During volatile times, many investors get agitated and begin to question their fundamental investment decisions and choices. This is especially true for those investors who monitor their portfolios daily and can be tempted to pull out of the market and wait on the sidelines until it seems safe to dive back in. One thing that can be helpful is to understand that equity market volatility is part of the investment experience and is therefore inevitable. Equity markets can always move up and down, especially over the short-term. Some suggest that the only certainties in life are death, taxes and market volatility.

During volatile times, many investors get agitated and begin to question their fundamental investment decisions and choices. This is especially true for those investors who monitor their portfolios daily and can be tempted to pull out of the market and wait on the sidelines until it seems safe to dive back in. One thing that can be helpful is to understand that equity market volatility is part of the investment experience and is therefore inevitable. Equity markets can always move up and down, especially over the short-term. Some suggest that the only certainties in life are death, taxes and market volatility.

Trying to time the market can be extremely difficult. One solution is to always understand your personal situation. Try to plan for your equity investments to maintain a long-term horizon and ignore the short-term fluctuations. To help make your investment decisions less emotional and more focused it is helpful to understand volatility. If the daily swings in the stock market seem too chaotic, remember these movements are near impossible to fully predict. For many investors there is no reason to even subject themselves to daily market headlines. If you have a long-term investment horizon for your equity holdings of at least five years, chances are the current volatility will pass – possibly in a couple of weeks, months or in at least a couple of years.

Try to keep things in perspective. Market pullbacks (defined typically as a drop between 5 and 10%), corrections (defined as 10 to 20%) and even bear markets (defined as 20% or more) are a normal part of the stock market cycle. According to Guggenheim, since 1945, the S&P 500 has declined between 5% and 10% 78 different times. The average time it took to recover to its previous highs was only about one month.

(Source: US News and Money Report 6/7/2018)

Volatility and risk are not the same thing. When a stock is volatile, it means that it tends to make big moves (up or down). When a stock is risky, it means that it can lose money (go down). In financial terms, risk is the potential permanent loss of money whereas volatility is how rapidly an investment tends to change in price. Volatility does not just imply risk of loss. Volatility simply refers to the price action. Some investments may be more volatile than others. Equity investments as a category are much more volatile than a bank deposit, but that does not mean an investor should avoid investments in equities. Just because an investment is more “volatile” does not necessarily mean it is “riskier” in the long term. Investors should always discuss with their financial advisors the potential of short-term volatility affecting the daily value of their investments and plan their investments accordingly.

Short-term movements of the market are unpredictable and do not abide by any average.

Equity markets are never going to produce straight line returns for investors. For example, in 2017, the stock market had an unusual year in which it did not even deliver a pullback of 5%. Meanwhile, 2018 brought investors the steepest correction in a decade during the fourth quarter and that year included a greater than 10% decline in the first quarter.

At any time, the equity markets could see a retreat of 10% or more which is referred to as a market correction. Here are four facts that can help investors understand market corrections.

1. Corrections are a part of the investing experience.

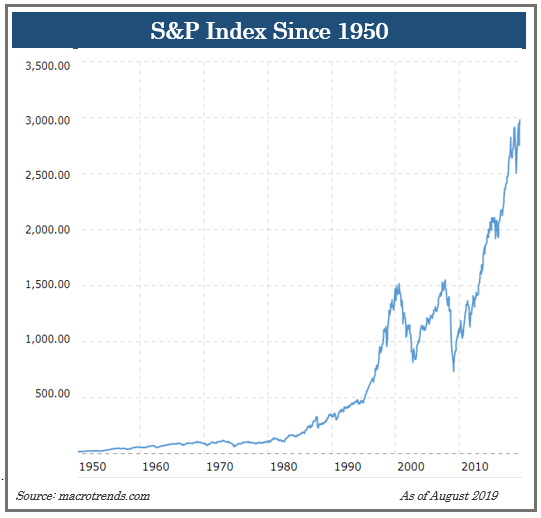

Since 1950, the S&P 500 has undergone 37 separate stock market corrections of at least 10%, not including rounding (i.e., declines of 9.5% to 9.9%). Considering that there have been over 69 years since the beginning of 1950, this works out to a correction, on average, every 1.87 years. (Source: The Motley Fool 5/2019)

2. The average length of those corrections was about 6 months.

According to data from stock market analytics firm Yardeni Research, the S&P 500 has spent 7,135 calendar days in correction since the beginning of 1950. Since then, there have been 37 corrections (of at least 10%). This works out to an average resolution time of 192 days, or slightly more than six months. Of these 37 drops in the market, 23 of them have resolved in 104 or fewer days, with only seven lasting longer than 288 days. 11 of the 14 instances that lasted longer than 104 days occurred between 1950 and 1984. (Source: The Motley Fool 5/2019)

3. “Rally” days outnumber correction days 2.55-to-1 since 1950.

Since the beginning of 1950 until May 13, 2019, there have been a total of 25,335 calendar days and over 69 years of data. During this time span, the S&P 500 has spent 7,135 of those calendar days tumbling from a peak to a trough. This means that for the other 18,200 calendar days, the S&P 500 has spent its time rallying from these correction lows. This ratio of upward momentum (18,200) to correction (7,135) is a healthy 2.55-to-1. (Source: The Motley Fool 5/2019)

4. Big up days occur within two weeks of big down days 60% of the time.

J.P. Morgan Asset Management releases an annual report titled, “Staying Invested During Volatile Markets.” This report looks at the S&P 500 over the trailing 20-year period and calculates what an investor would have made had they stayed invested, rather than trying to time the market by jumping in and out when they saw the first signs of trouble. Oftentimes, missing the S&P 500’s 10 best days means losing more than half of your would-be 20-year returns, missing around 30 of the best single-session gains, resulting in a loss over the 20-year period. (Source: The Motley Fool 5/2019)

An interesting observation in this annual report is the timing of when these worst days and best days occur. Although it has varied slightly from report to report, since the trailing 20-year dates being analyzed are changing, roughly 60% of the S&P 500’s top single-session gains occur within two weeks of its 10 largest single-session losses. This means that selling equity positions during big down days may cause you to miss out on the market’s biggest single-day rallies, which are impossible to time.

Beware of Media Magnification

One of the biggest challenges investors face is how to tune out the magnification of financial issues by the media. With thousands of media outlets all thirsty for viewers, some outlets resort to scare and fear tactics to attract an audience. Know that volatility is a part of the investment experience, however, it can still become difficult to make rational investment decisions when the markets are fluctuating. During these times, it is prudent to resist the temptation of watching news reports and obsessively watching your portfolio performance. Adhering to a long-term investment plan often requires taking the news with a grain of salt and putting spur-of-the-moment advice of others on the back burner.

One of the biggest challenges investors face is how to tune out the magnification of financial issues by the media. With thousands of media outlets all thirsty for viewers, some outlets resort to scare and fear tactics to attract an audience. Know that volatility is a part of the investment experience, however, it can still become difficult to make rational investment decisions when the markets are fluctuating. During these times, it is prudent to resist the temptation of watching news reports and obsessively watching your portfolio performance. Adhering to a long-term investment plan often requires taking the news with a grain of salt and putting spur-of-the-moment advice of others on the back burner.

Too often emotion, not logic, can overshadow investing habits, so the first step in declaring this mental independence is realizing how these influences, known as biases, affect us. Sometimes, the closer you put a short-term lens to your investments, the more likely you consider decisions that deviate from your long-term strategy.

What should an investor do in a volatile market?

In times of crisis, many people tend to overreact and sometimes do not make the best decisions. During volatile markets, it might be best to revisit your plan. Remember panic is not a plan.

In times of crisis, many people tend to overreact and sometimes do not make the best decisions. During volatile markets, it might be best to revisit your plan. Remember panic is not a plan.

When equity markets experience unnerving fluctuations, we suggest you ask yourself three questions:

1.Have my financial timelines changed?

2.Have my financial goals changed?

3.Has my risk tolerance changed?

If you answered “YES” to any of these questions, then it is wise to discuss these changes with us. An investor needs to be prepared to build a plan that includes risk awareness. One of our primary responsibilities as your financial advisor is to consistently keep in touch with you and monitor your situation. If you have concerns, some questions to ask us include:

- Can we review my financial plan?

- Can we revisit my risk tolerance?

- Are my investments diversified?

- What are my fixed income investments?

- Has the volatility presented any good opportunities?

While equities have risen, the continuing backdrop of a weakening economy, trade war fears and interest rate concerns always offer the opportunity to recheck your plan. Today’s traditional fixed rates might not help many investors to achieve their desired goals, so most investors may still need to include a strong mix of equities. Markets can continue to rise but they also could head lower. At the end of the day, investors should always put their primary focus on their own personal goals and objectives. If anything has changed for you please let us know.

Let’s focus on YOUR personal goals and strategy.

Our primary objective remains to continually understand our client’s goals and to match those goals with the best possible solutions.

Our advice is not one-size-fits-all. We will always consider your feelings about risk and the markets and review your unique financial situation when making recommendations. If you would like to revisit your specific holdings or risk tolerance please call our office or discuss this at our next scheduled meeting.

We pride ourselves in offering:

- consistent and strong communication

- a schedule of regular client meetings, and

- continuing education for every member of our team on the issues that affect our clients.

A skilled financial advisor can help make your journey easier. Our goal is to understand each of our client’s needs and then try to create a plan to address those needs. Should you need to discuss your investments, please call our office.