Throughout the year, our goal is to provide our clients a wealth of consistent and pertinent information on financial markets and economic topics. We believe the best client is an informed client. We hope you find the information we provide helpful, timely and meaningful for your personal financial situation. We take pride in offering first-class service to our clients and are truly thankful for each and every one of our relationships.

As 2021 comes to a close, we’d like to take a pause in financial and economic topics and share with you a message we feel is very important and critical, especially in these times of volatility and uncertainty – two things the world has had its fill of in the past two years. Our message is about gratitude

The Merriam-Webster dictionary defines the essential meaning of gratitude to be a “feeling of appreciation or thanks”. During the year-end holiday season, there is a universal theme of being thankful for the blessings the past year bestowed upon us. However, each and every day we have an opportunity to embrace and share gratitude. Harnessing this feeling and carrying it with you through the year – making it a habit – can be a powerful shield in times of difficulty. Remember – gratitude can be an attitude!.

From an investor standpoint, there are many things to be grateful for this year. Back in February 2020, the stock market plummeted and the world changed forever. In March of 2020, we saw three of the worst equity market point drops in U.S. history. The New York Stock Exchange was actually shut down several times during these massive drops. March 16th 2020, had the biggest drop, when the Dow Jones Industrial Average (DJIA) fell nearly 3,000 points, losing 12.9% of its value. (Source: forbes.com, 2/11/21)

Since the pandemic-driven stock market decline, equity markets rebounded incredibly well. Most investors who stayed the course and followed their long-term plans have seen rewards for their patience and consistency. In 2021, the S&P 500 and DJIA made several all-time highs and championed through volatility. Continued COVID-19 concerns, a change in administration, inflation worries, and signs of rising interest rates, all triggers for volatility, did not seem to deter the upward path of the stock market.

As we end 2021, the U.S. economy seems to be improved. Many sectors that directly affect the economy like unemployment rates are rebounding from their 2020 low points. New cases of COVID-19 are nowhere near peak levels, and most homeowners have seen a significant rise in their equity.

Sounds like many things to grateful for!

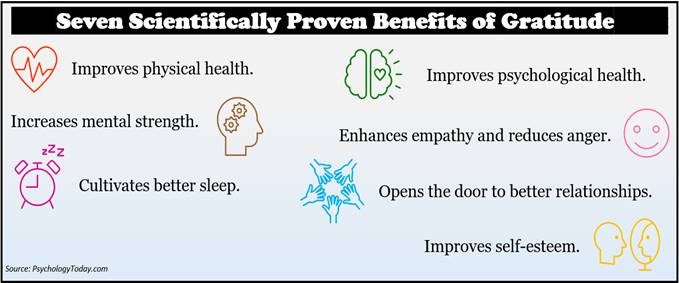

Gratitude can be helpful when you are trying to make wise financial decisions. We believe that focusing on longer-term investing provides more flexibility than attempting shorter-term horizons. Of course, even when investing long-term, there is no guarantee that market volatility will decrease, increase, or stabilize in any timeframe. A study that Psychology Sciences released revealed that participants who expressed gratitude were more likely to generate better results than who looked for immediate gratification. The research found that those who expressed gratitude appeared to display more patience and happiness with their current situation. The study also revealed that those who had more feelings of gratitude were able to reduce impulse buying due to feeling more overall contentment and were less reliant on the high that immediate gratification can provide. (www.forbes.com, 11/25/2019)

In terms of investing, gratification and patience could be useful when adhering to your time horizon, especially during times of volatility. Remember, stocks are considered long-term investments. Historically, it’s not uncommon for equity markets to drop 10% or more during a shorter period of time. Investing for the long-term can help investors stay on track during turbulent times to ride out market volatility, thus potentially achieving their original goals. Contentment is a result of gratification.

Being happy with what you have now will help reduce panic and rush decisions that may not be in the best interest of your investment portfolio. Contentment helps you stave off the temptation of unnecessary greed, or in other words, the feeling of never being satisfied even though you’ve achieved an objective, hit a target, or succeeded in a goal. For example, if you achieve a financial savings milestone, then you should savor this milestone. However, if you do so, but then you quickly start feeling your savings are inadequate, discontentment quickly can set in. There is nothing wrong with raising your goals or being ambitious, but when it turns into a constant state of discontent and it consumes your daily life, it’s healthy to step back, assess all the things you’ve been able to achieve and recapture that feeling of thankfulness and gratitude for having the ability to even achieve the goals in the first place.

The past few years have brought much difficultly and heartache for many. From sickness to the loss of jobs, which for some led to loss of homes and possessions, to the temporary closure of businesses which ultimately resulted in the permanent closure of many businesses. While we are primarily in the business of preserving your wealth and cultivating your financial goals, keep in mind that your first wealth is always your health. Being “wealthy” can have different meaning to many people. The end of the year is a good time to think about what wealth is to you and reflect back on if you focused on those items in the past year or not. This can help you define your priorities and goals for the upcoming year. We’ve included in this article a brief graphic to help you assess what you define as “wealth.”

In the spirit of the season, we want to express our sincere gratitude for the trust you place in us as stewards of your wealth. As always, we are here to help. We are always available to review your situation. We will always consider your goals as well as your feelings about risk and the markets and review your unique financial situation when providing any recommendations.

In the coming year, we will continue to provide you first-class service, including providing:

- consistent and strong communication,

- regular client meetings, and

- continuing education for members of our team on the issues that affect you.

We understand that having a good financial professional can help make your journey easier. As such, our commitment is to understand our clients’ needs and then try to create plans to address those needs.

So, for 2022, let gratitude be your attitude! As always, we appreciate the opportunity to assist you and your financial matters.

Make 2022 a Year of Gratitude!

We are grateful to have clients that value our expertise.

Our goal in 2022 is to continue to service our clients at the highest levels possible. We are also grateful for the opportunity to offer our services to other people just like you! Many of our best relationships have come from introductions from our clients.

If you know someone you feel could benefit from our services, please call Jessica Hansen at (714) 547-8787 ext. 102 and we would be happy to add them to our mailing list or arrange a complimentary financial check-up with them.

How do you define and then cultivate “wealth”?

What constitutes wealth to you? There are many ways to quantify “wealth” including your physical, emotional, mental, and financial wealth. What areas will you choose to focus on in 2022? Here are a few examples of how you can cultivate each area.

Health Wealth

- Be more active.

- Join a fitness club or group.

- Make better eating choices.

Emotional Wealth

- Embrace an attitude of gratitude.

- Reduce your exposure to toxic people and media magnifications.

Mental Wealth

- Practice activities that exercise the brain, such as reading.

- Engage in self-care activities like starting a new hobby.

Financial Wealth

- Meet with us at least annually for a financial check-up.

- Review and proactive tax planning ideas with us or a tax professional.

What will you do to make 2022 a year of gratitude? If you need us, we are always available to help!