The past few years have proved the Greek philosopher Heraclitus right when he proclaimed that, “the only thing constant is change.” Just when a sense of normalcy seemed to be realized, during the first quarter of 2022 the world was thrown another hardship as Russia invaded the Ukraine. For investors, this added more fuel for market volatility. Combined with inflation and rising interest rates, the first three months of 2022 became a roller coaster ride, challenging even the steadiest investors.

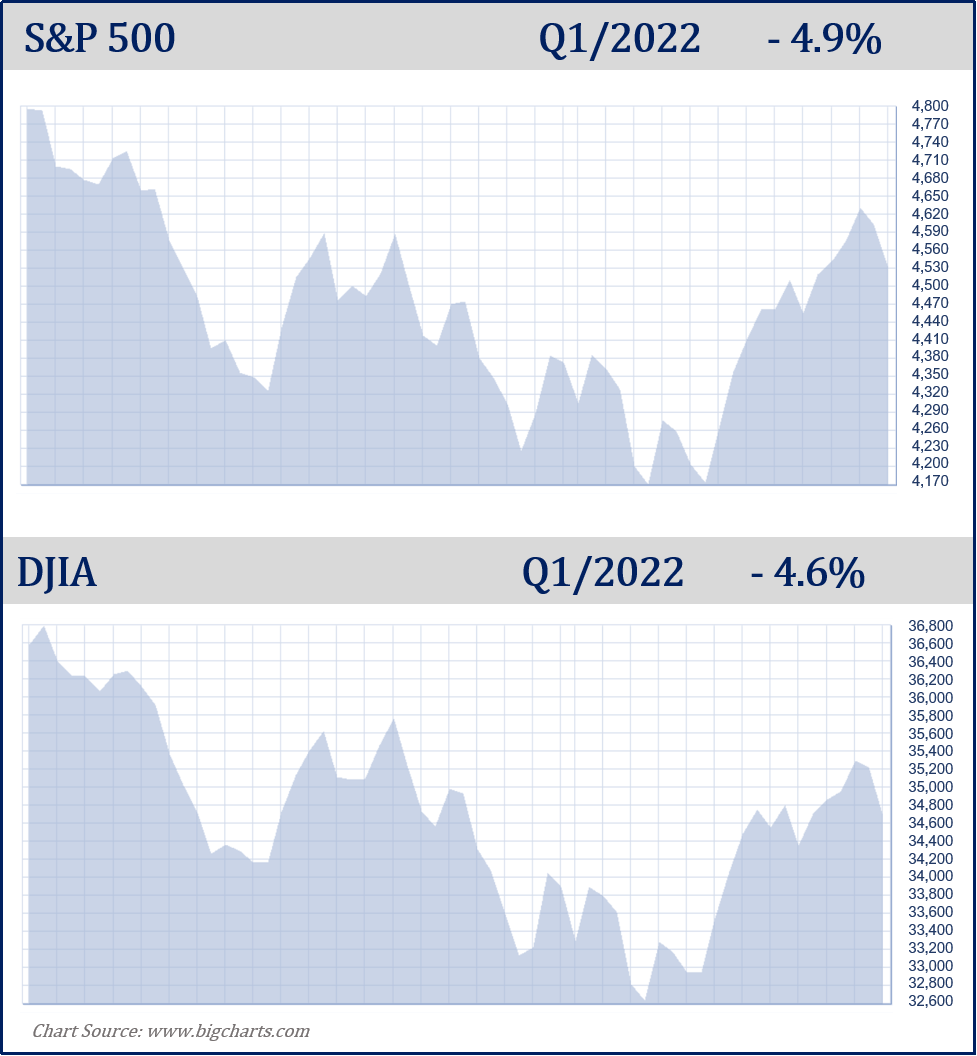

The first quarter of 2022 can effectively be described as volatile. After experiencing its worst January since 2009, the S&P 500 hit correction territory in February. After several more drops, toward the end of the quarter, equity markets began to rally. In March, the S&P 500 rose more than 3% while the Dow Jones Industrial Average (DJIA) rose 2.2%. Even after that increase, both bellwether indexes did not reach the same values they were at the beginning of the quarter.

For the quarter, U.S. stock markets closed their first losing quarter since March of 2020. The S&P 500 closed at 4,530.41, down 4.9% and the Dow Jones Industrial Average closed at 34,678.35, down 4.6%.

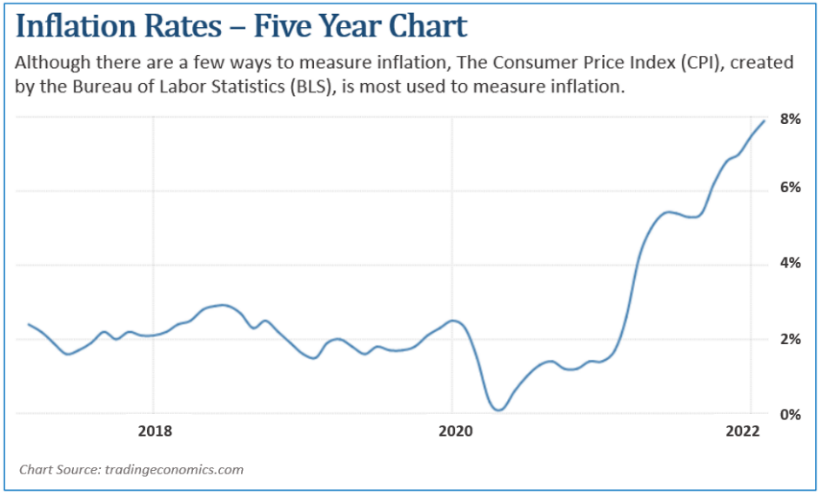

During the past three months, the cost of living saw a sizeable uptick as the consumer price index rose to its highest level since January of 1982. Due to the Russia/Ukraine war, consumers experienced an average 24% jump at the gas pump from February to March, which meant as much as a 53% increase over the past year. (Source: cnbc.com 3/10/222)

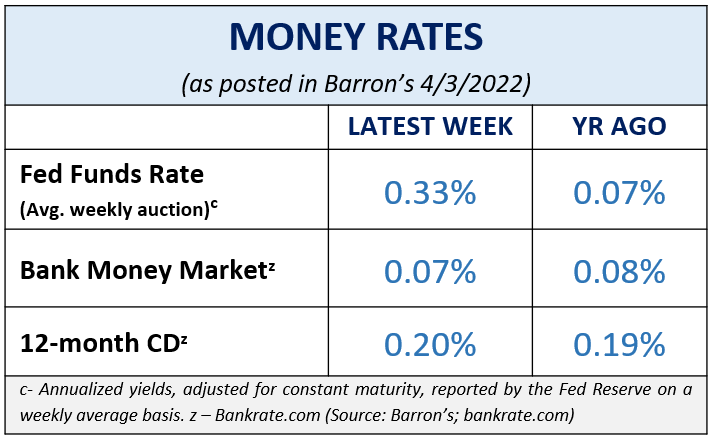

All eyes were on the Federal Reserve and interest rates as the Federal Open Market Committee (FOMC) met in March and raised their federal funds interest rates range for the first time since 2018. This move set the tone for anticipating several more rate hikes in 2022 and 2023, and at possibly higher basis points than expected.

In February, inflation rose 7.9% from 12 months earlier. This means that inflation is now at a 40-year high. Although there is no established formal inflation target, the Federal Reserve generally believes that an approximately 2% rate of inflation is acceptable.

It’s virtually impossible to avoid being affected by the current environment of inflationary pressure somewhere in your daily life. Whether it is at the gas pump or the grocery store, consumers are feeling squeezed and are looking for ways to cut costs and spending in their daily lives.

At the FOMC’s March meeting, Chairman Jerome Powell expressed the need to support a strong labor market. “We understand that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing, and transportation. We know that the best thing we can do to support a strong labor market is to promote a long expansion, and that is only possible in an environment of price stability. As we emphasize in our policy statement, with appropriate firming in the stance of monetary policy, we expect inflation to return to 2 percent while the labor market remains strong.” He also added that, “We will need to be nimble in responding to incoming data and the evolving outlook.” (Source: federalreserve.com 3/16/2022)

Stock markets can fall as an immediate response to rising interest rates. This time, markets defied conventional history and rallied. After an initial drop, the S&P 500 closed the day that the Fed announced the rate hike on a very strong note with the S&P 500 closing 2.2% higher than the day’s opening and the DJIA closed 1.6% higher. (Source: www.fortune.com 3/16/22)

There are always multiple factors in the economic environment that need to be watched because they can directly affect equity markets. With an excessive number of media sources nowadays, investors are being barraged with data and news making it difficult to keep up with the facts and information that may affect their personal situation. As your financial professional, we strive to keep an active eye on any issues, changes and activity that could directly affect you and your situation.

Inflation & Interest Rates

The much-anticipated rise in interest rates came in March, as the Federal Reserve raised the federal funds rate for the first time since 2018. The benchmark federal funds rate was increased by a quarter percentage point to between 0.25-0.5%.

Also in March, the Fed released new projections for interest rate increases. This past December, projections suggested three quarter percent increases in 2022. Now, officials are signaling there might be six more rate hikes this year, expecting to see the fed funds rate at nearly 2% by the end of this year. This will bring it just above pre-pandemic rates.

The Fed also suggested the percent of increase could rise as well, with half-percent (or 50 basis points) increases on the horizon to meet the near 2% target rate by the end of this year.

Federal Chairman Jerome Powell stated, “The labor market is very strong, and inflation is much too high. There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is what is required to restore price stability.” He added that, “if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.” (www. Reuters.com, 3/21/2022)

With interest rates combating the rapid inflation uptick, the median federal funds projections show interest rates at or near 2.75% by the end of 2023, bringing it to its highest rates since 2008. (Source. Wsj.com 3/17/22)

These new projections are a product of the larger than expected rising of inflation. Additionally, COVID-19 is still playing a role in supply chain disruptions which are contributing to a sharp rise in the cost of goods. Add in Russia’s war on Ukraine and the sharp increase in the price of oil and you have an unhealthy inflation environment. While United States oil prices have increased, many people may not know that the U.S. is currently one of the largest oil producers in the world and has been able to stave off drastic oil shock better than it has in the past. (www.Reuters.com, 3/21/2022)

As your financial professional, we are committed to keeping a watchful eye on the economy and how interest rate hikes and the trajectory of inflation affects our clients. If you are concerned about how these key items could affect you, please connect with us to discuss possible hedges against inflation and rising rates.

The Bond Market and Treasury Yields

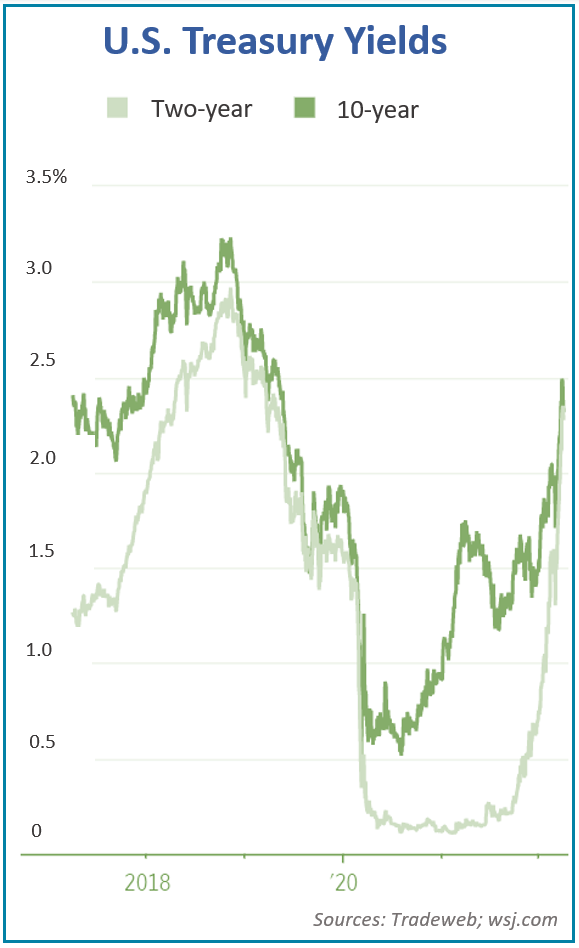

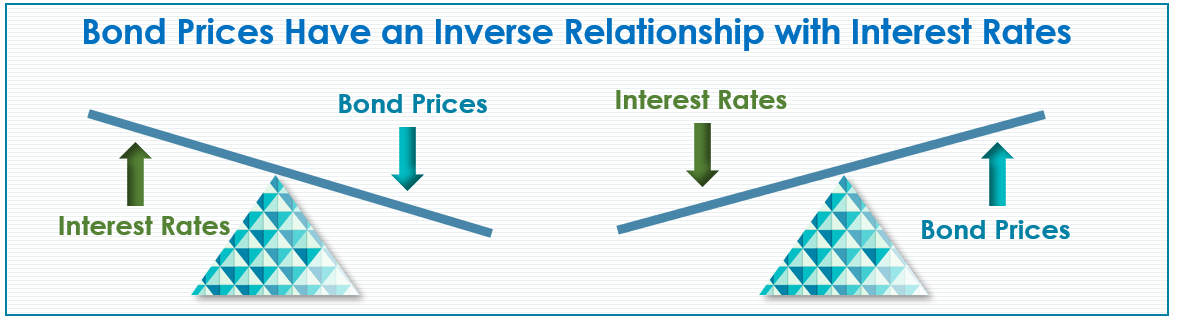

Bonds and interest rates move in the opposite direction. When interest rates rise, existing bond prices tend to fall, and conversely, when interest rates decline, existing bond prices tend to rise.

Recent times have not been very beneficial for bond holders. Bonds are many times considered to be more stable than equities for investors. This quarter, volatility in the bond market was high and U.S. bonds had their worst quarter in over 40 years. As an example, the Bloomberg U.S. Aggregate bond index, which includes mostly U.S. Treasurys, corporate bonds, and mortgage-backed securities, had a -6% return in the first quarter – its biggest quarter loss since 1980. Short- and mid-term bond yields also experienced rate increases this quarter. The 10-year Treasury yield finished the quarter at 2.35%. This is a significant jump from the 1.5% yield that 10-year bond holders had at the end of 2021. (Source: wsj.com 3/31/22)

Interest rates are rising and investors are expecting short-term yields to reach 3% in 2023, significantly higher than the current near 0.5%.

This is a good time for any bond investors to review their holdings. (Source: wsj.com 3/31/22)

In addition to rising interest rates, “quantitative tightening” could affect bonds. The Fed is beginning its task of reducing its $9 trillion balance sheet in part created by its bond buying program – or quantitative easing that helped stimulate the economy during the pandemic. The Fed stopped purchasing bonds this quarter. The impact of “quantitate tightening” on bonds will depend on how much and how quickly the Fed moves.

David Sekera, Morningstar’s Chief U.S. market Strategist stated, “Based on how much and how fast the Fed decides to unwind the balance sheet could have a significant impact on the supply-demand characteristics of the bond markets.” (Source: Morningstar.com 3/23/2022)

Eddy Vataru, Lead Portfolio Manager of the Osterweis Total Returns Fund, believes that Treasuries, which are typically viewed as “safer” investments, are also being impacted by the “calamity that’s driving inflation through the roof and trumping the flight-to-quality nature of the asset class.” (Source: Morningstar.com 3/23/2022)

Remember, bonds typically can be a key component to a diversified portfolio and can provide a good shield from equity volatility. However, please keep in mind that investors who placed a large percentage of their portfolio in bonds with the expectation of generating stable returns could have seen lackluster results. If you’d like to explore any exposure you have to bonds and whether or not they are still a good fit for your personal goals, please contact us. We are monitoring how the Fed’s movements and rising interest rates are affecting bond yields.

Investor’s Outlook

What does this all mean for investors?

As we continue on to the second quarter of 2022, many factors could complicate equity market performance and the speed and direction of the economy, including Russia’s war on the Ukraine and Covid-19 variants. Savers may need to become more disciplined and focused. Volatility isn’t likely to go away in the coming months, so investors need to be prepared.

Interest rates will continue to be at the forefront of our watch list. They can be complex and affect investors differently depending on their goals and timelines.

These five items are usually partnered with rising interest rates:

- Mortgage rates increase;

- Interest rates increase on savings accounts and Certificate of Deposits (CD);

- Existing bond prices decrease;

- Commodity prices decrease; and

- Equity markets may become more volatile.

The FOMC is set to meet again the first week of May. It is widely anticipated that they will approve another rate increase. With interest rate hikes on the horizon, we suggest you consider:

- reviewing all income-producing investments.

- locking in your mortgage rates.

- maintaining liquidity for all near-term needs.

- contacting us to review your personal financial plan, including risk management, diversification, and time horizons.

While bonds typically are directly affected by interest rates, stocks are not directly affected. However, they can be indirectly affected when interest rates rise and banks increase their rates for consumer and business loans. Reduced consumer and business spending could lower the value of many companies’ stocks.

Borrowing has become more expensive with the rise of interest rates. According to Jacob Channel, Senior Economic Analyst at LendingTree, the average 30-year fix mortgage rate is now 4% and likely to increase. This reflects a sharp spike from 3.85% to 4.16% the day after the Fed increased the fed funds rates and shared news of more rate hikes. (Source: www.cbnc.com 3/16/22)

Interest rate changes are far from done and the Fed is expecting to make several more moves this year and in 2023. Combined with a lower unemployment rate and better supply chain movement, the Fed is hopeful that the increase in interest rates will help quell rising inflation. Fed officials are estimating that as energy prices ease and supply chains return to more normal operations, we may see inflation drop down to 2.6% by the end of 2022. (Source: fidelity.com 3/10/22)

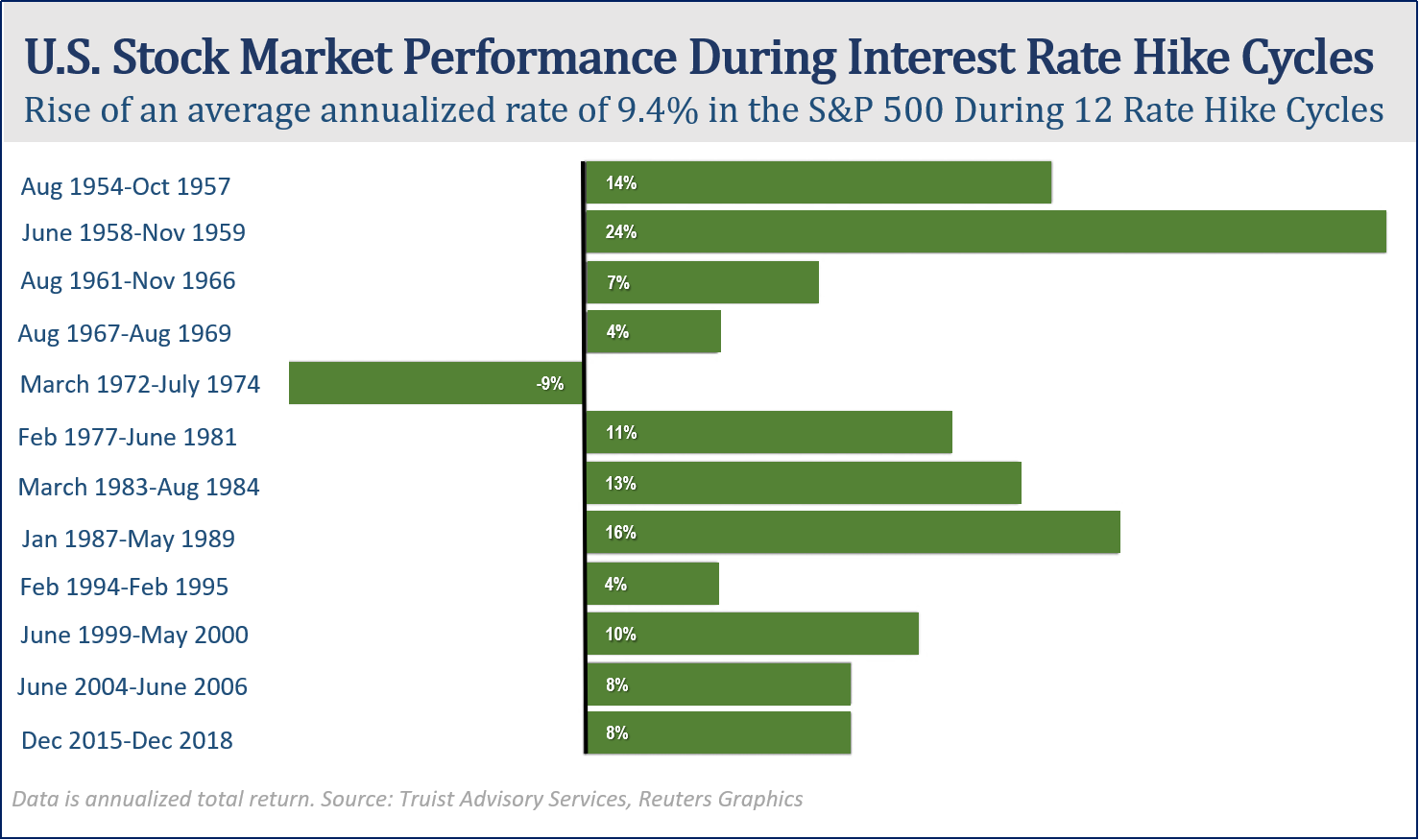

The good news is that historically, after an initial reaction, U.S. equity markets have risen during a period of rising interest rates. This is due to the fact that interest rates typically rise in a healthy economy.

According to a Deutsche Bank study of 13 interest rate increase cycles, the S&P 500 returned an average of 7.7% in the first year the Fed raised rates. An analysis by Truist Advisory Services of 12 rate hike cycles showed the S&P 500 posting a total return average of 9.4% with 11 out of those 12 periods having positive returns. (Source: www.reuters.com 3/16/22)

Moving forward, we still stand by our mantra of “Proceed with Caution.”

There is currently a lot of noise that can distract an investor. Equity market volatility; interest rate increases; inflation; global unrest; and pandemics; have all given the media, analysts, and economists much to talk about. Recently, two words that have been widely used are “stagflation” (high inflation, high unemployment, and slow or no economic growth) and “recession” (recognized as two consecutive quarters of economic decline). However, irrespective of what is presented, it is wise not to try predicting the future, but instead focus on your long-term goals and objectives.

Now is an ideal time for a proactive approach to your financial goals. Having a solid investment strategy is an integral part of a well-devised, holistic financial plan. Staying disciplined and following that strategy during times of volatility is equally important. As your financial professional, we are here to help you pursue your goals. Please call our office to discuss any concerns or ideas you have or bring them up at your next scheduled meeting. Prior to making any financial decisions, we highly recommend you contact us so we can help determine the best strategy. There are often other factors to consider, including tax ramifications, increased risk, and time horizon fluctuations when changing anything in your financial plan.

As always, please feel free to connect with us via telephone or email with any concerns or questions you may have.