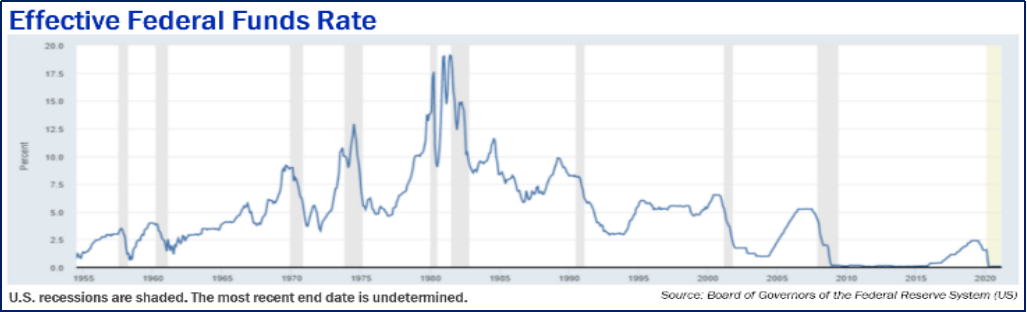

Interest rates play a crucial role in the American economic system. They influence the return on savings, the costs of borrowing and can have a bearing on the direction of many investments. The direction of interest rates is also known to provide insight into future economic and financial market activities.

After the Federal Reserve’s August 2021 meeting, Fed Chairman Jerome Powell stated that, should hiring numbers continue to improve, it will begin dialing back the ultra-low interest rate policies that were put in place to help stave off the effects of the pandemic-induced recession. In an effort to encourage borrowing and spending, the Fed has been buying $120 billion worth of mortgage and Treasury bonds per month. Short-term interest rates were also decreased to near zero to spur consumer spending, encourage hiring, and keep investors in the stock market.

Powell stated that the Fed will begin “tapering” off the bond buying program. “Tapering” refers to the gradual, not sudden, decrease in the Fed’s purchases. This is done in an effort to progressively remove monetary stimulus from the economy.

Powell stressed that this action does not mean an interest rate hike would shortly follow. Many variables, including the recent increase in Covid cases, are being watched and considered in any moves the Federal Reserve decides to take.

“The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest-rate liftoff, for which we have articulated a different and substantially more stringent test,” Powell said.

He continued, “We have said that we will continue to hold the target range for the federal funds rate at its current level until the economy reaches conditions consistent with maximum employment, and inflation has reached 2% and is on track to moderately exceed 2% for some time. We have much ground to cover to reach maximum employment, and time will tell whether we have reached 2% inflation on a sustainable basis.”

(Source: Bloomberg.com 8/27/2021)

One of our goals as your financial professional is to maintain a watchful eye on any changes that may affect your situation. Although the Fed has not determined when interest rates will be increased, interest rates can play a vital role in your financial planning. We feel now is a good time to review and prepare for how rising interest rates could affect some areas that your financial plan may include.

Winners and Losers of Rising Interest Rates

Here are a few major areas that interest rates could have a positive or negative impact.

Mortgage Rates

Historically, we are still seeing very low mortgage rates, however, an increase in interest rates could convince some potential home purchasers to push the pause button. Home prices are still high, and if interest rates increase, this double whammy may have many homebuyers deciding to stay put until the prospect of a better time to purchase a home arises.

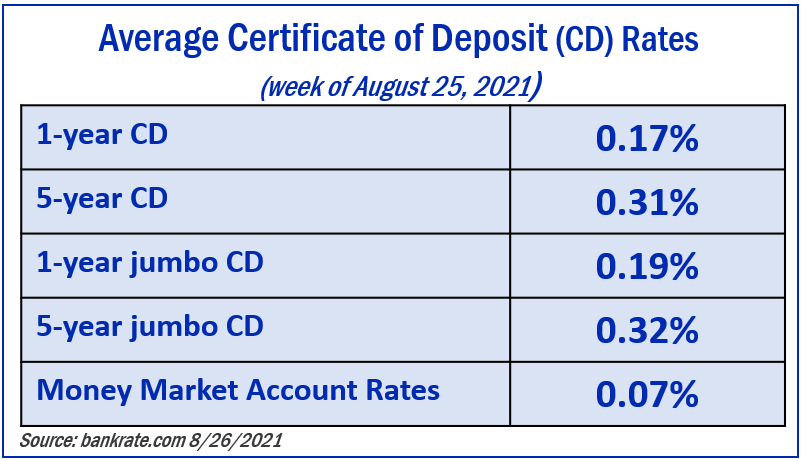

Savings Accounts

A rise in interest rates could be favorable for savings account and certificate of deposits (CDs) holders. While rates are still very low, if interest rates rise, the yields on these accounts typically increase.

Bond Holdings

With the economy continuing to strengthen and unemployment numbers decreasing, most Fed officials are expecting the Fed to reduce bond purchases this year. What exactly does this mean for bond holders and purchasers?

As you many know, bond and interest rates move in the opposite direction. When interest rates rise, existing bond prices tend to fall, and conversely, when interest rates decline, existing bond prices tend to rise. As interest rates rise, new bond yields are likely to change.

Yield is a straightforward concept. It is the current income return you receive when, for instance, you own a bond, as measured by a percentage. If the bond you bought for $1,000 pays you $30 per year — that’s a 3% annual yield.

For example, if you invest $10,000 in a 10-year U.S. Treasury bond with a 3% yield, that interest rate is fixed even as prevailing interest rates change with economic conditions—especially the rate of inflation. Let’s say after five years you decide to sell that bond, but interest rates have risen and now similar new bonds are paying 4%. Obviously, no one wants to pay $10,000 for a bond yielding 3% when a higher-yielding bond costs the same. Therefore, the bond’s value will decrease.

Bonds are many times considered a good option for a conservative, balanced portfolio. Although they could provide modest returns, many high-grade bonds are usually considered more stable than stocks and can provide income. However, investors who put a high percentage of their portfolios in bonds with the hopes of producing stable returns, could see lackluster results if interest rates rise.

Investments

Converse to bonds, interest rates don’t directly affect stocks. They can, however, indirectly affect stock prices. When interest rates rise, banks increase their rates for consumer and business loans. Reduced consumer and business spending could lower the value of a stock. When interest rates are increased, this usually means that there is economic growth or strengthening.

Portfolios that are well balanced, diversified, and planned to weather volatility should be well positioned to face rising interest rates.

Recommendations to Consider

In summary, when interest rates rise, the following usually happens:

-Mortgage rates increase

-Interest rates increase on savings accounts and CDs

-Existing bond prices decrease

-Commodity prices decrease

-Equity markets may become more volatile

Since each individual has different financial goals, interest rate fluctuations can affect investors differently. Having a solid financial plan, sticking to that plan, and working with a financial professional before making any decisions to sway from that plan is always advised. We offer the following five basic items for consideration if and when the Federal Reserve raises interest rates.

1. Maintain complete liquidity for all short-term and near-term needs. Liquid accounts in today’s interest rate environment will probably not keep pace with inflation. Although it is always important to maintain a liquid component in your portfolio, you should think about what major expenses you will incur in the next two years and consider keeping a larger than typical liquid pool of assets.

2. Consider shorter terms over high yields. Although shorter term bonds yield less than longer term bonds, they typically lose less value when rates rise. They are less sensitive to interest rates increases and may provide a more conservative but comfortable choice for some investors.

3. Review all of your income-producing investments. As wealth managers, we help our clients review their income-producing investments. Our primary goal is to match your portfolio to your timelines and personal financial situation.

4. Lock in mortgage rates. Refinance or lock in a low mortgage rate before they rise.

5. Monitor your portfolio regularly. Interest rates can move quickly or slowly. We stay apprised of the Fed and its decisions on interest rates so we can suggest adjustments to your portfolio as needed in a timely and educated manner.

Closing Thoughts

Interest rates can be complex. As mentioned earlier, we keep a watchful eye on interest rates and how they may affect our clients. In today’s interest rate environment, we are monitoring your investments with us. If you have any questions or would like us to review your specific situation, please let us know.

We are here to help! We are always available to review your investment portfolio with you. We will always consider your feelings about risk and the markets and review your unique financial situation when providing any recommendations.

We pride ourselves in offering:

- consistent and strong communication,

- a schedule of regular client meetings, and

- continuing education for members of our team on the issues that affect our clients.

A good financial professional can help make your journey easier. Our goal is to understand our clients’ needs and then try to create plans to address those needs. While we cannot control financial markets, inflation, or interest rates, we keep a watchful eye on them. We can discuss your specific situation at your next review meeting or you can call to schedule an appointment. As always, we appreciate the opportunity to assist you and your financial matters.