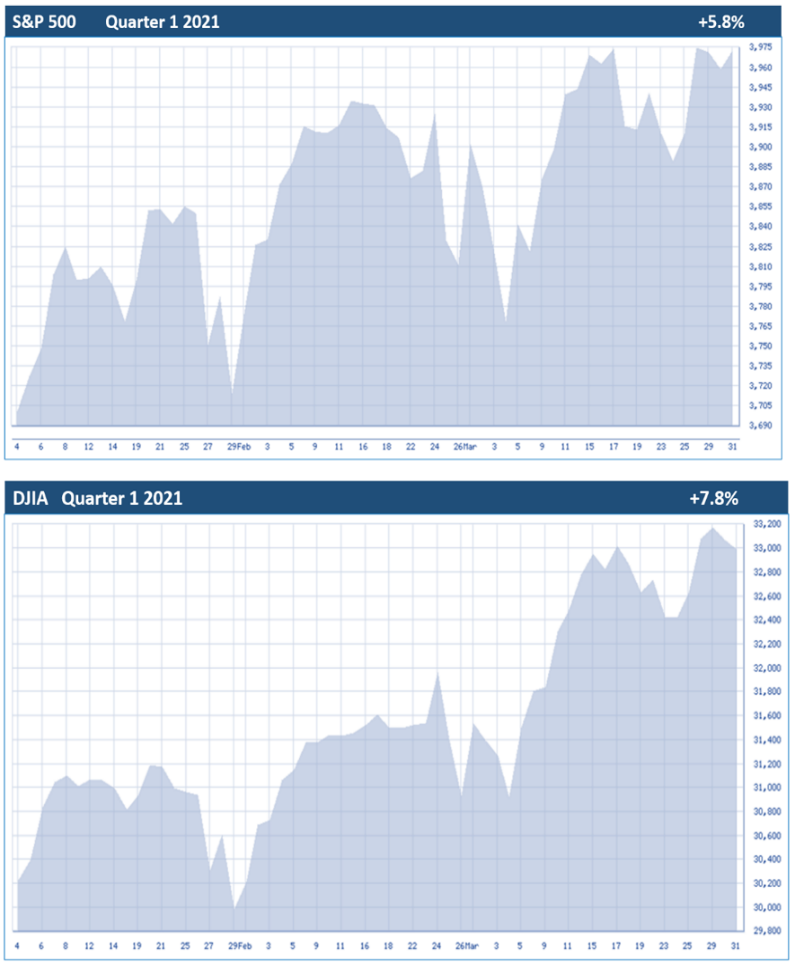

What a difference a year makes. The first quarter of 2021 included the one-year anniversary from the March 2020 equity market’s bottom. For the first quarter of 2021, equity markets encountered volatility but still created all-time highs. With the potential of herd immunity following mass vaccinations, investors finished the quarter with hopes that the end of the pandemic could be seen by mid-year. Many optimists are hoping that the U.S. economy will continue to accelerate when that happens. All three major indexes finished the quarter positive, marking the fourth consecutive quarter of doing so. The Dow Jones Industrial Average (DJIA) and S&P 500 rose 7.8% and 5.8%, respectively, while the tech-heavy Nasdaq gained 2.8%. (Source: finance.yahoo 4/1/2021)

During the quarter, newly elected President Biden introduced his $1.9 trillion American Rescue Plan. He also introduced at the end of the quarter, an outline of his infrastructure spending plan, which quoted a $2.3 trillion dollar price tag. This proposed plan is expected to focus on a broad range of infrastructural activities like; developing roads, airports, safe water supplies and greener technology. This plan could rise to an even higher dollar amount and it comes with a proposal to raise the corporate tax rate from 21% to 28% (after it was lowered from 35% to 21% in 2017). (Source: finance.yahoo 4/1/2021)

At the March Federal Reserve monetary policy meeting, the Fed upgraded its economic growth outlook for 2021 to 6.5%, up significantly from its last projection of 4.2%. They also projected unemployment rates to dip to 4.5% and inflation to rise to 2.4% by the end of 2021. Despite the more positive outlook, the Fed did not change its near-zero interest rates decision through the end of 2023. In response, the DJIA reached a record high of over 33,000. (Source: finance.yahoo 3/17/2021)

In a joint appearance in front of the U.S. House Committee on Financial Services on March 23, Treasury Secretary Janet Yellen stated, “We are meeting at a hopeful moment for the economy — but still a daunting one. While we are seeing signs of recovery, we should be clear-eyed about the hole we’re digging out of.” Fed Chair Jerome Powell added that while the housing market has fully recovered from the downturn, that “Business investment and manufacturing production have picked up, but spending on services remains low.” (Source: nbcnews.com 3/23/2021)

Key Points |

| 1 All three major indexes finished the quarter positive. |

| 2 Continued vaccine distribution and re-openings drive economy forward. |

| 3 Interest rates are projected to remain low through 2023. |

| 4 Federal tax deadline extended for 2020 returns. |

| 5 Avoid distractions and stay on path with your time horizons and risk tolerance. |

| 6 Call us with any questions or concerns about your investment strategy. |

During the quarter, many consumers’ options were still limited by the need to still social distance. Normalization of behavior following mass vaccination could mean a major uptick of consumer services, which would drive an overall Gross Domestic Product (GDP) recovery. The job market is also projected to recover in tandem with consumer services, as the service sector accounts for most of the lost jobs from the pandemic. Another massive stimulus injection started reaching eligible Americans as a result of the March 2021 government stimulus bill. Households and firms alike benefited thanks to record stimulus in 2020, however, the U.S. federal deficit reached its highest level outside of World War II. Although this becomes a bet that the U.S. economy will recover from the pandemic, the totality of new debt still is at a very high amount.

The consensus remains that economic recovery is still largely based on the containment of the virus and the progression of vaccination distribution. The quarter closed with further distribution of the vaccine combined with consumer activity, continued re-openings and unemployment reduction being very hopeful.

While there are always many key points and issues that need to be watched, this report’s goal is to focus on some central themes for investors.

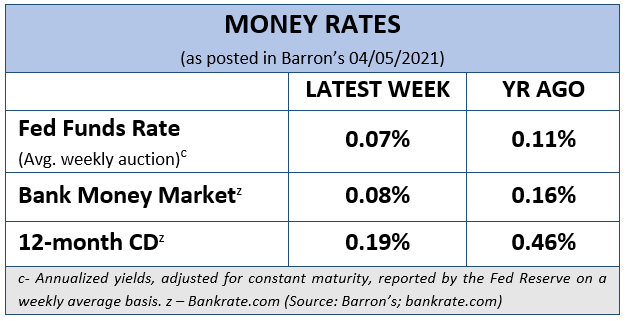

Interest Rates Still at Ultra-Low Levels

Despite the predicted upward trend in the economy, the majority of Federal Reserve Board’s policy committee members remained steadfast to 2024 as the first year they anticipate rate hikes. Shortly after releasing this news, the DJIA set a new all-time high.

Please remember, even though interest rates are extremely low, a fully diversified portfolio includes interest rate sensitive investments, like bonds. This could help neutralize market fluctuations and potentially reduce investment risk by investing in separate areas that could each react differently to the same event. In a period where the market rises, diversified portfolios will have lower returns than full equity portfolios. Conversely, with equities at or near all-time highs, bonds can offer protection to investors in the case of a large downturn. A well-diversified portfolio considers investments in different categories like stocks, bonds, and cash, whose returns have not historically moved in the same direction and to the same degree.

Interest rates are important for investors to monitor and they will continue to stay near the top of our watchlist.

Treasury Yields

The 10-year Treasury yield rose to pre-COVID highs in March, reaching 1.75%. This 10-year yield was less than 1% at the beginning of the year. The 10-year’s rapid rise was fueled by the prospect of more Covid-related stimulus money being distributed, potentially increasing inflation and that the Federal Reserve stated it did not intend to raise interest rates in the near future.

In March, the 30-year Treasury yield traded above 2.5%, the first time since August of 2019. This rise was short lived. After Fed Chair Jerome Powell and Treasury Secretary Janet Yellen made a joint appearance in front of the U.S. House Committee on Financial Services on March 23, U.S. Treasury yields receded down to 1.615% on the 10-year note and 2.326% on the 30-year note. (Source: cnbc.com 3/18/2021)

2020 Federal Tax Deadline extended

To relieve some of the stress of filing 2020 tax returns, on March 17, the Treasury Department and Internal Revenue Service announced that the federal income tax filing due date for individuals for the 2020 tax year will be extended to May 17, 2021. The May 17 deadline postponement also included federal income tax payments without penalties and interest for the 2020 tax year that would have been due on April 15, 2021.

This postponement only applies to individual federal income returns and tax (including tax on self-employment income) payments otherwise due April 15, 2021 and it does not include state tax payments or deposits or payments of any other type of federal tax including estimated tax payments.

Noise and Distractions

As if investors did not have enough to think about, the first quarter of 2021 brought major drama when Gamestop, a video game retailer that Wall Street bet heavily against, saw a rise of over 2,000% in its stock price. This surge was initially and primarily triggered through the social news platform, Reddit. The drama that ensued prompted Congress to hold hearings focused on the state of the stock market and questionable practices.

Media magnification is a powerful force. Sensational headlines can leave investors overwhelmed, stressed, and confused. If you have carefully created a strategy with realistic financial goals, veering off course in the hopes of short-term gains could potentially compromise the financial fortitude of your long-term goals.

As stewards of your wealth, we strive to align your investments to your time horizon and risk tolerance. Please connect with us prior to making any major changes in the path to your financial goals.

Investor’s Outlook

With the upcoming earnings season, investors could see market-moving news come from the continuation of a smooth Covid-19 vaccine rollout and a resumed reopening of the economy. Reports show that about one-third of the U.S. adult population has received at least one dose of a Covid-19 vaccine, as of late March. All of this gives us confidence that vaccination programs will continue to do the hard work of combatting the virus and enabling continued economic and market recoveries.

Interest rates are still very low on a historical basis. If they remain low and central banks globally continue to maintain support, we can see economies resume their recoveries. Patience from the Federal Reserve could easily benefit equity investors.

Corporate earnings are critical for equities and Blackrock reported that the overall Fourth-quarter earnings (which were released in early 2021) strongly beat consensus analyst estimates as well as what was mostly conservative company guidance. The continuation of this trend would be very helpful for equity investors. (Source: Blackrock 4/1/2021)

As mentioned earlier, the Biden administration is proposing an injection of another large amount of dollars into the economy in hopes to help turbocharge the U.S. economic recovery, assist in renovating infrastructure, and taking measure to combat climate change. Some experts are speculating that the government’s spending will bring the federal deficit to unsustainable levels. These plans will be financed in part by major tax hikes on corporations and high earners that the administration has proposed. Whether or not this will affect equities is up in the air. “Equities do not appear to be pricing much concern regarding tax hikes,” wrote David Kostin, Chief U.S. equity strategist at Goldman Sachs. It can be wise to watch and wait as more details unfold on Biden’s tax and economic recovery plans. (Source: Barron’s 3/23/2021)

Altogether, there’s great confidence that the U.S. economy will recover from the pandemic. One thing we know for sure is that peaks and valleys have always been a part of financial markets. Equity markets will continue to move up and down. Regardless of what the equity markets are doing, our goal is to make sure your investing plan is centered on your personal goals and timelines. Even when investing for the long-term, there is no guarantee that market volatility will decrease, stabilize, or increase over any timeframe.

Caution is still the principal notion for investors.

Our advice is not one-size-fits-all. We will always consider your feelings about risk and the markets and review your unique financial situation when making recommendations. If you would like to revisit your specific holdings or risk tolerance, please call our office, or bring it up at our next scheduled meeting. If you ever have any concerns or questions, please contact us!

We are here for you!

We pride ourselves in offering:

- consistent and strong communication,

- a schedule of regular client meetings, and

- continuing education for every member of our team on the issues that affect our clients.

A skilled financial professional can help make your journey easier. Our goal is to understand our clients’ needs and then try to create a plan to address them.