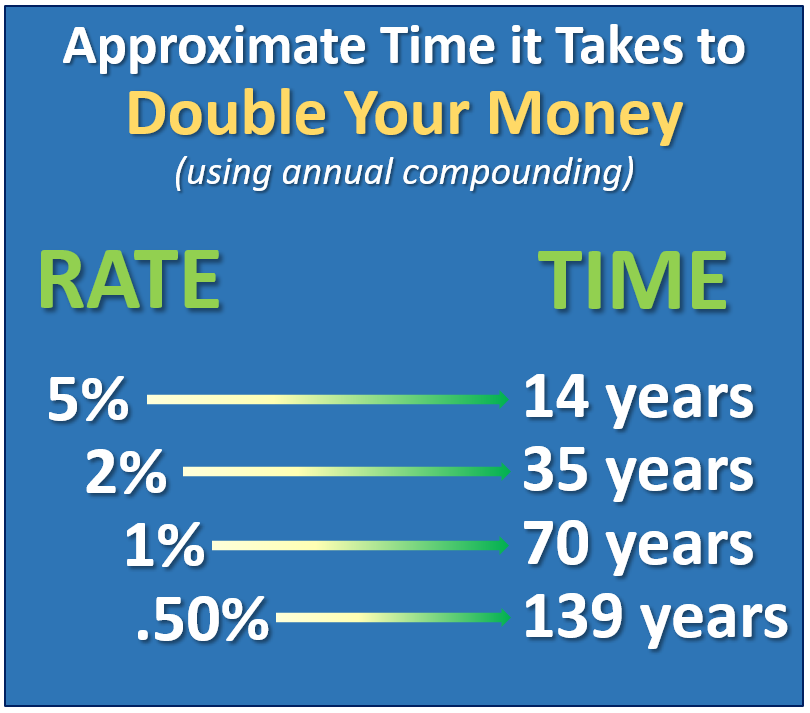

At today’s low interest rates, investors might not be able to generate the type of returns they need or want with a heavy emphasis on fixed income. At 1% it takes about 70 years to double your money and at 0.50% that time period grows to 139 years.

Interest rate investing and interest rate risk can be complex. Take, for example, the nuances to reviewing duration, including how to compare the different types of bonds, like investment grade corporate bonds and treasuries. Just because they have the same level of duration, this does not mean that any two bonds will respond identically to interest rate changes. In the case of corporate bonds, their prices are also influenced by the credit quality of the company.

This is where we can help. When overseeing the investments, we recommend to clients, we take economic growth and interest rates into consideration.

In today’s interest rate environment, a review from a qualified financial professional can prove to be a productive exercise. We are proud of the research we do on our clients’ behalf and are always willing to offer a “complimentary” financial review for your friends and associates.

We are here for you!

While we cannot control financial markets or interest rates, we keep a watchful eye on them. We are always available to review your investment portfolio with you. If you have any questions about interest rates or anything else, please do not hesitate to contact us.

Our advice is not one-size-fits-all. We will always consider your feelings about risk and the markets and review your unique financial situation when providing any recommendations. If you would like to revisit your specific holdings or risk tolerance, please call our office, or bring it up at our next scheduled meeting.

We pride ourselves in offering:

- consistent and strong communication,

- a schedule of regular client meetings, and

- continuing education for every member of our team on the issues that affect our clients.

A skilled financial professional can help make your journey easier. Our goal is to understand our clients’ needs and then try to create a plan to address those needs. As always, we appreciate the opportunity to assist you in addressing your financial matters.