There are numerous investment philosophies, but at the end of the day, almost all investors have a common goal – to have their money work for them and increase their assets.

There are numerous investment philosophies, but at the end of the day, almost all investors have a common goal – to have their money work for them and increase their assets.

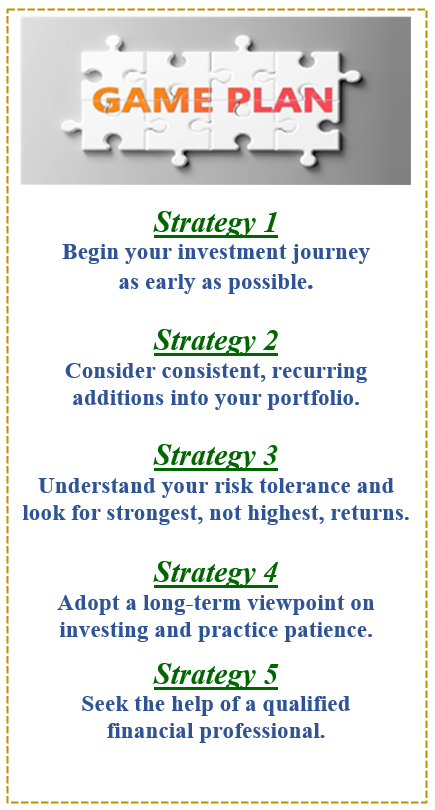

As financial professionals, our goal is to partner with each of our clients on their unique journeys and create a game plan for optimizing their wealth. While we keep a watchful eye on their investments and provide recommendations, we strive to help our clients develop and understand a plan to pursue their financial goals. Our approach incorporates the philosophy that we believe our best client is an educated client.

Do you have an investment philosophy? Are you aware of the common denominators that knowledgeable investors have? Here are five key strategies that can help you become a more proficient investor and improve your investing experience.

The Sooner the Better

“The best time to plant a tree was 20 years ago. The second-best time is now.” Of course, it’s better late than never, but those who begin their investing journey early have an advantage. For example, the further away you start investing from your retirement age goal, the more opportunity you have to build your “nest egg” and see more solid returns on your money.

refunds, holiday or birthday cash gifts, or work bonuses, can boost your investment portfolio.

Also, identifying strong investments and adding to them when appropriate is a healthy habit for investors. Being consistent requires discipline, but this strategy can prove to be very fruitful over time. As a financial professional, we enjoy helping clients maintain a consistent investment approach.

Click here to download a PDF of this report.