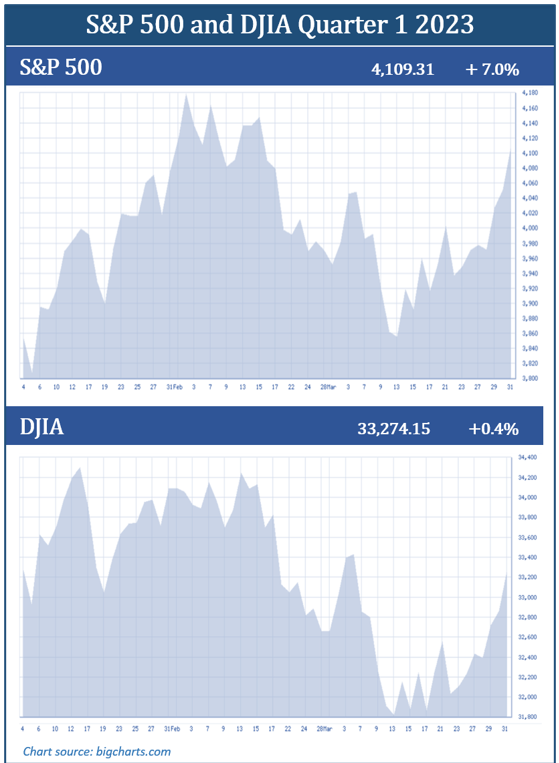

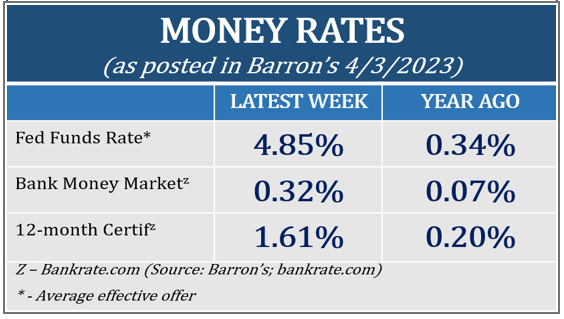

The first quarter of 2023 had investors sitting on the edge of their seats as the equity markets took them for a bumpy ride. In the end, the quarter did close on a good note, with U.S. stocks having a late quarter comeback following some positive news that the Federal Reserve’s preferred inflation gauge took a dip in February after an uptick in January. The core personal consumption expenditures price index (PCE) (excluding food and energy) increased 4.6% in February from a year earlier, slowing from a 4.7% 12-month annual pace in January. It was up 0.3% from January, compared with a 0.4% increase that was originally expected by economists. This was a welcome sign that the Fed is gaining traction in its long battle against inflation. (Source: barrons.com, 3/31/2023)

The first three months of 2023 were a classic example that volatility can be very prevalent in equity markets. Despite a banking crisis, an initial uptick in inflation rates, additional increases in interest rates and economic uncertainty, U.S. equities still managed to endthe quarter on a high note.

The Dow Jones Industrial Average (DJIA) ended the quarter up 0.4%, after rising 3.2% in the last week of the quarter, its largest one-week gain since the week ending November 11, 2022. The DJIA closed on March 31, 2023, at 33,274. The S&P 500 rose 7.0% during the first quarter, which is its best three-month performance since the fourth quarter of 2021. The S&P 500 closed the quarter at 4,109. (Source: cnbc.com, 3/31/23)