Fourth quarter earnings season kicked off last week, and markets were generally left wanting more. That doesn’t necessarily mean this earnings season will be disappointing, especially considering the bar has been lowered so much. Plus, some of the disappointment was around special bank charges and November-quarter-end companies’ results were solid. This reporting period may lack the splashy “earnings recession over” headlines we got last quarter, but it takes on added importance because it sets the tone for 2024. After 2023 was a year in which improving valuations delivered strong gains, this year, earnings will likely have to do the heavy lifting.

Low Bar Helps Set The Stage For Some Upside

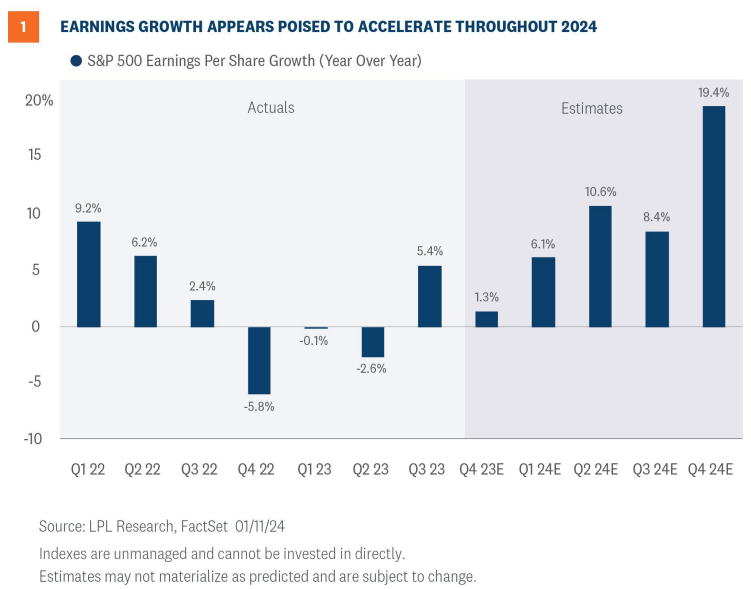

One of the more interesting dynamics heading into the fourth quarter reporting period is how much expectations have come down during the past three months, despite the resilient U.S. economy. According to FactSet data, the consensus S&P 500 earnings per share estimate has been cut by 6.8% since September 30, the most since a similar cut in Q3 2022, and about double the average intra-quarter estimate cut over the past 10 years. The lowered consensus estimate implies just 1.3% year-over-year earnings growth for S&P 500 companies (Figure 1).

Keep in mind that the fourth quarter estimate, which is slightly deflated by the special FDIC charges incurred by the big banks, is expected to kick off a period of earnings growth acceleration as illustrated in Figure 1.

The cuts have been broad-based. Estimates for nine of 11 sectors came down during the fourth quarter, led by significant cuts in healthcare (down 21%) and materials (down 13.5%). Only technology and utilities estimates rose during the period.

Does The Low Bar Mean More Upside?

This outsized reduction in estimates could be interpreted in two ways: Either the low bar could set the stage for greater upside, or it could be a sign of additional weakness that markets have not observed just yet. In this case, there are signs pointing in both directions.

On the plus side, a weak dollar is supportive of non-U.S. earnings and could be worth an additional percentage point to overall earnings. The average level of the currency was about 3% lower in the fourth quarter of 2023 than in the prior-year period. In addition, South Korean export growth, which has historically correlated well to S&P 500 earnings, has inflected higher and is a positive signal.

On the negative side, the downward revision to healthcare earnings has been so dramatic that it is hard to envision big upside for that sector.

In natural resources sectors, particularly energy, the revisions are a function of commodity price weakness, suggesting limited upside there potentially.

And finally, economic data has been mixed lately, reflected in deteriorating economic surprises but stabilization in purchasing managers’ manufacturing surveys. Overall, the data points to nothing more than typical earnings upside, despite fourth quarter gross domestic product (GDP) growth tracking to a respectable 2.2%, according to the Atlanta Federal Reserve.

Factoring all of that in, plus results last week, we believe around 5% is the most likely target range for fourth quarter earnings growth, similar to the prior quarter’s increase. Note that number excludes the special assessments the big banks are paying to replenish the FDIC’s deposit insurance fund following the bank failures in March last year.

Don’t Underestimate The Importance Of The Magnificent Seven

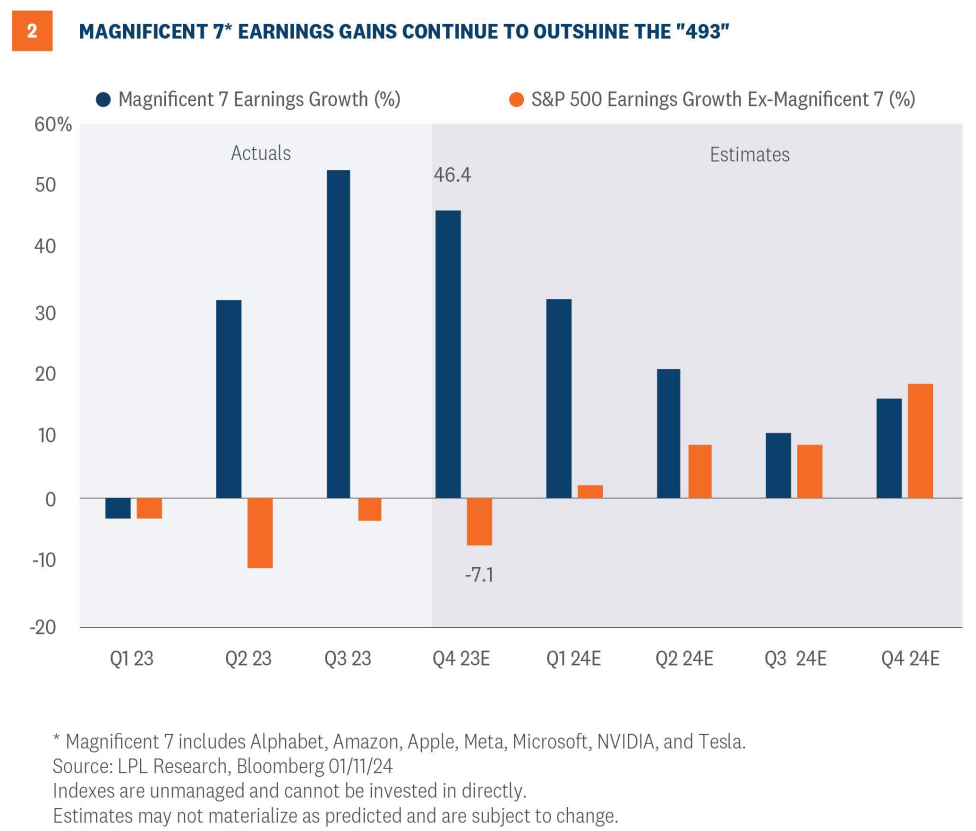

A lot has been made about this market being concentrated in the biggest growth names at the top of the S&P 500. Well, it’s true that those stocks drove a lot of the index’s 26% gain last year— more than 60% of it in fact, despite their combined weight in the index sitting at around 28%.

It’s also true that those stocks are essentially single-handedly driving earnings growth for the broad market right now. In fact, these seven stocks, including Alphabet (GOOG/L), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA), are expected to collectively grow earnings by 46% in the fourth quarter, while the S&P 493 (the S&P 500 excluding these seven stocks), is expected to experience a 7% earnings decline, according to Bloomberg data (Figure 2).

Results for this important group will be a key factor in determining whether S&P 500 earnings can generate attractive upside to current estimates. We expect results to be solid given estimates have been revised higher for this group in recent months and the enthusiasm around artificial intelligence (AI) continues to build.

Margin Expectations Seem Too Low

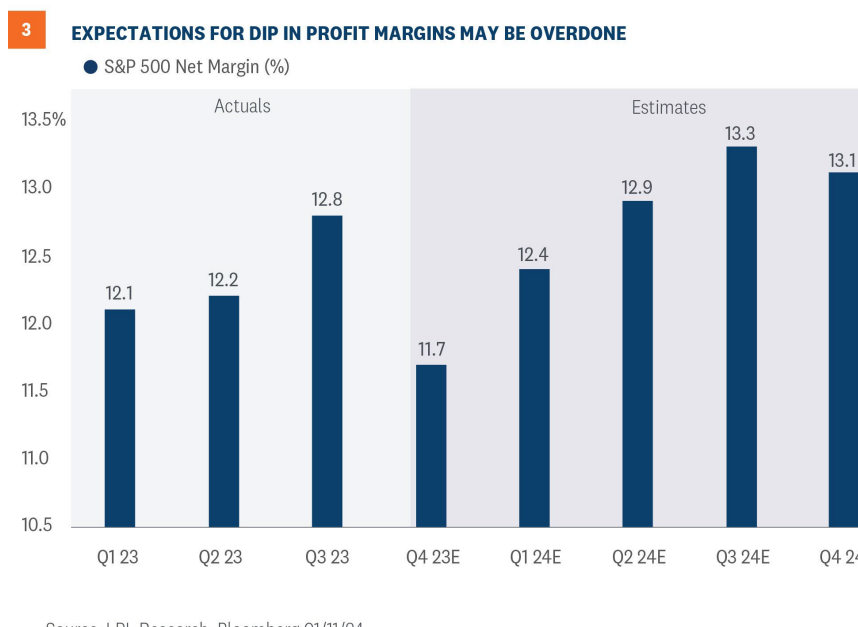

Margins are always an important element of corporate profits but take on added importance when revenue growth is modest. It’s also tougher to generate substantial margin beats when the business cycle is mature, as it is now. For example, margins can massively beat estimates coming out of recessions, but upside potential is more limited when economic growth is slowing after a multi-year economic expansion.

Analysts are forecasting a more than one percent drop in net profit margins from the third quarter to the fourth quarter. That seems overly pessimistic to us despite modest revenue growth expectations of 3% (Figure 3).

In fact, estimates reflect the lowest margins since the fourth quarter of 2020, before COVID-19 vaccines were widely available (seems like a long time ago, doesn’t it?). Higher inflation translates into pricing power for companies. So, as inflation has fallen, that power has eroded some and weighed on margins, though at least partly offset by easing cost pressures.

Revenue upside could help support margins despite disinflation. Based on consensus estimates from analysts, fourth quarter revenue growth is expected to come in at about 3%, well below what is implied by economic growth not adjusted for inflation, i.e., nominal gross domestic product (GDP). Nominal GDP growth has historically correlated well with S&P 500 revenue growth, suggesting the consensus estimate calling for a 3% increase could be a couple of percentage points too low.

Soft Economy May Not Preclude Solid Earnings Growth In 2024

As always, we will want to watch company guidance closely throughout earnings season. That guidance is particularly interesting around year end because it gives analysts and the market more reliable information about management expectations and the business climate for the upcoming year.

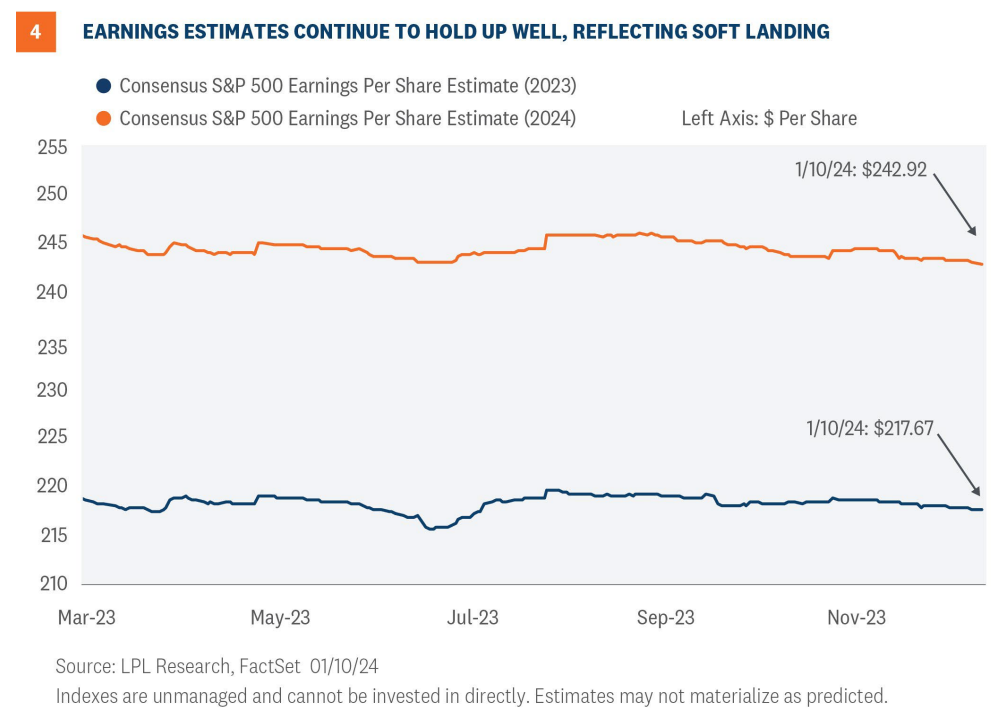

The good news as companies close the books on 2023, is earnings exited their recession during the third quarter and have entered a period of growth. However, the slow-growth economy we expect will not be conducive to big earnings gains. LPL Research expects just 1% growth for the U.S. economy this year, with an above-average probability of a mild, short-lived contraction at some point during the year

Despite that modest growth, buoyed by some inflation-driven pricing power, easy comparisons in the healthcare and natural resources areas, and powerful fundamental tailwinds for the technology sector in artificial intelligence and the cloud, we believe S&P 500 earnings can grow at a mid-to-high-single-digit pace in 2024. Our 2024 S&P 500 earnings per share (EPS) forecast is $235 per share, about 8% above the current 2023 consensus S&P 500 EPS estimate of $218 and in line with the long-term historical average earnings growth rate (Figure 4). That forecast is well below the bottom-up consensus S&P 500 EPS estimate of $243, but slightly above the top-down, macro strategists’ consensus estimate of $233.

Recommended Tactical Asset Allocation Positioning

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) recommends a neutral tactical allocation to equities, with a modest overweight to fixed income funded from cash. The risk-reward trade-off between stocks and bonds still looks relatively balanced to us even after the strong late-year rally, with core bonds providing a yield advantage over cash. The Committee favors U.S. equities over international and emerging markets (EM), but favors Japan among developed non-U.S. markets and Latin America and India within EM.

The STAAC recommends large cap growth-style equities over their large cap value counterparts. The Committee believes growth-style large cap equities may benefit from lower inflation and stabilization of interest rates in the intermediate term. Growth stocks may also benefit from superior earnings prospects against a backdrop of a slowing economy.

Within fixed income, the STAAC recommends an up-in-quality approach with benchmark-level interest rate sensitivity. We think core bond sectors (U.S. Treasuries, agency mortgage-backed securities (MBS), and short-to-intermediate maturity investment grade corporates) are currently more attractive than plus sectors (high-yield bonds and non-U.S. sectors), except for preferred securities, which appear attractive after having sold off last spring due to stresses in the banking system.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-000524-1223 | For Public Use | Tracking #527478 (Exp. 01/2025)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.