After two solid years of strong returns, equity markets are currently experiencing a significant downfall in 2022. While it’s always possible equity markets could turn upward quickly, an equity downturn experience can leave an extensive impact on the psyche of even the most seasoned of investors and consequently impact how they manage their money. During downturns, some investors become too traumatized to put their cash to work in the markets. Others can react by aggressively day trading and making rash investment decisions. Neither of these behaviors are beneficial for long-term financial success. For long term financial success, incorporating a proper process-oriented approach for managing investments is typically one of the better ways to avoid similar missteps.

Understanding the key factors that are contributing to 2022’s bumpy ride can be helpful. Surging inflation, rising interest rates, the Ukraine/Russia war, and continued COVID lockdowns in China that are restricting the supply chain are all influencing the volatility narrative for equity markets.

In early May, the Federal Reserve raised interest rates for the second time in 2022 to continue its daunting task of stopping the inflation snowball – without causing a recession. While the economy is still strong, recession rumors have investors worried about the future.

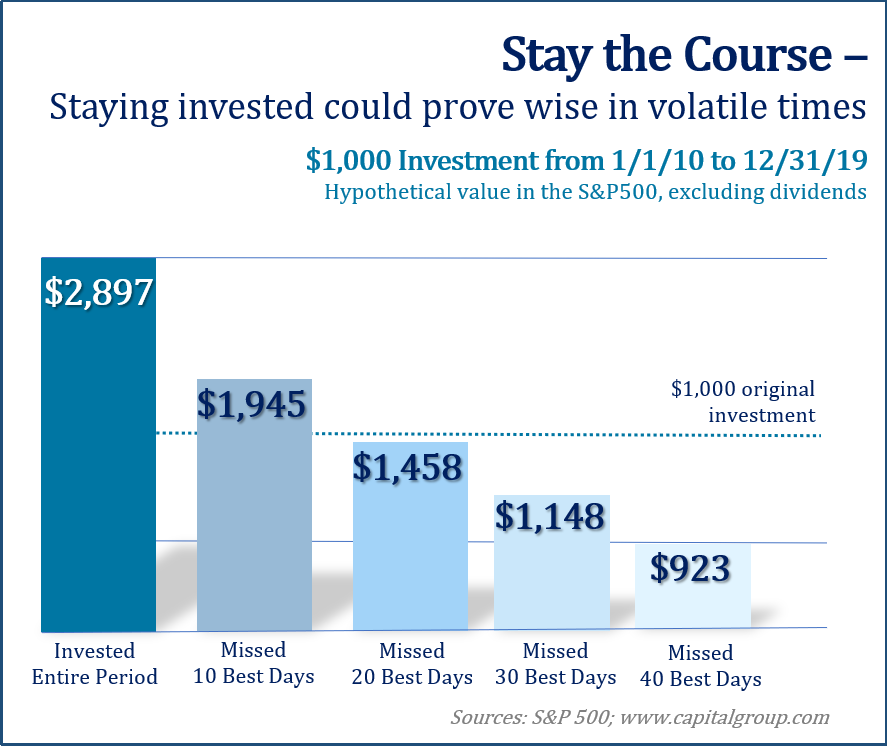

Staying the course and remaining invested could prove to be a wise decision during volatile times. Incorporating an appropriate process-oriented approach for managing investments and focusing on the long-term can typically prove to be one of the better ways to help buffer the effects of volatility. “It won’t be the economy that will do in investors; it will be the investors themselves. Uncertainty is actually the friend of the buyer of long-term values,” were the wise words of Warren Buffet. For knowledgeable investors, panic is not a plan. In fact, panic can lead to a costly mistake.

Please remember, market downturns are uncomfortable but not uncommon. Short-term investors are likely to feel the effects of recent market volatility more acutely than long-term investors. Historically, investors who stay in the market through volatile times come out significantly ahead of where they would have been should they pulled their money out. Short-term fluctuations typically right themselves and investments prove to be more fruitful than if they had been removed from equity markets in a downturn.

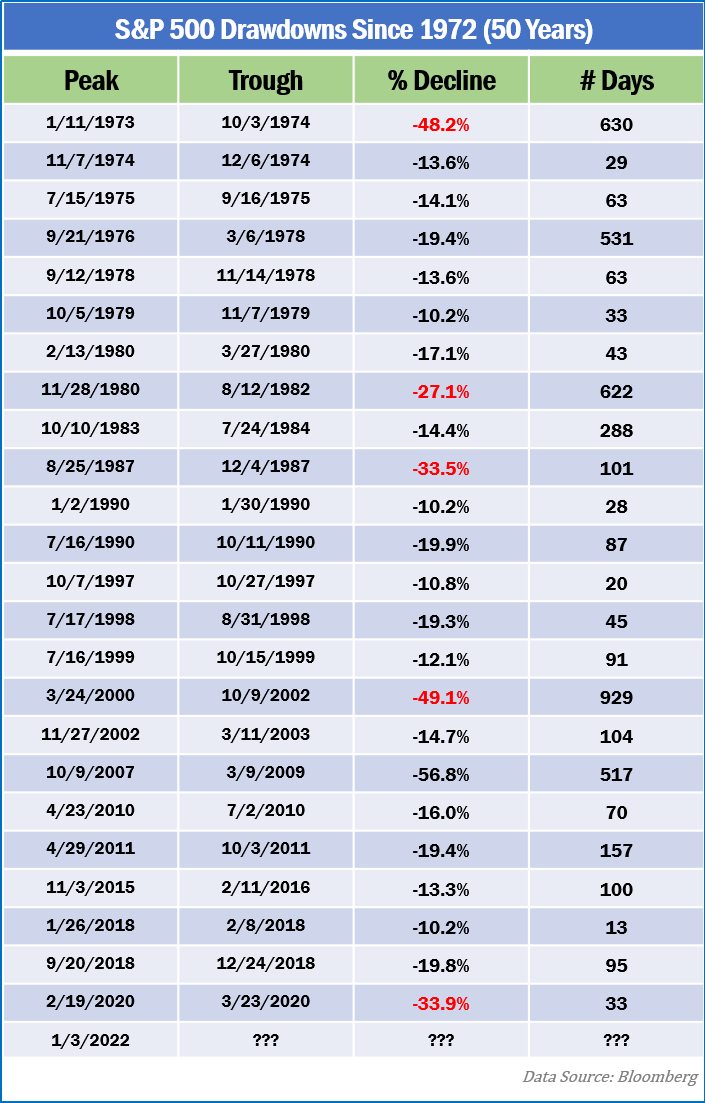

As the chart shows, drawdowns or market declines have been a part of history. Dating all the way back to 1972 (50 years), investors have experienced and survived market declines. Predicting the timing of the exact movement of equity markets is near impossible. While planning during a downturn can be a challenge, it is always prudent and recommended.

We suggest you consider the following to help guide your decisions now and in the future:

- Have a long-term mindset for your investments.

- Stay the course of your pre-determined plan especially during market volatility.

- Focus on saving, not spending. If you need to have large purchases, plan ahead and do the math to ensure your finances are adequate. With rising interest rates and inflation, in may be wise to hold off on large ticket items.

- Embrace diversification. While having a diversified portfolio won’t guarantee you gains, it is a strategy to help provide a balance between risk and reward.

- Avoid panic sell-offs and disregard media magnification. The media attracts our attention by inciting fear and anxiety. Limit your exposure to the news and social media and focus on your personal goals and plans.

- Be aware of any tax implications or tax efficiencies that any moves you make may have and discuss your plans with a financial professional prior to making any moves.

By rebalancing or adding new money to their equity portfolios during market downturns, investors can potentially generate better returns over the long run. Investors make money in equities typically when they buy low and sell high. If you have any questions about your portfolio, please call us prior to making any decisions and we can assist you in determining the best strategy for your unique situation.

There are many options and strategies out there for investors. However, the sound principals of successful financial planning remain constant. Build a well-devised plan with a qualified professional, stick with that plan, focus on the long-term, and be aware of any tax consequences of your actions.

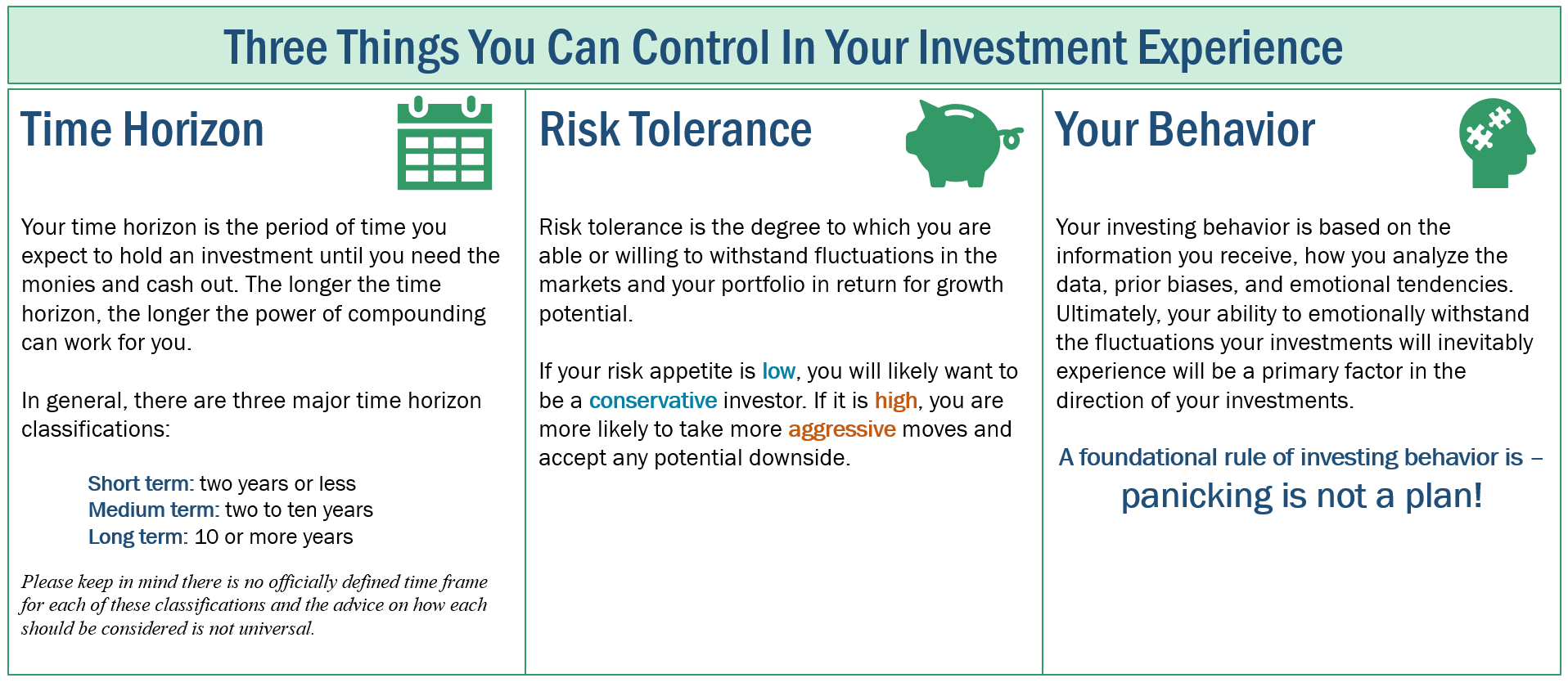

Don’t forget, while you cannot control the direction of the financial environment or your returns, you do have control of three very important things:

1.Your risk tolerance.

2.Your time horizon.

3.Your behavior.

If you have a firm grasp of each of these, you should be able to maintain discipline and remain calm during these times of and market fluctuations arise.

For example, the decade after the crisis in June 2008 gave plentiful rewards to those who chose to stay invested – in fact, 147% worth of rewards. This is versus the 74% average return for those who pulled their monies out of the stock market during the fourth quarter of 2008 or first quarter of 2009. (fidelity.com, 4/27/22)

Conclusion

We firmly maintain a “proceed with caution” approach.

Our primary responsibility is to focus on our clients’ financial goals. As a wealth manager, we take all key elements, like risk tolerance and time horizon, into consideration when assessing financial pictures and determining a plan that we feel offers the best chance to achieve a client’s goals. As always, we are available to revisit your financial holdings to make sure they are still compatible with your timeline goals and risk tolerance.

We believe an educated client is the best client and will keep you apprised on issues we feel could affect your situation.

As a reminder, please keep us aware of any changes (such as health issues or changes in your retirement goals). The more knowledge we have about your unique financial situation the better equipped we will be to best advise you.

We pride ourselves in offering:

- consistent and strong communication,

- a schedule of regular client meetings, and

- continuing education for every member of our team on the issues that affect our clients.

A skilled financial professional can help make your journey easier. Our goal is to understand our clients’ needs and then try to create an optimal plan to address them.