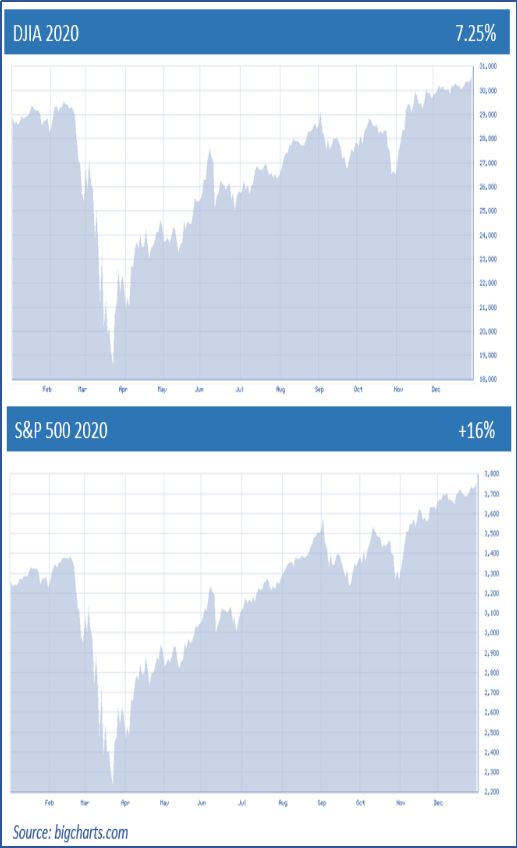

There are many years that history could easily forget, but 2020 certainly will not be among them. The year 2020 challenged us in more ways than we were prepared for and the thoughts of a “Happy New Year” seemed to be more prevalent this New Year’s Eve than ever. In the investment markets, the year 2020 ended much like it began, with equities in a bull market and making fresh all-time highs. This fact might seem somewhat unsurprising if it was not for the historic events that occurred in the first quarter, namely the worst global pandemic in a century and the almost shockingly brief bear market that accompanied it. The S&P 500 has surged roughly 65% since its March low and finished the year up over 16%. (Source: forbes.com 1/2020)

The economy’s nascent recovery gets much of the credit for the market’s gains, as does a federal stimulus package, massive amounts of liquidity from the Federal Reserve and the rapid development of multiple COVID-19 vaccines.

For the new year, talks of vaccines defeating the spread of coronavirus and an economic rebound could potentially result in a time of celebration. While the economy suffered in 2020, most U.S. stock indexes ended the year at or near all-time highs and market strategists see the major indexes pushing even higher in 2021. Predictions of a stronger economy, robust profit growth and some more massive stimulus from governments and central banks are expected. These factors combined with keeping interest rates near zero have been crucial in leading this year’s rebound from the March 2020 lows.

The Dow Jones Industrial Average (DJIA) advanced in the fourth quarter eclipsing the 30,000 level while the S&P 500 also experienced gains. The DJIA finished 2020 higher by more than 7.25%, while the S&P 500 rose over 16%. (Source: cnbc.com 1/4/2020)

As you look at the year’s results, analysts remind us that a surge in technology and internet-related shares were fueling the U.S. indexes to record highs. Gains in Apple, Amazon and Microsoft alone accounted for more than half of the S&P 500’s 16% total return, according to Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices. Analysts also feel that “valuations near 16-year highs are raising concerns about the sector’s vulnerability.” While many equities ended the year strong, technology companies were clearly amongst the best performers.

2020 was another strong year for many other asset classes. Some of the highlights included:

- Global stocks (as measured by the MSCI World Index) climbed 14%.

- Gold (as measured by NYMEX per troy ounce) soared 28%.

- Bonds (as measured by the Barclays Aggregate Bond Index) gained 5%. (Source: fidelity.com 12/31/2020)

Although equities advanced in 2020, these gains came despite a backdrop of grim news that overshadowed the year. These included:

- COVID-19 shutting down the economy and contributing to more than 300,000 deaths in the U.S.

- An almost nonstop attention to politics which caused some to read every movement of the stock market as a referendum on the election.

- Social justice unrest and the protests that followed.

- Uncertainties in many areas of life and business.

While there are always many key points and issues that need to be watched, this report’s goal is to focus on a few key themes for investors. Unlike people, equity markets do not have emotions and investors might be best served remembering that. The final quarter of 2020 will be remembered for many reasons, but perhaps none more consequential than the development of at least three viable COVID-19 vaccines. Hopefully, we entered 2021 on a path toward a daily life that is less restrictive and provides a healthy boost to the economy.

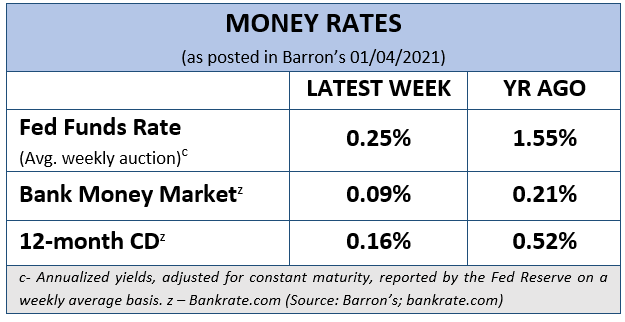

Interest Rates Remain at Ultra-Low Levels

In December, the Federal Reserve announced its decision to continue to support the economy by buying Treasury bonds. At the December press conference, Treasury Secretary Powell said that the Fed would continue to use a variety of monetary tools until officials are confident the U.S. economy is fully recovered. The Federal Reserve has suggested interest rates will remain near zero through 2023. (Source: cnbc.com 12/16/2020)

Since March, interest rates on even the highest-yielding savings accounts have been less than 1% and many times closer to 0%. While savers are generating next to nothing on cash accounts, homeowners can potentially take advantage of these low rates by refinancing their mortgages.

While interest rates are low, a fully diversified portfolio should include interest sensitive investments, like bonds. Therefore, in a period where the market rises, diversified portfolios will have lower returns than full equity portfolios. On the flip side, with equities at or near all-time highs, bonds can help protect investors in the case of a downturn. Remember, diversification is a strategy used to reduce risk by investing in different areas that could each react differently to the same event. A well-diversified portfolio looks for investments in different categories like stocks, bonds, and cash, whose returns have not historically moved in the same direction and to the same degree.

Interest rates are important for investors to monitor and they will continue to stay near the top of our watchlist, but for now, the consensus appears to be that rates are going to be low for a long time.

New Administration in 2021

Our job as financial professionals requires analyzing political activity and relaying how a new administration could impact the investment world. After one of the most contentious elections ever, with the largest voting numbers ever recorded, a new administration is taking over in January.

According to CNBC, the new Democratic control of Congress should help keep the bull market in stocks going with a big boost of fiscal spending, but it could also throw new hurdles into its path, like higher taxes and higher interest rates.

“Every Democratic president since Woodrow Wilson served their first year in office with the support of a Democratic House and Senate,” said Sam Stovall, CFRA chief investment strategist. He added during that first year, “The market did very well.” Dan Clifton, head of policy research at Strategas, expects a first stimulus to come early in the Biden administration and could include payments for individuals, funds for state and local governments, and extensions for unemployment benefits. (Source: cncb.com 1/6/2021)

Could a Democratic Congress push through stimulus programs to boost the economy that could help the stock market? Would this outweigh a tax increase? How will the new administration handle trade talks with China? All these questions and many more like them mean that investors need to carefully watch the political results of the incoming administration. Public policy and the new administration are clearly on our watchlist.

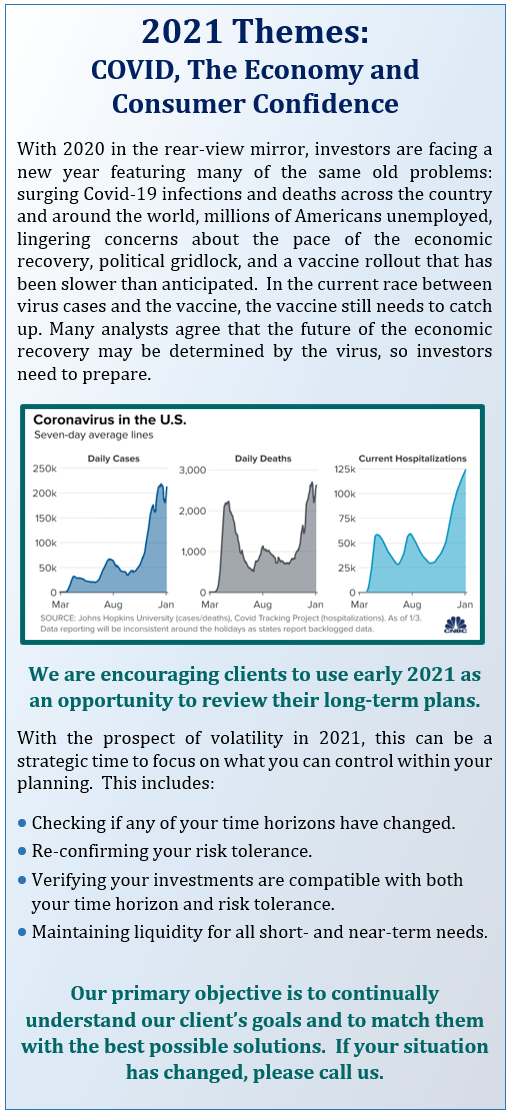

The Economy and the Stock Market

As the year ends, investors are left with the reality that there is still a wide divergence between financial markets and economic performance. Equity indexes ended the year at or near all-time highs, while Main Street still suffered from lockdowns, high unemployment and uncertainty. In March, the coronavirus pandemic brought a decade-long economic expansion and bull market to an end, but a powerful monetary and fiscal response from the Government and Treasury led to a roaring recovery in the stock market. The economy was not as fortunate, as its recovery has been uneven at best, and the rate of improvement slowed dramatically as we approached the end of the year.

Former Fed Chair Janet Yellen, who is currently President Biden’s choice for Secretary of the Treasury is remembered for famously stating that, “the stock market isn’t the economy,” but the two still inevitably reconnect over time. Hopefully, the new year brings a robust recovery in the rate of economic growth, combined with the monetary and fiscal stimulus already in the system and what is likely to be proposed by the new Congress this year. Today’s low interest rates are a foundation of the bullish narrative because they leave investors to consider higher risk stocks and bonds. While no one can predict the future with complete accuracy, many professionals are stressing, that investors need to diversify and balance their portfolios. For 2021, the economy and its ability to recover are near the top of our watchlist.

Investor Outlook

The stock market enters 2021 with favorable outlooks. Vaccines should help prevent the spread of COVID-19. S&P 500 earnings are expected to keep rebounding. The Federal Reserve has assured markets that it will not raise interest rates and there have already been some new rounds of fiscal stimulus signed into law. Please remember that the stock market is forward-looking and many prominent analysts feel that it has already priced in a stronger economy and the pausing of the coronavirus pandemic. That raises the risk that any disappointment in the recovery will rattle investors, especially with the P/E (price-to-earnings) ratio of the S&P 500 at a high level. This has caused some leading market followers to argue that the stock market is overvalued.

Most analysts are optimistic for 2021. Barron’s recently surveyed 10 market strategists and chief investment officers at large banks and money-management firms on the outlook for 2021. Averaging their year-end S&P 500 forecasts, which range from 3800 to 4400, the group expects the index to rise 9% in 2021 to about 4040. Add a dividend yield of around 2% and U.S. stocks could return a total of 10% to 11%. Their panel predicts the U.S. economy will grow by 5% in 2021, its fastest rate since 1984.

Predicting short term changes in the equity markets is still near impossible. Equities are primarily for long term investors. With interest rates at or near zero, investors who need returns need to consider equities.

With 10-year Treasuries yielding around 1%, equities become even more noticeable on an investor’s choice list. Equity markets will continue to move up and down. Even if your time horizons are long, you could see some short-term downward movements in your portfolios. For 2021, caution is still the principal notion for investors. Our goal is to make sure your investing plan is centered on your personal goals and timelines.