We have used most of the superlatives we know to describe corporate America’s stunning performances over the past two earnings seasons. Despite lofty expections, results exceeded estimates by the biggest margins we’ve ever seen (and one of the authors of this report has been doing this for 23 years). We expect solid earnings gains during the upcoming third-quarter earnings season, but upside surprises will be smaller. Unfortunately, we won’t need as many superlatives.

Look for Many—But Smaller—Upside Surprises

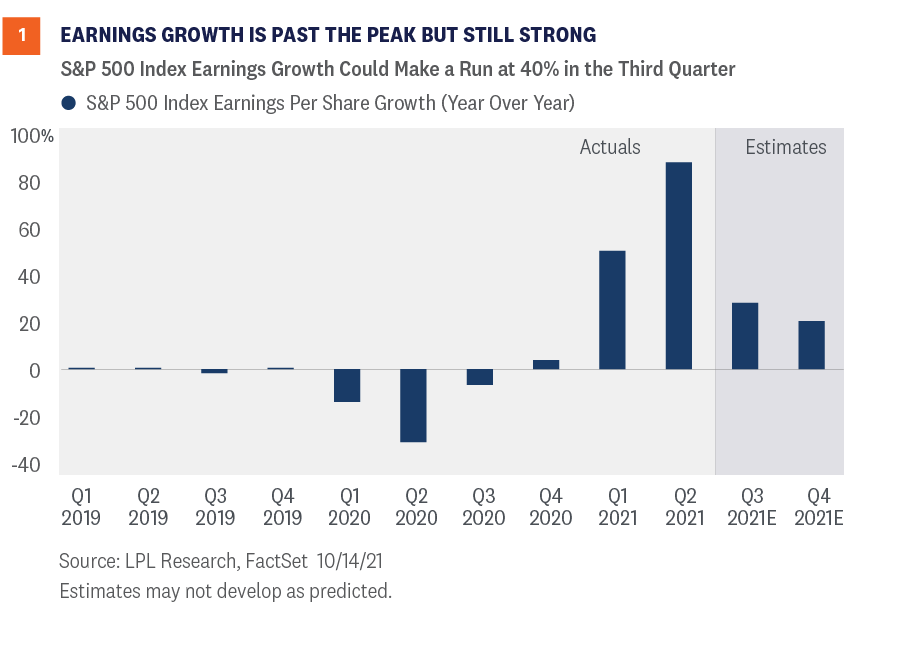

Earnings growth in the first half of 2021 was amazingly strong, with S&P 500 Index earnings growing 52% and 90% year over year in the first and second quarters, shown in Figure 1. The growth was stellar, but the most impressive thing to us about these numbers was the more than 20 percentage point upside surprises for both quarters. Those surprises came after the bar had already been raised following strong earnings results during the second half of 2020.

After being pleasantly surprised by corporate America for a year now, we won’t totally dismiss the possibility of big upside surprises again during the third-quarter earnings season. However, we would point to several reasons we think earnings growth overall will be much closer to the current third-quarter consensus estimate implying a 29% increase:

- Slower economic growth from the Delta variant. According to the Federal Reserve Bank of Atlanta’s estimate, the growth rate of gross domestic product (GDP) for the third quarter is tracking to just 1.3%, down from 6% two months ago. Manufacturing demand remains robust based on new orders, but company surveys and anecdotes continue to point to difficulty filling those orders due to the supply chain disruptions.

- Supply chain challenges have intensified. We have heard from a number of global companies in recent weeks that their profit margins are coming under more pressure from supply chain challenges. Nike cited shipping delays and factory shutdowns in Vietnam for lowering its guidance. FedEx lowered guidance amid rising labor costs, staffing shortages, and logistical challenges. Sherwin-Williams cut its outlook, citing materials shortages and higher-than-expected input cost inflation, exacerbated by Hurricane Ida. Margin pressures from shortages of labor and materials will be a common theme for the third quarter—and likely a quarter or two beyond.

- Pre-announcement numbers are good, but not quite up to second quarter levels. The number of S&P 500 companies providing positive guidance for the third quarter has decreased by 11 compared to the second quarter, according to FactSet. Meanwhile, the number of companies providing negative guidance for the third quarter has increased by 10 compared with the second quarter. Still, more companies have provided positive guidance than negative guidance for five straight quarters for the first time in at least 15 years, which signals more than just a few percentage points of upside surprise to the S&P 500 earnings estimate.

- Smaller increase in the consensus estimate. The estimate for third-quarter earnings rose during the quarter, but not as much as it did leading up to first- and second-quarter earnings seasons. The consensus third-quarter S&P 500 earnings estimate rose 2.9% over the three months ending September, down from increases of 7.2% for second-quarter earnings in the second quarter, and 6.5% for first-quarter earnings during the first quarter. Any increase is good, however, given the long-term average is a decline of 5%.

- Bottom line—expect upside as earnings continue to benefit from the reopening and high profit margins. But don’t expect the massive upside surprises of recent quarters. A third-quarter earnings growth rate in the mid-to-high 30s would be excellent.

What We’re Watching

Here are three things we will be watching as the numbers roll in and companies share thoughts about the future:

- How long might supply chain issues last? It will be very interesting to hear how long companies expect supply chain bottlenecks and shortages of labor and materials to last. These pressures on companies’ costs may impair profit margins for the rest of 2021—and likely into 2022. Raising prices will help, but unfilled orders may cap revenue growth, making it difficult for companies to beat analysts’ earnings targets.

- What is the outlook for wage increases? Wages are a big component of corporate America’s cost structure. We will be looking for confidence from companies that wage pressures will not get much stronger, though we anticipate higher wages will eat into profit margins in coming quarters. The question is how much. Productivity gains from technology investments (i.e., doing more with less) can only go so far in containing wage increases, which are already running above 4% annualized.

- How will stocks react to smaller upside surprises? Investors and analysts may have gotten spoiled by massive upside surprises in recent quarters. We’re interested to see how the market will react to smaller beats and guidance that may not be enough to push analysts’ estimates materially higher. While most companies will clear the higher bar, few will soar well above it as so many did last quarter.

Conclusion

Earnings growth in the third quarter will likely be quite strong, possibly making a run at 40%. While that’s excellent growth, it’s a far cry from the 90% increase in S&P 500 earnings in the second quarter. It will be interesting to see how corporate America wades through supply chain issues. If those headwinds are continuing to intensify, then our $205 estimate for 2021 S&P 500 earnings will be tough to reach (FactSet’s consensus estimate is currently $201).

Against this more challenging earnings backdrop, we maintain our positive stock market outlook. In the near term, we continue to look for dips to buy, given the prospects for a pickup in economic growth in the fourth quarter, still low interest rates, and historically strong fourth-quarter returns. Risks include another COVID-19 wave, stubbornly “sticky” inflation that could push interest rates sharply higher, potential tax increases in 2022, and, as always, geopolitics.

Looking out to 2022, prospects for above-average economic growth and further earnings gains potentially point to another good year for stock investors, though probably not as good as 2021 has been. We expect interest rates to stay low enough to justify maintaining current valuations as earnings grow, which could set the stage for double-digit returns for the S&P 500 in 2022.

More to come on our 2022 outlook in early December with the release of the yet-to-be-named Outlook 2022.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Midyear Outlook 2021: Picking Up Speed publication for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-928450-1021 | For Public Use | Tracking # 1-05201962 (Exp. 10/22)