Key Points

1. Equity markets reached new highs again this quarter.

2. The bull market is now over 10 years old and is the longest on record.

3. The Fed changed its stance on raising interest rates and has indicated that a future move could be to lower rates.

4. Trade wars and tariffs have created market and investment uncertainty.

5. Market volatility continues and investors need to remain cautious.

6. Focus on your personal goals and call us with any concerns.

The first half of 2019 brought very strong results for financial markets. Both equity and bond investors saw positive results leaving investors in a happy mood. The Dow Jones Industrial Average (DJIA) enjoyed its largest June gain since 1938 and the S&P 500 experienced its best first half in two decades. (Source: CNBC.com 6/28/2019)

The first half of 2019 brought very strong results for financial markets. Both equity and bond investors saw positive results leaving investors in a happy mood. The Dow Jones Industrial Average (DJIA) enjoyed its largest June gain since 1938 and the S&P 500 experienced its best first half in two decades. (Source: CNBC.com 6/28/2019)

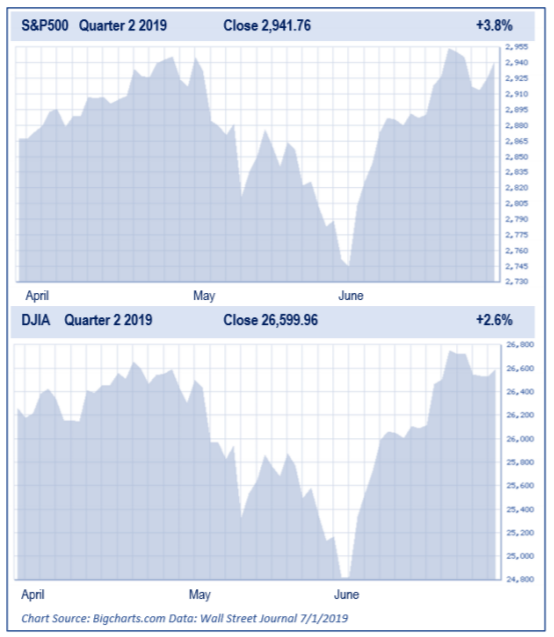

Concerns of an economic slowdown overshadowed the quarter for many investors. In May, the major equity indexes started heading lower. Although the quarter’s final results showed an upward move of 3.8% for the S&P 500 and 2.6% for the DJIA, these gains came with an extension of the volatility that investors have been experiencing since October of 2018. (Source: Wall Street Journal 6/29/2019)

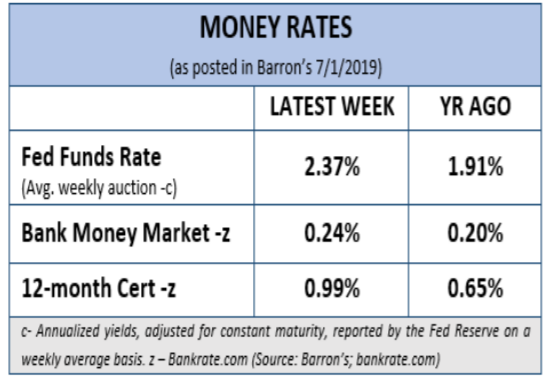

The strong six-month period that equity and debt securities have enjoyed has been tied to the pivot that the Federal Reserve has made on its interest rate outlook. In 2018, the Federal Reserve’s stance was to raise short-term interest rates multiple times. Early in the month of January 2019, Fed Chairman Jerome Powell, switched that thinking when he announced that the Fed would be “patient” in boosting rates. In late spring, the dialogue from the Fed shifted toward indicating that their next move might be a rate cut. This shift helped create the environment which led to attractive returns for both stock and bond investors. (Source: Barron’s 7/1/2019)

The strong six-month period that equity and debt securities have enjoyed has been tied to the pivot that the Federal Reserve has made on its interest rate outlook. In 2018, the Federal Reserve’s stance was to raise short-term interest rates multiple times. Early in the month of January 2019, Fed Chairman Jerome Powell, switched that thinking when he announced that the Fed would be “patient” in boosting rates. In late spring, the dialogue from the Fed shifted toward indicating that their next move might be a rate cut. This shift helped create the environment which led to attractive returns for both stock and bond investors. (Source: Barron’s 7/1/2019)

While equity markets closed the quarter at or near all-time highs, analysts ended the quarter with a checklist of concerns for the future. A slowing global economy, trade wars and tariffs, sluggish corporate earnings and the Federal Reserve’s upcoming decisions all headline a list of issues that could affect year-end results. According to FactSet, the S&P 500 made new all-time highs in the 2nd quarter. That was after S&P 500 earnings dipped 0.4% in the first quarter and were projected to decline in the second and third quarters of 2019 (compared to a year prior). A weak global economy and trade wars were cited as major contributors to earnings declines. (Source: USA Today 7/1/2019)

Although equity markets are high and investors should be cautious, some positive signs exist. At quarter close, the United States and China seemed to be on a constructive path. While Japan and many countries in Europe seem to be in economic stress, U.S.-based companies appear to be on more solid footing. (Source: USA Today 7/1/2019)

Investors are now enjoying the longest bull market ever, and two camps of thought are now emerging. One camp points to the fact that based on historical numbers, like price earnings (P/E), that equities are highly overvalued and overpriced. The other camp insists that we are in a “TINA” market, meaning, There Is No Alternative to stocks. This group feels that until rates rise significantly, this will remain true and that means there could be significant upside in the current market. Equities are not cheap and even the savviest of investors need to have a watchful eye on risk. As financial professionals, we always try to make our best forecasts. We look for a probability of success, understanding we face an inexact future. Short-term interest rates and cash equivalent yields are still historically low. Our goal is to focus on client’s timeframes and needed returns to achieve their goals.

Interest Rates Are Crucial

Interest rates are crucial for investors and the way the system works is that everyone follows the federal funds rate, which is the interest rate banks charge one another for overnight borrowing. The decision to raise, lower or maintain the rate is determined by the Fed’s Federal Open Market Committee (FOMC). At their June meeting, the committee signaled a willingness to lower short-term interest rates to sustain economic expansion. While the Federal Open Market Committee voted 9-1 to keep the benchmark rate in a target range of 2.25% to 2.5%, eight members favored a rate cut this year. When discussing potential rate cuts and the need to keep the economy moving in a healthy direction, Fed Chairperson Jerome Powell said in a press conference that some officials believe the case for accommodation has “strengthened.” At the session, the central bank predicted one or two rate cuts, but not until 2020. Despite cautious wording in the post meeting statements many analysts are claiming that markets are behaving as if the Fed will cut rates in 2019. (Source: CNBC 6/19/2019)

This scenario has set up a confrontation between Fed Chairman Jerome Powell and President Donald Trump, who has been pressuring the Fed to cut rates. The Fed committee’s June report changed language from its May statement to indicate that economic activity is, “rising at a moderate rate,” a downgrade from “solid.” “In light of these uncertainties and muted inflation pressures, the committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective,” the statement said. The “act as appropriate to sustain the expansion” language mirrors a statement from Powell in early June. (Source: CNBC 6/19/2019)

In response to the Fed’s statement, the yield on the benchmark 10-year Treasury note fell to below 2%. This means that investors looking for better returns would have to consider equities even if they were highly priced. Due to low interest rates, mortgage rates also continue to be at historically attractive levels. Low rates also allow companies to borrow money at cheaper levels and therefore can encourage expansion and investment. While low rates are good news if you are a homeowner thinking of refinancing your mortgage or a chief financial officer about to roll over some of your company’s bonds, it is concerning news if you want to see faster global economic growth in the years ahead. Lower long-term rates imply that investors expect even lower growth and inflation than had seemed probable just weeks ago. (Sources: CNBC 6/25/2019, New York Times 7/4/2019)

Savers looking at interest rates to meet their goals will find today’s low rates concerning. This is where a conversation with your financial professional could help you understand your alternatives and options. One of our primary objectives is to help our clients navigate today’s low interest rate environment. Low short-term interest rates seem likely to continue and investors will still need to keep a watchful eye on them.

Savers looking at interest rates to meet their goals will find today’s low rates concerning. This is where a conversation with your financial professional could help you understand your alternatives and options. One of our primary objectives is to help our clients navigate today’s low interest rate environment. Low short-term interest rates seem likely to continue and investors will still need to keep a watchful eye on them.

Trade Wars and Tariffs

Financial powerhouse BlackRock lowered its global growth outlook, based on expectations that trade and geopolitical frictions will continue for the remainder of 2019. The firm said central banks are responding to the weaker outlook and are loosening policy, creating a constructive environment for U.S. and European stocks. BlackRock sees the tariff and trade tensions between the United States and China as part of a bigger concern for global markets. They note that trade issues create concern and uncertainty. Tariffs make costs higher for corporations and force some companies to change their supply chains altogether. According to Jean Boivin, head of the BlackRock Investment Institute, the uncertainty from trade wars should continue for some time. “We see the ebbing and flowing,” he said. “We’re going to feel the intensity go up. Then there’s going to be a truce. We think that’s going to continue.” (Source: CNBC 7/8/2019)

On June 29th, Presidents Trump and Xi agreed to continue trade negotiations during their much anticipated meeting on the sidelines of the G-20 summit in Japan. “We’re holding on tariffs, and they’re going to buy farm product,” Trump said at a press conference after the summit. That same day, equity markets rose in response. However, uncertainty about whether a meaningful agreement can be finalized could loom over markets in the second half of the year. (Source: CNN Business 7/1/2019)

For now, existing tariffs remain in place and will continue to affect businesses. Tariffs and trade negotiations could affect equities, so this is another key area that investors need to continue to monitor.

What Should an Investor Do?

Investors were clearly rewarded in the first half of 2019, and markets ended the quarter at or near record highs. CDs and money market funds can offer some of the highest level of safety but in today’s low interest rate environment they offer rates of around 2% or less. Some analysts are predicting equity markets will continue to rise while others are fearful. So, what should an investor do?

An investor needs to be prepared to build a plan that includes risk awareness. While equities have risen, the continuing backdrop of a weakening economy, trade war fears and interest rate concerns create a need to recheck your time horizons. Today’s traditional fixed rates might not help many investors to achieve their desired goals, so most investors may still need to include a strong mix of equities. Markets can continue to rise but they also could head lower. Bernstein Economist Phillipp Carlsson-Szlezak writes that, “though stocks, on average aren’t any more volatile than they were 100 years ago, the calm periods are calmer and the turbulent periods are more turbulent”. He also asks the question, “Do we live in times of high or low equity volatility? The answer is: both.” (Source: Barron’s 7/1/2019)

Barclays predicts it is most likely that the market will continue to rise, but investors need to continue to proceed with caution. In December of 2018, the S&P 500 saw a sharp decline (its worst December drop since 1931), then in the first quarter of 2019, the index more than recovered that entire decline. May of 2019 was also a period of downfall for equities, however by the end of June, equity indexes were again at or near new highs. No one can predict the next rise or selloff with precision, therefore, its essential that investors prepare.(Source: CNBC 7/3/2019, Barron’s 7/1/2019)