For the last several months, talk of a recession has been making news headlines. Analysts and investors have been speculating if, when, and how bad of a recession the U.S. could experience. News sources have resembled Paul Revere proclaiming, “a recession is coming!”

For the last several months, talk of a recession has been making news headlines. Analysts and investors have been speculating if, when, and how bad of a recession the U.S. could experience. News sources have resembled Paul Revere proclaiming, “a recession is coming!”

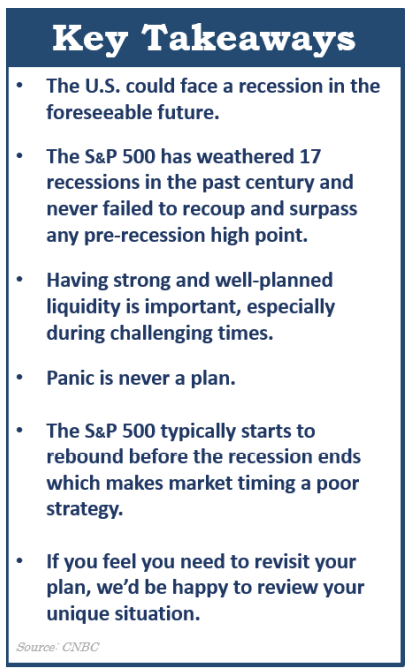

In their recent meetings, the Federal Open Market Committee (FOMC) reported that they expect the U.S. to experience a recession in the coming months of 2023. How long and how severe is unknown. Investor fears are becoming higher due to recent interest rate increases, inflation, and the failure of some community banks.

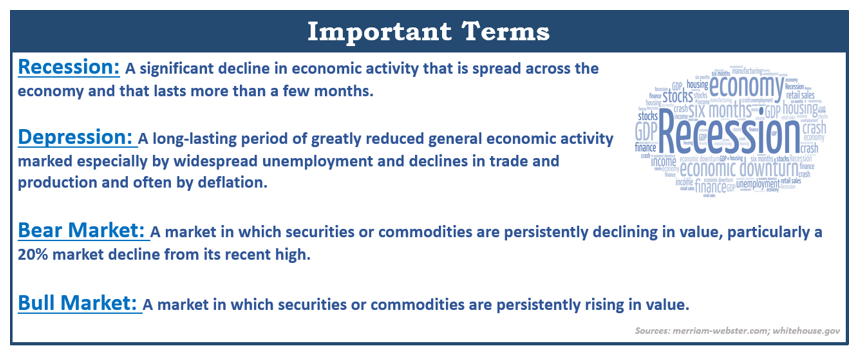

We believe an educated client is the best client, so let’s define a recession, as it could mean many different things to people. The conventional definition is that two consecutive quarters of falling real Gross Domestic Products (GDP) constitute a recession. GDP is the broadest measure of the activity and health of the economy.

According to a White House release, this is not the official definition nor the way that their economists evaluate a business cycle. “Both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.” (Source: whitehouse.gov, 7/21/22)

The Bureau of Economic Research’s (NBER) Business Cycling Dating Committee is the official organization that determines whether the data compiled shows the U.S. is in a recession. They define it as, “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Rather than argue over the definition of the term recession, let’s review some helpful information for investors. To put recessions into perspective,

since 1854, there have been 33 recessions, with five of them experienced since 1980. For many of us, recency bias plays a role in our thoughts because from December 2007 to June 2009, we experienced what was called, “The Great Recession”. This recession was primarily caused by the collapse of subprime mortgages and the credit crunch in the global banking system and lending, which ensued. As findings of that recession share, an estimated 6 million American households defaulted on high-risk housing loans. As a result of that recession, the stock market reacted dramatically. Also, during that time, the GDP fell 4.3%, which was the largest decline in 60 years, and the unemployment rate peaked at 10% in October 2009. (Source: businessinsider; 8/8/22)

As we currently stand, we are not experiencing anything like the Great Recession. The economy is slowing down, but still growing and the GDP is still increasing (with the inflation-adjusted rate of 2.6% in the first quarter of this year). The unemployment rate is hovering around 3.4%.

Regardless of how you define a recession, investors are likely to feel the pinch of an economic downturn before the year ends.

As an investor, what should you consider for your “nest egg?” Well, the bad news is that nothing is “recession-proof.” However, there are still some things you can consider in preparing for tougher times.

Two major demographics that are impacted by a recession are investors and retirees/pre-retirees. Let’s take a brief look at some strategies each one could use to become more recession resistant.