It’s probably a fair assumption to say that most investors are happy 2022 is in the books. After enjoying the longest bull market in history, from after the financial crisis in 2009 to the beginning of the COVID-19 pandemic, the bear finally officially rose from its slumber and dominated Wall Street. There’s no sugar-coating the fact that if you had money invested in the financial markets in 2022 it was an unpleasant year, perhaps even one of the worst you will experience as an investor. 2022’s equity market loss was the 7th worst loss since the 1920s and the bond market also had one of its worst years in history. It was the worst year since 2008 for all three major indexes. Fortunately, as a new year begins, all that matters is what happens from here, not what happened in the past.

It’s probably a fair assumption to say that most investors are happy 2022 is in the books. After enjoying the longest bull market in history, from after the financial crisis in 2009 to the beginning of the COVID-19 pandemic, the bear finally officially rose from its slumber and dominated Wall Street. There’s no sugar-coating the fact that if you had money invested in the financial markets in 2022 it was an unpleasant year, perhaps even one of the worst you will experience as an investor. 2022’s equity market loss was the 7th worst loss since the 1920s and the bond market also had one of its worst years in history. It was the worst year since 2008 for all three major indexes. Fortunately, as a new year begins, all that matters is what happens from here, not what happened in the past.

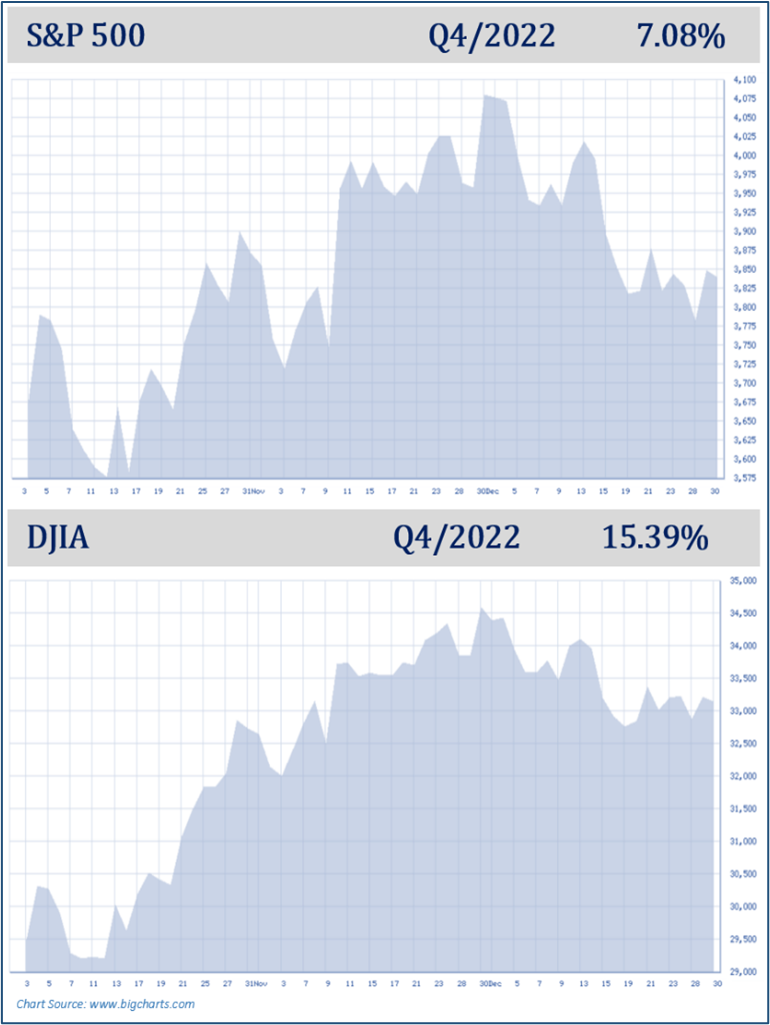

Although the yearly results were discouraging, the fourth quarter of 2022, despite its volatility and uncertainty, brought slight improvements in the U.S. equity markets. The Dow Jones Industrial Average (DJIA) closed out at 33,147.25, ending the year down 8.8%. Similarly, the S&P 500, closed at 3,839.50 to close out the year down 19.4%.

(Source:cnbc.com 12/29/22)

During 2022, inflation, rising interest rates, slowing economic growth, the weakening of fiscal and monetary stimulus – all packed a bearpaw-sized punch to investor’s portfolios. Recession fears also played a key role in the direction of the market. All these major factors allowed volatility to prevail and investors rode a steady downward trend throughout the year. 2022 was a solid practice in emotional resilience and trust in the long-term perspective of investing.

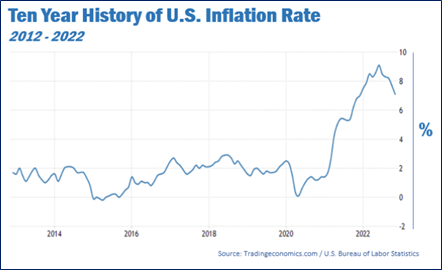

On a positive front, the Fed’s efforts to slow down the rate of inflation finally began to show quantifiable results. The U.S. annual inflation rate experienced a slowing down and was 7.1% for the 12-months ending November 2022.

As we look toward a new year, multiple factors remain key issues for the direction of equity markets, most particularly, the continuation of rising interest rates, and speculation of if, how long, and how deep of a recession the U.S. and global economy could see in 2023 and beyond. Uncertainty remains and wise investors should have a sufficiently diversified portfolio that looks for balance in times of volatility. This is a key time to practice patience and to remain focused on your personal long-term goals.

As we close out what was undoubtedly a rough year for equity markets, investors are bracing for another potentially rocky year. As your financial professional, we are committed to keeping you apprised of any changes and activity that could directly affect you and your unique situation.

Inflation & Interest Rates

In 2022, Americans saw seven federal interest rate increases, ending the historically low interest rates that were enjoyed since the “Great Recession” from 2007-2009.

In their efforts to use interest rate increases to lower inflation, the Fed raised interest rates twice in the fourth quarter of 2022. In November, rates increased 0.75% for a target rate range of 3.75 – 4.00%. Then, as planned, the Fed again raised rates at the December meeting. However, because inflation started to show potential signs of slowing down in the months prior, the Fed raised it by only 50 basis points, for a target rate range of 4.25 – 4.50%. This marked a 4.25% total rate increase in 2022, the fastest upward cycle of interest rates in history.

In their efforts to use interest rate increases to lower inflation, the Fed raised interest rates twice in the fourth quarter of 2022. In November, rates increased 0.75% for a target rate range of 3.75 – 4.00%. Then, as planned, the Fed again raised rates at the December meeting. However, because inflation started to show potential signs of slowing down in the months prior, the Fed raised it by only 50 basis points, for a target rate range of 4.25 – 4.50%. This marked a 4.25% total rate increase in 2022, the fastest upward cycle of interest rates in history.