The highly transmissible Delta variant of COVID-19 now makes up an overwhelming majority of the new cases in the U.S., bringing with it a rise in cases and hospitalizations. Widespread vaccine distribution and distancing measures have helped limit the variant’s impact, but we could still see some drag on economic growth as some restrictions are reintroduced and consumers potentially become more cautious. While we may see an increase in market volatility due to the Delta variant, we believe the S&P 500 is still likely to see more gains through the end of the year.

The Delta Variant May Drag On Economic Growth

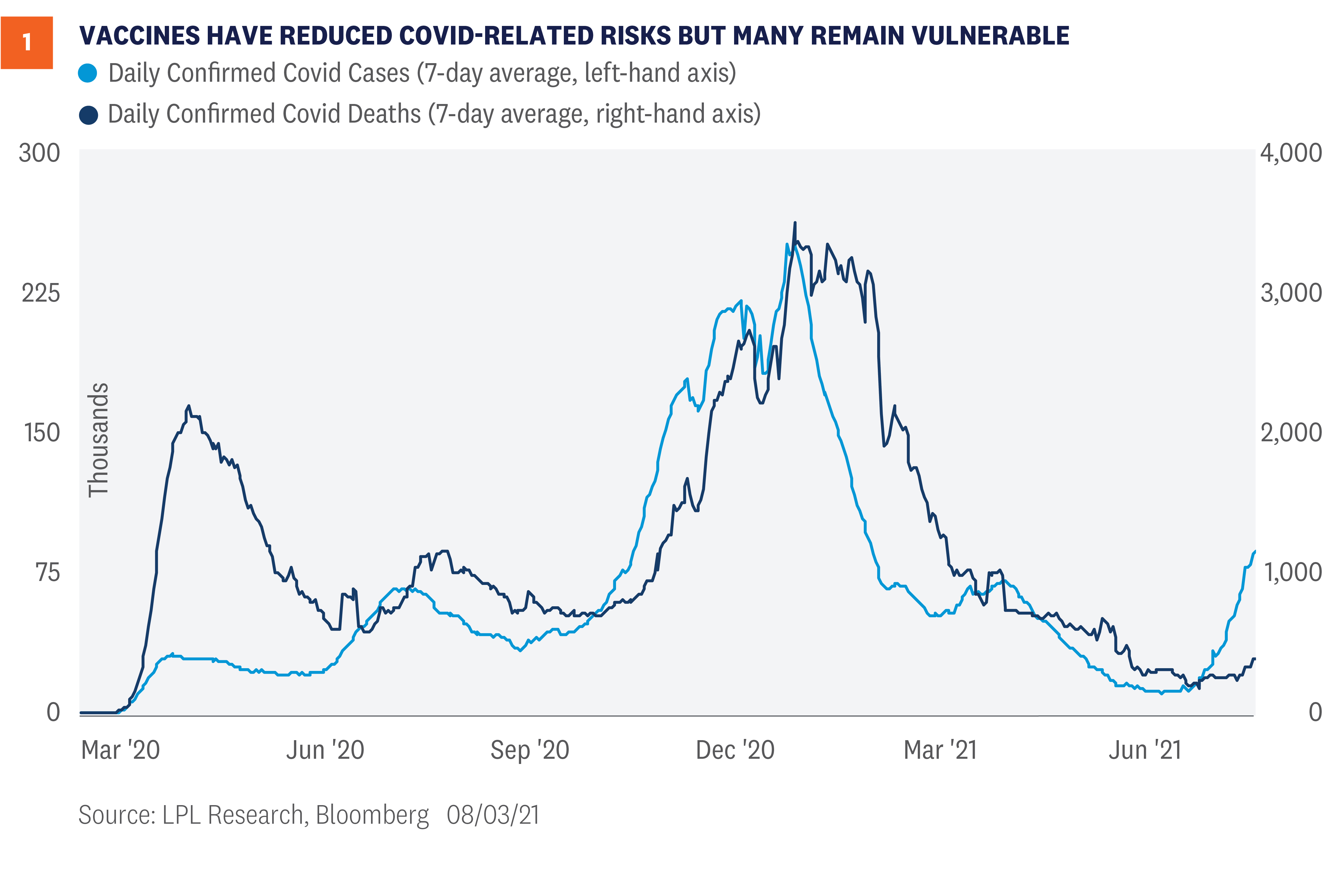

Despite the increased transmissibility of Delta and the increased health threat for those who aren’t vaccinated, our understanding of the measures needed to contain COVID-19 is in an entirely different place than it was in 2020. Above all else, we have not just one but several vaccines, which drastically reduces the risk from the variant, although it can’t completely eliminate it. We understand the effectiveness of masks in limiting transmission. Treatments have improved. We also know that the virus is not easily transmitted by touching surfaces—especially with simple good practices around handwashing—limiting the need for certain restrictions. Because of that, deaths from COVID remain near the lowest level of the pandemic despite the pick-up in cases [Figure 1]. Much of that is due to the vaccines’ ability to limit serious cases, though health risks remain high for those who aren’t vaccinated. We are also seeing some strain on healthcare systems in regions with low vaccination rates.

Our view has consistently been that governments should, and generally will, impose restrictions only to the degree necessary to protect the most vulnerable and keep our healthcare system from getting overwhelmed. There’s not a clean, scientific answer to exactly what that point is, but there is a solid set of guidelines. If individuals, businesses, and officials use those guidelines as appropriate for their communities, there will still likely be some added drag on economic growth—but we think it will be manageable, with the drag still outweighed by the on-going rebound.

How much added drag? The most recent gross domestic product (GDP) reading for the U.S. put economic activity back above the level where it was before the pandemic. That does raise the bar. We do think third-quarter GDP forecasts could fall a few percentage points, the lost growth being pushed back into late 2021 and early 2022. But even if the impact was so strong that we saw modest economic contraction, which we view as unlikely, we would expect the economy to bounce back quickly.

New Restrictions, Supply Chains Sources of Concern

Any drag on economic growth would likely come from a few key sources:

While we are unlikely to see a new wave of widespread shutdowns in the U.S., there may be added restrictions. The effectiveness of vaccines and our increased understanding of how to contain COVID will limit the need for restrictions, especially with vaccination rates rising again and vaccines available to anyone eligible who wants them. The strongest measures will probably be around mask mandates and social distancing, with stronger restrictions confined to localities where they are most needed.

Even without government mandates, there will still be changes in individual behavior that may slow the rate of economic growth. Changes in individual behavior due to safety concerns will probably have a larger impact than government intervention. This will likely be especially true for those with young children who are not eligible for vaccinations and those who choose not to get vaccinated. Behavioral changes may slow the recovery in the job market in particular if the changing environment places additional childcare demands on parents or raises workplace safety concerns.

We are likely to see an extension of supply chain disruptions. While the impact from Delta could slow demand growth, it may have a bigger impact on the supply side. Some countries where vaccine availability has been low have already imposed added restrictions, which could limit factory activity, exacerbate shortages, and create added price pressures. The economy has been slowly starting to work its way through supply/demand imbalances, but this may negate some of the progress, putting a temporary cap on growth.

Market-Positive Elements of Response May Gain Traction

Not all the news around the Delta variant has been bad from a market perspective. We may even be close to the inflection point where much of the bad news has been priced in and markets start looking past the Delta variant’s growth impact. Markets tend to lead the economy, not the other way around. Think about where we were on March 23, 2020, when the S&P 500 bottomed. Granted, we are in a very different place right now, as we have not seen a substantial Delta-related pullback yet, only rotation toward some less risky areas of the market, so there may still be bumps ahead. But we think any dips in stock prices are likely to be short-lived and it may not even take all that much clarity before we see some rotation back to the market sectors that would benefit most from reopening.

Vaccination rates are starting to rise again. While some people may still choose to remain unvaccinated, it’s hard to ignore the extreme risk disparities between those who are vaccinated and those who aren’t as Delta has spread. Rising cases, as well as efforts of local officials, have led to vaccination rates starting to rise again, and we recently crossed the threshold of 70% of U.S. adults having received at least one vaccination shot. Delta’s greater transmissibility does mean “herd immunity” will be harder to achieve, but there does seem to be progress.

Europe is showing improvement. Europe is providing a model of the ability of countries with high vaccination rates to limit the impact of the Delta variant. Europe has been battling Delta longer than the U.S. and seems to be turning the corner, reinforcing that we do have the tools to limit the spread of the variant without large economic disruptions. While it’s clear that the Delta variant could create significant added economic strain if left unchecked, it’s also becoming increasingly clear that we have the tools to contain the impact while still protecting the economy.

Stimulus is more likely to stay in place or even expand. Equity markets almost universally like stimulus even if there might be potential long-term negative consequences. Delta has already pushed back expectations of the first Federal Reserve rate hike. Market-based expectations had been pulled forward to 2022 as U.S. growth surprised to the upside, but have now been pushed back again to 2023. The Biden administration’s stimulus plans may also receive greater support if the economy stumbles due to Delta, and we could even see some added COVID-oriented measures. Even if the stimulus comes with a long-term cost, it is likely to be viewed as market positive in the near term due to the added safety net it provides.

Reopening momentum will be difficult to reverse. Even with heightened restrictions in place, individuals and businesses will be reluctant to completely lose reopening momentum. Of course, it’s not completely in their control, but we think there will be a bias toward not being overly cautious, and less of a need where vaccination rates are high. There is rising concern over the Delta variant, and people will be more cautious on average, but we are very unlikely to return to the levels of fear seen in 2020.

Short-Term Concerns are Real But Market Impact Likely Limited

Despite the greater transmissibility of the Delta variant and increased health risk for those who are not vaccinated, we think the U.S. and global economy will continue to expand over the rest of the year. We maintained our 2021 U.S. growth forecast at 6.25 – 6.75% in our Midyear Outlook 2021: Picking Up Speed even as forecasts were rising and that decision now seems prudent, but we also see no need to lower it. Global vaccine distribution has a long way to go, but we’re making steady progress. Meanwhile, vaccine availability is high in the U.S. and our understanding of how to contain the virus has deepened substantially since the outbreak began in early 2020. There are still increased risks to growth and we may see patches of market volatility, but we believe any meaningful dip in equity markets should still be viewed as an opportunity to add risk for appropriate investors, and may also provide opportunities to rebalance portfolios toward reopening beneficiaries.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Midyear Outlook 2021: Picking Up Speed publication for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-850750-0721 | For Public Use | Tracking # 1-05176386 (Exp. 08/22)