Blog

5 Big Mistakes Investors Make

For the past 22 years, I have had the privilege of assisting individuals who sought investment and retirement council.

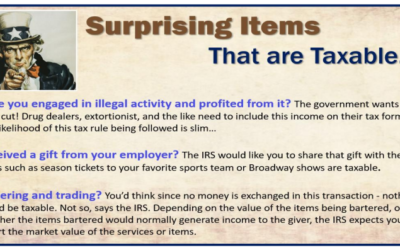

Helpful Information for Filing 2021 Income Taxes and Proactive Tax Planning for 2022

Tax planning should always be a key focus when reviewing your personal financial situation.

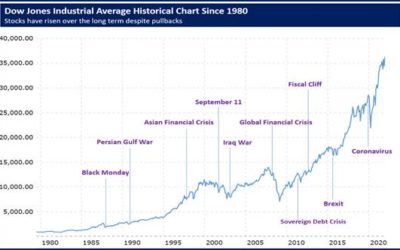

Market Volatility: A Normal Part of the Investment Experience

Baseball legend Yogi Berra once said, “It’s tough to make predictions, especially about the future.”

Quarterly Economic Update Fourth Quarter 2021

2021 closed as a banner year for many investors. Although the year ended with both winners and losers, in retrospect, the sudden recession created by the COVID pandemic in 2020,,,

Research

Powell Walked a Tightrope | Weekly Market Commentary | March 24, 2025

Trade uncertainty and nagging inflation made Federal Reserve (Fed) Chair Jerome Powell walk a tightrope at the latest press conference.

Powell Walked a Tightrope | Weekly Market Commentary | March 24, 2025

Trade uncertainty and nagging inflation made Federal Reserve (Fed) Chair Jerome Powell walk a tightrope at the latest press conference.

Market Correction Perspective | Weekly Market Commentary | March 17, 2025

Inconsistency seems to be the only constant since tariffs were first announced. The White House’s continuous change in direction on trade policy has weighed on business sentiment gauges and left investors with limited visibility to buy the dip.

Navigating Strategic and Tactical Investment Horizons: The Differences | Weekly Market Commentary | March 10, 2025

Heightened volatility and uncertainty in both financial markets and the broader economy present challenges and opportunities for investors. Understanding the fundamental differences between the strategic and tactical investment horizons through which an investor can face these challenges and approach these opportunities is essential for navigating these complex environments.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER