After one of the most contentious presidential elections in recent history, as of November 6th, the election results are still not finalized and they might be contested for the foreseeable future. A new administration could bring changes, so we thought it would be helpful to review some information to think about if Joe Biden becomes the next President. Amongst many experts, preliminary discussions suggest that if we have a divided Congress (Republican Senate and a Democratic House of Representatives) gridlock may continue for the foreseeable future.

While the final election results are still being calculated, the outcomes of two longer-term unknowns are still centerstage: (1) the continuing evolution of the COVID-19 pandemic and its impact on the economy, the markets and human conditions; and (2) the continuation of massive debt and deficit spending. On the first issue, we will hopefully have a reasonably optimistic outlook in the near future. We all look forward to a time where vaccines and effective therapies are available. We do not know exactly when, but we are optimistic that day will come. The second issue is more financially driven. While the country is borrowing from the future to help circumstances today in a completely bipartisan manner, eventually these borrowings will need to be repaid. This could result in lower growth or higher taxes at some point in the future, but that still needs to be determined.

An immediate unknown is the state of additional fiscal stimulus legislation. This will be a known outcome if a package is agreed upon prior to year-end. The actual outcome of any stimulus package may be quite different if it is not enacted until next year.

Just days before the 2020 U.S. elections, President Trump plugged record economic growth in a last-ditch effort to persuade voters to re-elect him. Democratic rival Joe Biden said the U.S. is stuck in a “deep hole” and that the recovery is in danger of stalling.

Who’s right? The presidential candidates have sharply contrasting views on the economy, but they are both telling a version of the truth. The economy has recovered from the coronavirus pandemic faster than expected, but by some measures the nation still remains in a recession. Also, the record rise in daily new coronavirus cases in October threatened to stall a recovery that was already losing momentum. (Source: MarketWatch 11/1/2020)

Given that backdrop, we still need to focus on helping our clients pursue their financial goals. While it’s not yet possible to time travel, it’s still critical that we plan for the future. Voting is an important right that gives us a say in who our leaders are, but it is not a reason to change your fundamental financial goals. Equity investments are never going to produce straight line returns for investors, but in today’s low interest rate environment they are a cornerstone of many portfolios.

As an immediate reaction to the election, equity markets rose rapidly, which is good for investors. However, investors still should prepare for a reaction to uncertainty and volatility, which could potentially bring equity markets down quickly. During volatile times, many investors get agitated and begin to question their fundamental investment decisions and choices. This is especially true for those investors who monitor their portfolios daily and can sometimes be tempted to pull out of the market altogether and wait on the sidelines until it seems safe to dive back in. One thing that can help is to understand that equity market volatility is part of the investment cycle. Investment markets can always move up and down, especially over the short-term. Pullbacks are often not a time to panic and should rather be used as a reason to analyze and assess. Under certain circumstances, it may even be the case that a pullback represents an attractive buying opportunity for certain portfolios. Some experts suggest that investors need to remember that the only certainties in life are death, taxes and market volatility.

Short-term movements of the market are unpredictable and do not abide by any average.

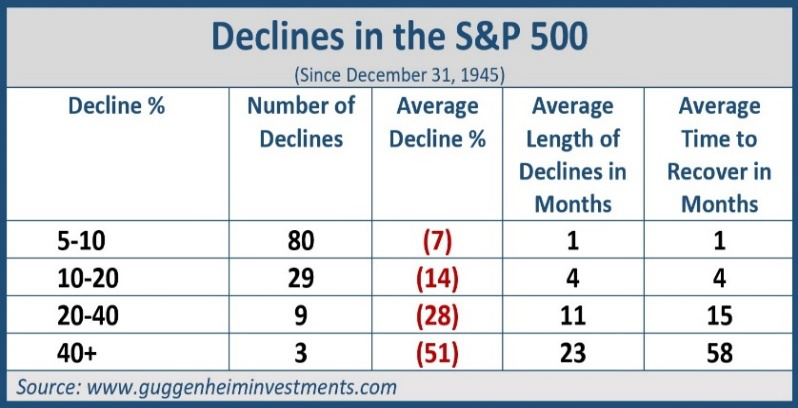

At any time, the equity markets could see a retreat of 10% or more. Our firm attempts to not act on emotion. We try to put market events in context to determine what they mean. Market pullbacks (defined typically as between 5 and 10%), corrections (defined as 10 to 20%) and even bear markets (defined as 20% or more) are a normal part of the stock market cycle. Investors can gain important perspective on market pullbacks by considering post-World War II declines in the S&P 500 Index. Research by Guggenheim Investments showed that the majority of declines fell within the 5-10% range with an average recovery time of approximately one month. Market declines between 10-20% had an average recovery period of approximately four months. They concluded that pullbacks within these ranges are not uncommon and occurred frequently during the normal market cycle. While they can be emotionally unnerving, they generally will not fully undermine a well-diversified portfolio and are not necessarily signals for investors to panic. Even more severe pullbacks of 20-40% registered an average recovery period of only 15 months. (Source: GuggenheimInvestments.com)

Here are five general guidelines that might be helpful to review, especially if the equity markets become more volatile.

1. Focus on only investing money in equities that you can earmark for at least five years.

Over long periods, equity markets have produced positive returns for many investors. However, the long term is usually longer than five years. Investors who allocate money that they need in the short term to equities run a greater risk that they might end up having to sell during a prolonged bear market, and therefore would face losses because of it. Investors should try to avoid putting their assets in this position. They should consider keeping the money they will need in the short term out of the market.

2. Make equity investments that you feel comfortable holding for the long-term.

One of the most difficult ways to advance your wealth is to speculate and try to make a quick return in the equity markets. If you do this at the wrong time, you could get end up with losses or stuck holding positions you might not want in a prolonged downturn. Legendary investor Warren Buffett has been noted for advising, “you shouldn’t hold a stock for 10 minutes if you wouldn’t feel comfortable holding it for 10 years”.

3. Maintain an appropriate asset allocation for your risk tolerance and time frames.

When constructing your portfolio, a good measure is to not invest money you’ll need soon in equities and to respect your personal risk tolerance. In today’s low interest rate environment, you need to consider investing in equities to potentially earn reasonable returns and potentially build wealth, but by doing so you take on greater risk. For younger investors who have a long-time horizon, they can consider taking on more risk than an older investor who might consider safer, but lower returning investments.

This is where talking with us about your goals, time horizons and risk tolerances can be helpful. As financial professionals, we try to make recommendations based upon understanding your personal circumstances and preferences.

4. Consider a diversified portfolio

A diversified investment portfolio is typically one that consists of various assets that attempt to earn the best return with less risk. A typical diversified portfolio has a mixture of equity and fixed income investments. Traditionally, equities can perform best when the economy is growing and fixed income is a more stable holding when the economy is struggling. A common theme for many investors is to use asset allocation to determine their exact mix of equities and fixed income holdings. Your portfolio can depend on your comfort with different risk levels, your goals, and where you are in life.

5. Use professional guidance.

Sir John Templeton was one of the greatest investors and fund managers ever. One of his famous quotes was, “The only way to avoid mistakes is not to invest—which is the biggest mistake of all.” Another was, “Do your homework or hire wise experts to help you.” This is where we can offer some assistance. We will always consider your feelings about risk and the markets and review your unique financial situation when making recommendations.

Note: The views stated in this letter are not necessarily the opinion of Romero Wealth Management and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. This material contains forward looking statements and projections. There are no guarantees that these results will be achieved.

All indices referenced are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. The S&P 500 is an unmanaged index of 500 widely held stocks that is general considered representative of the U.S. Stock market. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is no guarantee of future results. Due to volatility within the markets mentioned, opinions are subject to change without notice.

Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax professional. Asset allocation and diversification are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss.

Sources: MarketWatch 11/1/2020, GuggenheimInvestments.com, The Motley Fool, WisdomTree.com. Contents Provided by The Academy of Preferred Financial Advisors; Academy of Preferred Financial Advisors, Inc.© 2020