The first half of 2022 has been a nightmare for even the most seasoned of investors. When looking back, from the March 2020 lows until January 2022, investors were treated to a 21-month bull market that saw equity markets more than double. Since then, the S&P 500 has dropped 20.6%, its worst first six months of a year since 1970. The Dow Jones Industrial Average’s 15.3% first-half drop is its worst since 1962, while declines of 29.5% from the NASDAQ Composite and 23.9% from the Russell 2000 are both indexes’ worst first halves on record. The Bloomberg U.S. Aggregate, a broad index of fixed-income securities, fell 10.7% since the start of 2022. That’s also its worst first half on record, based on data going back to 1975.

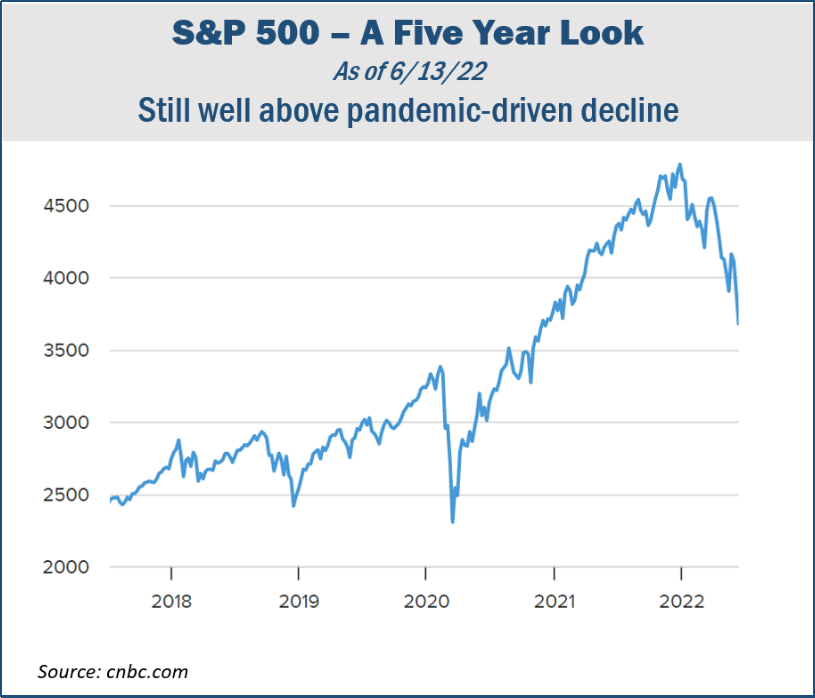

Although equity markets are still higher than they were during pandemic lows, mid-year investment statements could make even the most patient of investors uncomfortable. As Warren Buffett has said, “The stock market is a device which transfers money from the impatient to the patient.” Investors now more than ever are going to remember that equities are for their long-term dollars.

On June 13, when the S&P 500 closed near 22% below its record high on January 3, it officially put the S&P 500 into a bear market. A “bear market” is defined as a decline of 20% of an index’s recent high. This marks the first bear market for this index in over two years, the last one triggered by the selloff in early 2020 due to the pandemic-driven lockdowns that stunted economic activity. Even with this downturn, the S&P 500 is still up nearly 70% from the 2020 low. (Source: wsj.com; 6/13/22)

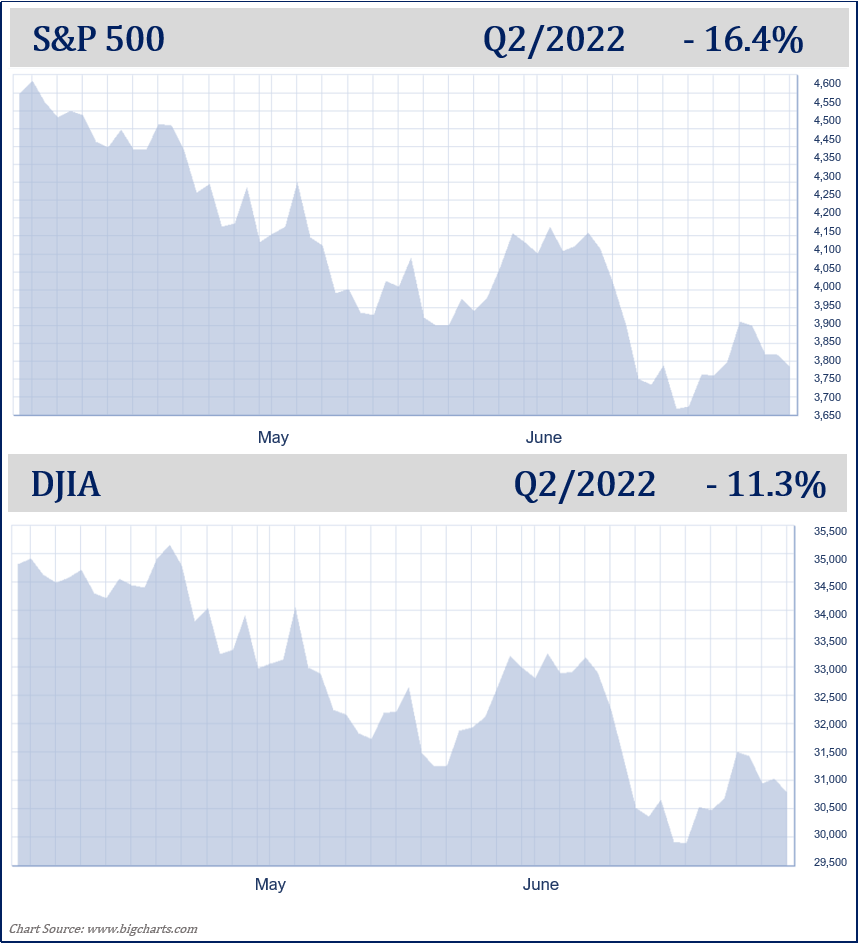

The S&P 500 ended the quarter down 16.4% while the DJIA was only down 11.3%. The second quarter continued this year’s theme of heavy volatility: high inflation rates; rising interest rates and forewarnings of more rate hikes in the near future; elevated gas prices; and continued global unrest.

The annual inflation rate for the U.S. was 8.6% for the 12 months that ended this May. According to the U.S. Labor Department, this was the largest increase in over 40 years. Food, energy, and shelter, the three areas that make up about 54% of the consumer price index (CPI), continue to be high priced items, and many forecasters do not expect these main staples to simmer down any time soon.

Fuel oil was up 106.7% over the past year, and shelter costs rose at the fastest rates in over 31 years. With these increases, this means the average worker lost a whopping 3% income over the last 12 months. (Source: cnbc.om; 6/10/2022)

In this current economic environment, discussions of a recession are at the forefront of financial news headlines. Despite debate and rumors, we are not currently in a recession. The word recession is a harsh word and the media conjures up images and instills feelings that many people have reserved for events like the Great Depression. The last recession the U.S. experienced was recent but short as it only lasted from February 2020 to April 2020. While possible, a number of experts believe we will not see a recession in the near future. The U.S. Department of Labor statistics show unemployment at 3.6% in May, the lowest since the pandemic, and consumers spending is still strong despite inflation. Equity markets are still well above pandemic-drive declines. Please remember, that even if we do go into a recession, this does not mean that investors will get wiped out!

There are two schools of thought in today’s economic environment. While many investors are seeing crisis, others are looking at the dip in equity markets as an opportunity to buy stocks “on sale.”

There are always multiple factors that need to be watched because they can directly affect equity markets. With an excessive number of media sources nowadays, investors are being barraged with data and news making it difficult to keep up with the facts and information that may affect their personal situation. As your financial professional, we want to help you sort through the confusion and keep you apprised of changes and activity that could directly affect you and your situation.

Inflation & Interest Rates

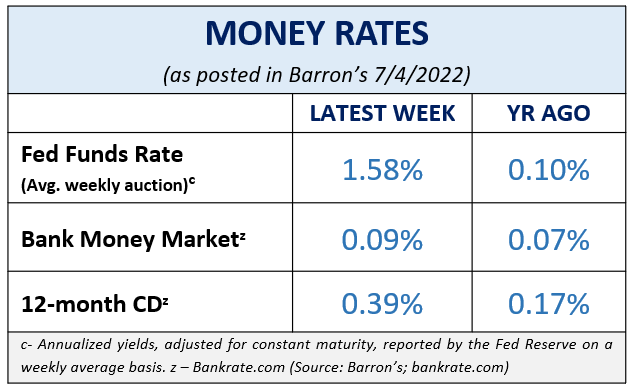

The last decade has offered historically low interest rates. Now, interest rates hovering near zero are a thing of the past. Although increased rates were much anticipated, the rate at which the Feds are doing so is sending shock waves in Wall Street and the general U.S. public.

Standing by its commitment to fight inflation, on June 15, the Federal Reserve again raised interest rates, this time by 75 basis points, or 0.75%, the biggest single rate hike since 1994. Add that to the 0.75% increase already implemented this year, this brings the Federal Funds Rate to a target range of 1.50 – 1.75%. Wall Street responded with selloffs, taking the S&P 500 officially into a bear market. In late June, the DJIA dropped below 30,000 for the first time since January 2021.

Most analysts are expecting another 0.75% interest rate increase in July and economic projections are suggesting that 2022 will end with the Fed funds rate near 3.4%.

The Fed is making these moves in an effort to quell inflation for Americans. “At the Fed, we understand the hardship high inflation is causing. We are strongly committed to bringing inflation back down, and we are moving expeditiously to do so,” Fed Chairman Powell stated in the Senate Banking Committee meeting. (Source: cnbc.om 6/22/22)

A growing group of analysts fear that aggressive interest rate hikes could trigger a recession. Fed Chairman Powell stated at his Senate Banking Committee in June that while, “it is not our intended outcome at all, it’s certainly a possibility.” He continued, “We are not trying to provoke and do not think we will need to provoke a recession to bring down inflation.” (Source: fortune.com 6/22/22)

The Federal Reserve’s goal is to create a soft landing for the U.S. economy but it is finding this task challenging. “Frankly, the events of the last few months around the world have made it more difficult for us to achieve what we want, which is 2% inflation and a strong labor market.” Fed Chairman Powell stated. (Source:cnbc.com 6/22/22)

The Fed will need to see strong evidence that the inflation rate is slowing down to assess how quickly and at what rate they will adjust interest rates. “Over coming months, we will be looking for compelling evidence that inflation is moving down, consistent with inflation returning to 2%,” Powell said. “We anticipate that ongoing rate increases will be appropriate; the pace of those changes will continue to depend on the incoming data and the evolving outlook for the economy.” (Source: cnbc.om 6/22/22)

What does this mean for you? Don’t plan on seeing rate increases stagnate or go away in the near future. With continued expectations of more rate increases, we suggest you: proactively pay off all non-essential interest-bearing debt, maintain liquidity for any short-term purchases, and if you have a mortgage, if you haven’t already, look into locking in your rate. If you have bonds in your portfolio, understand the duration of them. Also, for clients we are reviewing all income-producing investments.

As your financial professional, we are committed to keeping a vigilant eye on all aspects of financial planning that may affect you. Interest rates will continue to be near the top of our watchlist. If you are concerned about how interest rate increases may affect your portfolio, please connect with us to discuss any possible strategies that may help combat the effect on your personal situation.

The Bond Market and Treasury Yields

It’s been a while since investors have seen bonds paying decent yields. Bond prices and interest rates move in the opposite direction. The historically low interest rates we saw since the pandemic-driven global crisis did not make bonds very favorable. Now, with the Fed raising interest rates this past quarter, bond prices were lowered and yields rose. For many investors, bonds are starting to look more attractive than they have in the past few years.

Investors seeking a safer alternative to equities amidst market volatility, rising interest rates, and tightening financial conditions, often look at bonds. At the opening of the week after the Fed announced the interest rate increase, the benchmark 10-year Treasury note yield was 3.3% and the 30-year Treasury note yield was 3.37%. These yields are helping bonds become more favorable as key components to a diversified portfolio. Please remember, while diversification in your portfolio can help you reach your goals, it does not ensure a profit or guarantee against loss.

Should a recession happen, the Fed may feel they will need to cut interest rates to stimulate the economy and get us back out of that recession. If this happens, the opportunity to take advantage of favorable bond yields could be brief. In short, bond investing can be tricky. If you’d like to explore how bonds could fit into your retirement income strategy, please contact us. We are monitoring how the Fed’s movements and rising interest rates are affecting bond yields.

Investor’s Outlook

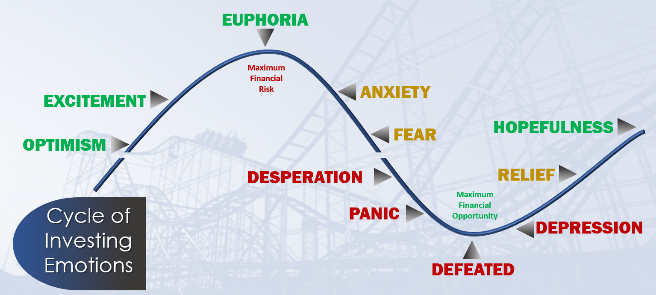

The current economic environment is most certainly testing the discipline of even the savviest of investors. There is currently a lot in play that can justifiably make any investor worried. Some investors panic and jump ship during choppy waters, and some ride it out and wait for calmer waters. Which mindset do you have?

The cycle of emotional investing is a theory every investor should understand. Preparing a plan to react to each cycle before it happens can help you make the best, non-emotional and non-hasty decisions.

The term “bear market” can scare a lot of investors. However, let’s take a look at some facts about bear markets that may help put them in perspective.

- Bear markets are normal. As we have mentioned, market downturns are uncomfortable, but not uncommon. Since its inception in the late 1920s, the modern S&P 500 has seen 26 bear markets. Keep in mind that there have also been 27 bull markets. During these bear markets, stocks on average lost 36%. However, stocks have gained an average of 114% during the bull markets, thus rewarding long-term investors.

- The long-term average frequency between bear markets is 3.6 years. This means an investor could see about 14 bear markets in a 50-year investment window. Since 1930, the market has been bearish for a total time period equal to 20.6 years. This means that stocks have been on the rise the other 71.4 years!

- Bear markets last for significantly less time than bull markets. Bears last on average 9.6 months to 2.7 years on average for bulls.

- Does a bear market mean a recession is coming? Not necessarily. Of the 26 bear markets, a little more than half came with a recession. Keep in mind that a bear market means the decline in the value of stocks. A recession means something entirely different. A recession is the overall decline in the country’s production of goods and services and is considered active when we experience this decline over the course of two consecutive quarters. (Source: cnbc.com; 6/13/22)

Investors have seen multiple record highs over the last few years in the stock market. At some point, a market correction or larger downturn for equity markets was inevitable. Please remember, a normal part of investing is experiencing the ups and downs of the market.

We feel that volatility isn’t likely to go away in the coming months, so investors need to be prepared. However, remember, if you have a well-diversified, long-term financial plan, abandoning ship is almost certainly not in your best interest. Not reacting to the fear-mongering news headlines, keeping perspective of market fluctuations, and focusing on your long-term goals can help you stay on course toward your financial objectives.

Investors have yet to see if the Fed’s attempts to fight inflation will work effectively and without driving the U.S. economy into a recession. We are still not near the Fed’s long term target inflation rate of 2%. Please keep in mind that the cost of borrowing is up, so, as mentioned previously, maintain liquidity for any larger purchase you know or think you will have in the near future. We are keeping a watchful eye as the Fed continues their moves on interest rates.

Many other variables could affect the speed and direction of the economy. The last few years have reminded us that “anything can happen.” COVID is still an issue, especially when it comes to commodities that are manufactured in China, the second largest world economy that is still committed to a “ZERO-COVID” policy that enforces mass quarantine and closures. Additionally, we are experiencing geopolitical unrest, particularly the war in Ukraine; and, who knows what the upcoming months will present to us. That is why we always abide by our mantra of “proceed with caution.”

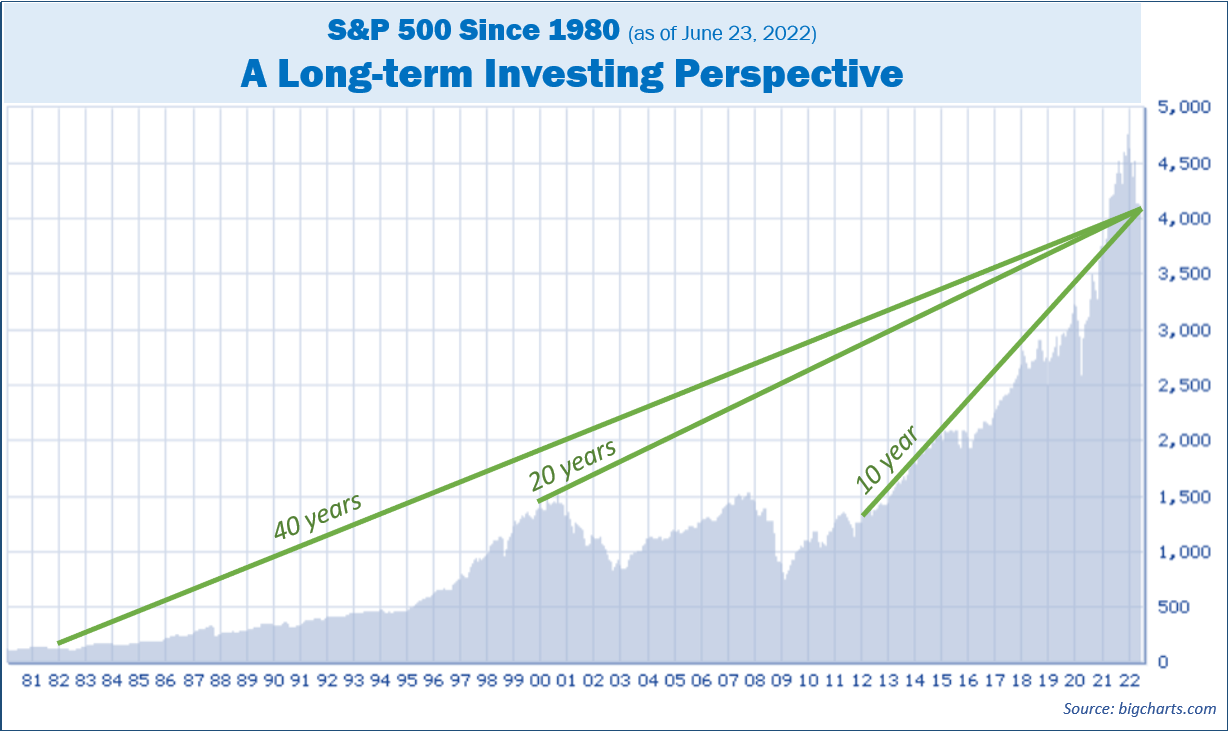

It is never prudent to try to find equity market tops and bottoms. It will prove to be a futile task. Instead, focus on your time in the market, not trying to time the market. It can be very tempting to sell to avoid any losses, but if you do sell and still find yourself out of the market during a recovery, you can miss out on significant gains. Just like you, we don’t like to see equity markets go down but we understand that it is part of the process. We do not have predictive powers but we understand that equity investors can attempt to best meet their goals over long periods of time. Historically, investors with a long-term plan that stayed the course and remaining invested were rewarded.

Investors who are disciplined and strategic with their finances know that panic is not a plan. As your financial professional, our strategy is to devise a plan that includes how you will react to the ups and downs, including your time horizon, tax implications, liquidity needs, risk tolerance, and your overall personal objectives. Having a long-term plan is important and sticking to it is equally as important.

These are challenging times for investors and we want you to be comfortable knowing that we are staying apprised of any situations that may affect you. Having a proactive approach to your financial goals and a solid investment strategy is part of the holistic offerings we provide our clients.

Please call our office to discuss any concerns or ideas you have or bring them up at your next scheduled meeting. Prior to making any financial decisions, we highly recommend you contact us so we can help determine the best strategy. There are often other factors to consider, including tax ramifications, increased risk, and time horizon fluctuations when changing anything in your financial plan.

As always, please feel free to connect with us with any concerns or questions you may have.

Remember, investing in equities should be viewed as a long-term commitment!