Retirement savers understand the importance of being proactive. Having healthy retirement savings can help you live comfortably in your later years. As stewards of our clients’ wealth, we take great satisfaction in helping them prepare for retirement. We also enjoy assisting parents and grandparents who wish to contribute to their loved ones’ futures by properly gifting funds to a retirement account, provided the recipient has earned income and qualifies. Funding retirement accounts at younger ages can significantly improve the chances of enjoying a comfortable financial situation during retirement.

You can contribute to a 2025 IRA until the tax filing deadline of April 15, 2026. The annual contribution limit for 2025 is $7,000, or $8,000 if you are age 50 or older. Your ability to use a Roth IRA contribution can be limited based on your filing status and income (see box in this report). Now is a good time to consider making your 2025 retirement contributions.

For complete rules on Individual Retirement Accounts (IRAs), please visit www.irs.gov Publication 590a or call us to discuss this and all your retirement strategies. In the meantime, here is some information that you may find helpful

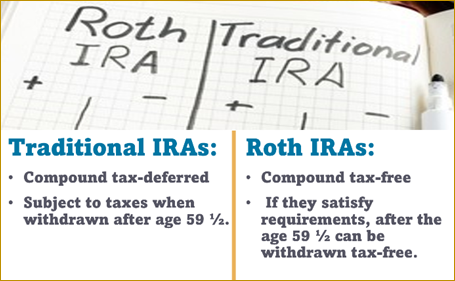

Traditional IRAs

A traditional IRA (Individual Retirement Account) is a way in which individuals can save for retirement and receive tax advantages. Traditional IRAs come in two varieties: deductible and nondeductible. Contributions to a traditional IRA may be fully or partially deductible, depending on your circumstances (i.e., taxpayer’s income, tax-filing status and other factors) and generally, amounts in a traditional IRA (including earnings and gains) are not taxed until distribution.

A clear advantage of traditional IRA accounts is the benefit of deferring taxes on all dividends, interest and capital gains earned inside the IRA account and the potential for annual tax-free compounding. This may allow an IRA to have a faster growth rate than a taxable account.

Roth IRA

A Roth IRA is an IRA that is subject to many of the same rules that apply to a traditional IRA with some major exceptions. Unlike traditional IRAs which can be tax deducted, you cannot deduct contributions to a Roth IRA.

Some Roth IRA advantages include:

- If you satisfy the requirements, qualified distributions can be tax-free.

- You can leave funds in your Roth IRA for your entire lifetime.

- Beneficiaries inherit your Roth IRAs tax-free, if account requirements have been satisfied.

Many investors know and understand that the largest benefit of the Roth IRA is its tax-free withdrawal of contributions, interest and earnings in retirement, but Roth IRAs can also be a powerful part of good estate planning.