One of our main goals as holistic financial professionals is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies. Staying current on the ever-changing tax environment is a key component to helping our clients benefit from potential tax reduction strategies.

Other than some IRS inflation adjustments, calendar year 2023 has brought limited changes in tax laws for individuals. This report focuses on information that could be helpful for individuals in conjunction with tax planning for calendar year 2023. It also has a section that shares some of the tax laws that are currently set to sunset at the end of 2025.

Remember, the Tax Cuts and Jobs Act (TCJA) enacted in 2017 brought many changes to the tax code. The Tax Cuts and Jobs Act included many provisions for individuals that took effect in 2018 but are currently set to expire after 2025. One big uncertainty for all taxpayers is what will happen to the tax code after 2025.

As financial professionals, we try to be proactive. The primary objective of this report is to share strategies that could be effective if considered and implemented before year-end. Please note that this report is not a substitute for using a tax professional. In addition, many states do not follow the same rules and computations as the federal income tax rules. Make sure you check with your tax preparer to see what tax rates and rules apply for your state.

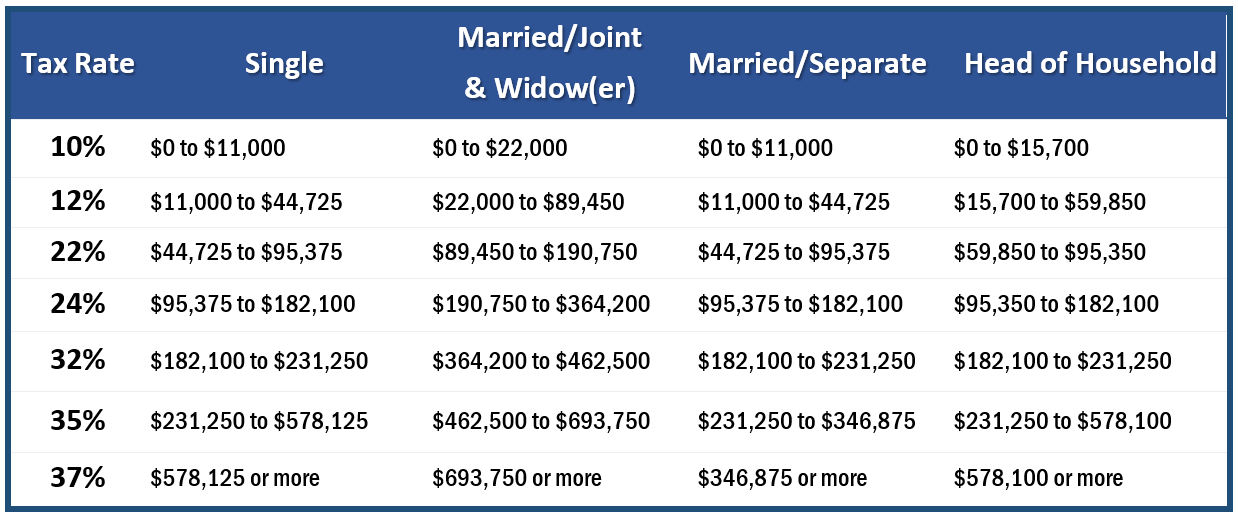

Income Tax Rates for 2023

For 2023 there are still seven tax rates. They are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Under current law this seven-rate structure will phase out on January 1, 2026.

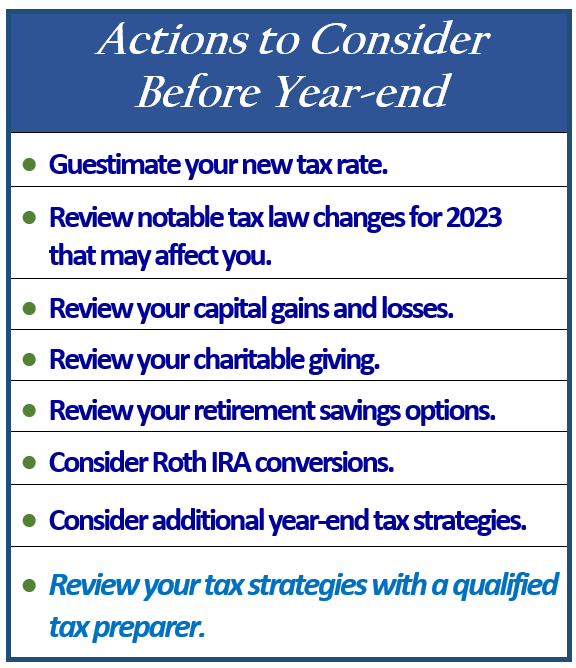

Year-end Tax Planning for 2023

One of our foremost goals is to help our clients try to optimize their tax situations. This report offers many suggestions and reviews of strategies that can be useful to achieve this goal.

Everyone’s situation is unique, but it is wise for every taxpayer to begin their final year-end planning now! Choosing the appropriate tactics will depend on your income as well as several other personal circumstances. As you read through this report it could be helpful to note those strategies that you feel may apply to your situation so you can discuss them with your tax preparer.

Some items to consider include:

Evaluate the use of itemized deductions versus the standard deduction.

For 2023 tax returns, the standard deduction amounts will increase to $13,850 for individuals and married couples filing separately, $20,800 for heads of household, and $27,700 for married couples filing jointly and surviving spouses.

As a reminder, the Tax Cuts and Jobs Act roughly doubled the standard deduction. Its goal was to decrease tax payments for many of those who typically claim this standard deduction. Although personal exemption deductions are no longer available, the larger standard deduction, combined with lower tax rates and an increased child tax credit, could result in less tax. You should consider running the numbers to assess the impact on your situation before deciding to take itemized deductions.

The TCJA still eliminates or limits many of the previous laws concerning itemized deductions. An example is the state and local tax deduction (SALT), which is still currently capped at $10,000 per year ($5,000 for married filing separately).

Consider bunching charitable contributions or using a donor-advised fund.

For those taxpayers who are charitably inclined it makes sense to think about a plan. One way to utilize the tax advantages of charitable contributions is through a strategy referred to as “bunching”. Bunching is the consolidation of donations and other deductions into targeted years so that in those years, the deduction amount will exceed the standard deduction amount.

Another strategy is to consider using a donor-advised fund. A donor-advised fund, or DAF, is a philanthropic vehicle established at a public charity. It allows donors to make a charitable contribution, receive an immediate tax benefit and then recommend grants from the fund over time. Taxpayers can take advantage of the charitable deduction when they’re at a higher marginal tax rate while actual payouts from the fund can be deferred until later. It can be a win-win situation. If you are charitably inclined and need some guidance, please call us and we can assist you.

Review your home equity debt interest.

For mortgages taken out after October 13, 1987, and before December 16, 2017 (i.e., entered into a binding contract by that date), mortgage interest is fully deductible up to the first $1,000,000 of mortgage debt incurred to acquire or improve a qualified residence. The TCJA lowered the threshold to $750,000 or $375,000 (married filing separately) for homes purchased after December 15, 2017, but before January 1, 2026. All interest paid on any mortgage taken out before October 13, 1987, is fully deductible regardless of your mortgage amount (“grandfathered debt”). Many mortgage holders refinanced for lower rates or to cash out in the last few years, so remember, to the extent debt increases the interest might not be deductible.

Interest on home equity lines of credit (HELOCs) and cash-out refinancings may be deductible as well if the funds were used to improve the home that secures the loan (or if the proceeds were invested). Please share with your tax preparer how the proceeds of your home equity loan were used. If you used the cash to pay off credit cards or other personal debts, the interest is not deductible, but that may change when the TCJA sunsets at the end of 2025.

Revisit the use of qualified tuition plans.

Qualified tuition plans, also named 529 plans, are a great way to tax efficiently plan the financial burden of paying tuition for children or grandchildren to attend elementary or secondary schools. Earnings in a 529 plan originally could be withdrawn tax-free only when used for qualified higher education at colleges, universities, vocational schools or other post-secondary schools. However, they changed that so 529 plans can now be used to pay for tuition at an elementary or secondary public, private or religious school, up to $10,000 per year. Unlike IRAs, there are no annual contribution limits for 529 plans. Instead, there are maximum aggregate limits, which vary by plan. Under federal law, 529 plan balances cannot exceed the expected cost of the beneficiary’s qualified higher education expenses. Limits vary by state. Some states even offer a state tax credit or deduction up to a certain amount.

Contributions to a 529 plan are considered completed gifts for federal tax purposes, and in 2023 up to $17,000 per donor, per beneficiary, qualifies for the annual gift tax exclusion. Excess contributions above $17,000 must be reported on IRS Form 709 and will count against the taxpayer’s lifetime estate and gift tax exemption amount ($12.92 million in 2023).

There is also an option to make a larger tax-free 529 plan contribution, if the contribution is treated as if it were spread evenly over a 5-year period. A lump sum contribution of up to $85,000 ($17,000 x 5) can be made to a 529 plan in 2023. No other gifts can be made to the same beneficiary, however, front-end loading the gift allows for additional tax-free compounding. Parents and grandparents sometimes use this 5-year gift-tax averaging as an estate planning strategy. If you want to explore setting up a 529 plan, call us and we would be happy to assist you.

Maximize your qualified business income deduction (if applicable).

One of the most talked about changes from the Tax Cuts and Jobs Act enacted in 2017 is the qualified business income deduction under Section 199A. Current proposals want to change this deduction, but for 2023, taxpayers who own interests in a sole proprietorship, partnership, LLC, or S corporation may be able to deduct up to 20% of their qualified business income. Please be careful because this deduction is subject to various rules and limitations. In 2023, limits on this deduction begin phasing in for taxpayers with income above $364,200 for those married filing jointly taxpayers (and $182,000 for all other filers).

There are planning strategies to consider for business owners. For example, business owners can adjust their business’s W-2 wages to maximize the deduction. Also, it may be beneficial for business owners to convert their independent contractors to employees where possible, but before doing so, please make sure the benefit of the deduction outweighs the increased payroll tax burden and cost of providing employee benefits. Other planning strategies can include investing in short-lived depreciable assets, restructuring the business, and leasing or selling property between businesses. This piece of the tax code is complicated and would take an entire report to discuss, so we recommend that if you are a business owner, you should talk with a qualified tax professional about how this new Section 199A could potentially work for you.