The latest episode of the debate between stock market bulls and bears has gotten more interesting. For every valid point from one side, there’s an equally compelling argument on the other side. Perhaps the best reason for the debate is the uniqueness of this environment. The pandemic and its aftermath don’t come with a historical playbook. We haven’t been here before. So we’ll just recognize that the outlook is uncertain, weigh the pros and cons, glean what we can from the past, and give it our best shot. Call us cautious bulls.

Topic 1: Economy

Bull case: Consumer is resilient, the labor market is strong, wages are rising, and inflation is coming down steadily.

Bear case: Inflation is still high, leading indicators are signaling recession, manufacturing activity and housing market have slowed significantly.

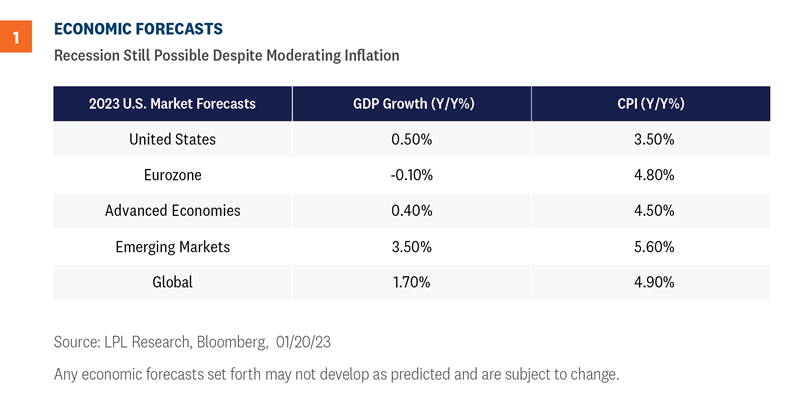

Background: The global economy will likely slow from the upper-2% range in 2022 down to slightly above zero in 2023 (Figure 1). Much depends on China’s growth path now that it has largely abandoned its overzealous Zero-COVID-19 policy.

If the U.S. falls into recession, the chances are it would occur during the first half of 2023 and will not likely be as deep as the 2008 recession, which was initiated by a fundamentally flawed financial market.

One reason we’re currently seeing a healthy debate on the likelihood of a recession is that most metrics that typically precede recessions are flashing warning signs. Business activity and consumer spending are contracting. However, recent data, including a stable labor market and decelerating inflation, suggest a soft landing may still be possible. As supply chains improve in the months ahead and Federal Reserve (Fed) tools become more impactful, we could see the rate of inflation decelerate more in 2023. So far, producer prices, wages, and survey data clearly point to improvement with inflation.

If the economy does fall into a recession, the cause will likely be from the consumer sector retrenching after years of inflationary pressures, high housing costs, and slow real wage growth.

Our take: The U.S. economy either narrowly avoids recession or enters a mild and short-lived recession in the early-to-middle portion of 2023. Easing inflation pressures and a stable job market with only modest additional tightening from the Fed are keys to limiting the severity of an economic downturn.

Topic 2: The Fed

Bull case: Pricing pressures continue to recede and the Fed ends its rate hike campaign this spring, essentially declaring victory on inflation and opening the door for potential rate cuts in the back half of the year. Interest rates continue to fall and/or stabilize, re-steepening the yield curve. Dollar weakness continues.

Bear case: Inflation proves sticky, prompting either further Fed tightening or a higher-for-longer policy path and raising the odds of recession. Interest rates move higher along with the dollar, weighing on risk assets.

Background: The market maxim of ‘Don’t fight the Fed’ has proven prescient once again. Since the Fed embarked on its historic rate hike cycle last March, the S&P 500 Index entered a bear market and witnessed a 25% peak-to-trough drawdown in 2022. However, according to the futures market, the probability of the Fed reaching its last interest rate hike is inching closer. Forecasts suggest the Fed’s aggressive campaign to tackle inflation could be completed this spring. Moreover, and in stark contrast with Fed rhetoric, the futures market is indicating the Fed could cut interest rates toward the latter half of the year.

These projections are predicated on the assumption that inflation will continue to edge lower at a faster pace than initially expected. Recent inflation-related data, especially the Consumer Price Index (CPI) and the Personal Consumption Expenditures Index (PCE), both underscore that inflation has plateaued and is easing in key areas of the economy.

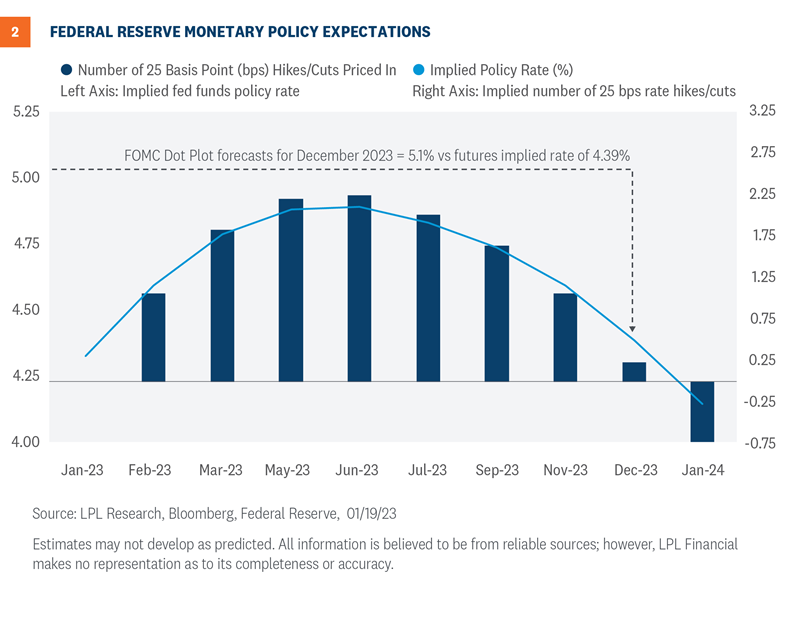

Figure 2 provides a visual of the contrasting interest rate projections between the Fed and futures market. The blue line depicts the implied policy rate based on probabilities from the fed funds futures market. As you may notice, a potential peak in the terminal rate is expected sometime this spring, which aligns with LPL Research’s 2023 outlook. Furthermore, the market has priced in rate cuts later this year, with the federal funds rate forecasted to reach the 4.25%–4.50% range by year-end. The dotted grey line highlights the latest Summary of Economic Projections (SEP) from the Fed, which shows policymakers’ forecast for a fed funds rate of 5.1% for the end of 2023 with no rate cuts penciled in for this year.

Our take: How the diverging policy expectations between the market and Fed get resolved boils down to the rhetorical glass half-full or glass half-empty question. Our expectation is the Fed will stop hiking rates in March after two more 25 basis point (0.25%) hikes and will be a positive catalyst for stock market performance in the coming year.

Topic 3: earnings

Bull case: Earnings fall less in inflationary environments because of revenue strength. Expectations are already very low. Companies have had plenty of time to prepare for the slowdown. U.S. dollar headwinds turning to tailwinds as the greenback heads lower.

Bear case: Margin pressures intensifying. Estimates likely still too high for a potential recession in 2023 when historically earnings have typically fallen about 10%. Contributions from energy are dwindling.

Background: As we discussed in our Q4 earnings season preview, expectations for earnings season for the quarter and 2023 are quite low. As supply chain pressures ease, growth in China picks up, inflation (likely) falls further, and the dollar potentially moves lower, companies will be in a better position to generate earnings growth in late 2023 and early 2024. Consumers still have money to spend. Margins will deteriorate further in the short-term but companies are taking steps to manage costs after preparing for recession for months now—especially the big banks as we have heard during their earnings reports. A return to prior decade norms is unlikely given the new higher profitability regime, backed by technology advances.

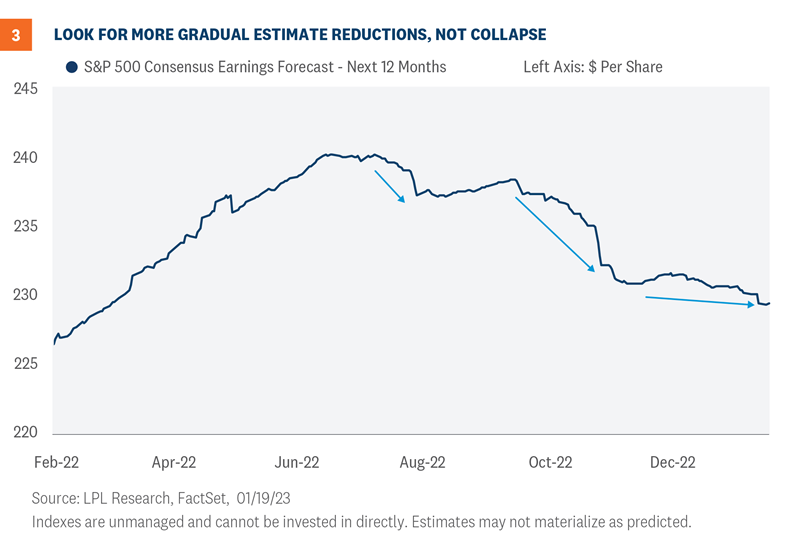

Estimates remain too high but are already coming down, as shown in Figure 3. The reduction in estimates for S&P 500 earnings this year from the 2022 peak is already in line with the long-term average of 10%. Estimates will come down further, but the pace of those reductions will likely slow after the bar is lowered again during the current earnings season.

Our take: Markets may be pleasantly surprised by a modest, rather than significant, earnings decline in 2023 supported by strong revenue, cost controls, and a healthy U.S. consumer. LPL Research expects earnings resilience to be supportive of stocks later this year.

Topic 4: China’s Reopening

Bull case: China’s reopening will help unsnarl global supply chains, driving global growth and helping ease inflation pressures. Stimulus measures will be supportive.

Bear case: China’s re-opening will be uneven and inflationary pressures will continue.

Background: After nearly three years of a stringent policy that closed down large and important parts of China, in what was called Zero-COVID-19 policy, Beijing has ordered the reopening. Although the COVID-19 virus continues to spread across the country, leading to a self-imposed voluntary lockdown, expectations are that by the second half of the year, the economy could begin to emerge from the serious economic decline wrought by strict lockdown measures. Supporting the economy, which is the world’s second largest, has become an important message from top Chinese leadership.

In addition, the government is enacting policies to help the beleaguered and debt-laden property development market. The totality of the property market accounts for nearly 25% of China’s economy. Comments regarding support for the private sector are of particular interest as that could help generate stronger growth for the overall economy, even if only marginally.

Moreover, government officials have stressed they want to ensure personal consumption, or personal spending, gains momentum following years of pent-up demand as fears of lockdowns dominated consumer activity.

Trade with China’s Asian partners is expected to improve, as is trade with traditional partners in Europe, particularly Germany, France, and Italy. With central banks continuing to raise rates in order to tackle inflation, and growing concerns about a slowing global economy, China’s emergence as a dominant presence in world trade would certainly help bolster prospects for a stronger global economic landscape.

Our take: China’s reopening is more bullish than bearish, but geopolitical tensions will remain a risk. We believe China-heavy emerging market equities are more of a trade than a long-term investment at this point.

Conclusion

LPL Research remains reluctant bulls but wary of the risks of further equity market volatility. Mild recession and modest earnings declines are likely already baked in the cake. Should the Fed pause after a March interest rate hike, the stage may be set for a nice stock market rebound on the back of falling inflation, reasonable valuations, and stable interest rates. Earnings may not be much of a catalyst this earnings season, but we see some of the pessimism turning into optimism as 2023 progresses.

The hotly contested bull-bear debate will continue early in 2023 and likely keep volatility elevated in the near term, but we expect these key risks to stocks to be largely resolved mid-year, setting the stage for stocks to make a run at our year-end fair value S&P 500 target of 4,400–4,500 by year-end.

Jeffrey Buchbinder, CFA, Chief Equity Strategist, LPL Financial

Quincy Krosby, PhD, Chief Global Strategist, LPL Financial

Jeffrey Roach, PhD, Chief Economist, LPL Financial

Adam Turnquist, CMT, Chief Technical Strategist

You may also be interested in:

- Q4 Earnings Preview: Pessimism May Be Overdone – January 17, 2023

- Market, Stocks, and Bonds Lessons Learned from 2022 – January 9, 2023

- 2023 Market Outlook: LPL Research Takes a Look at the Year Ahead – January 3, 2023

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from Bloomberg.

For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered inv estment advisor and broker -dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment a dvice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-1397800-0123 | For Public Use | Tracking #1-05357099 (Exp. 01/24)