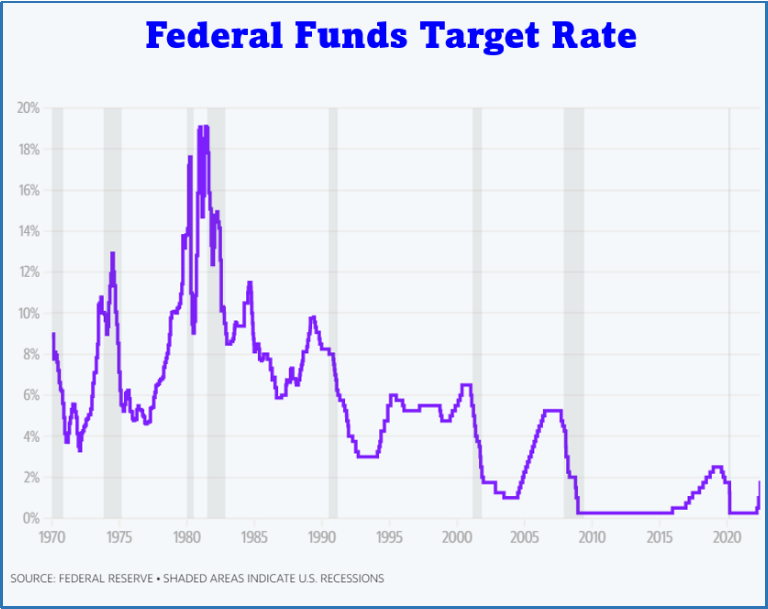

During the last few years, borrowers and spenders have enjoyed historically low interest rates. However, analysts all agreed that at the Federal Reserve’s June meeting, interest rates were going to be increased. Although rising interest rates have been anticipated, many Americans aren’t feeling prepared for the effects of these new rates. Combined with today’s exorbitant gas prices, the continued forward push of inflation rates, and supply chain/inventory issues, many households are feeling the effects of interest rate increases.

On June 15, the Federal Reserve raised interest rates again by 75 basis points, or 0.75%, the biggest single rate hike since 1994. This is in addition to the 0.75% increase already initiated this year, bringing the Federal Funds Rate to a target range of 1.50% – 1.75%. At the press conference following the decision, Fed Chairman Jerome Powell said the move was, “an unusually large one.” He also added that he expected another 50 or 75 basis point move in July.

The Federal Open Market Committee has four more meetings scheduled for 2022. Economic projections suggest that interest rates will increase to near 3.4% by the end of the year, thus increasing it by another 1.75% spread across the four remaining meetings. (Source: finance.yahoo.com 6/15/2022)

Are you well positioned to minimize the impact that rising interest rates has on your personal financial situation?

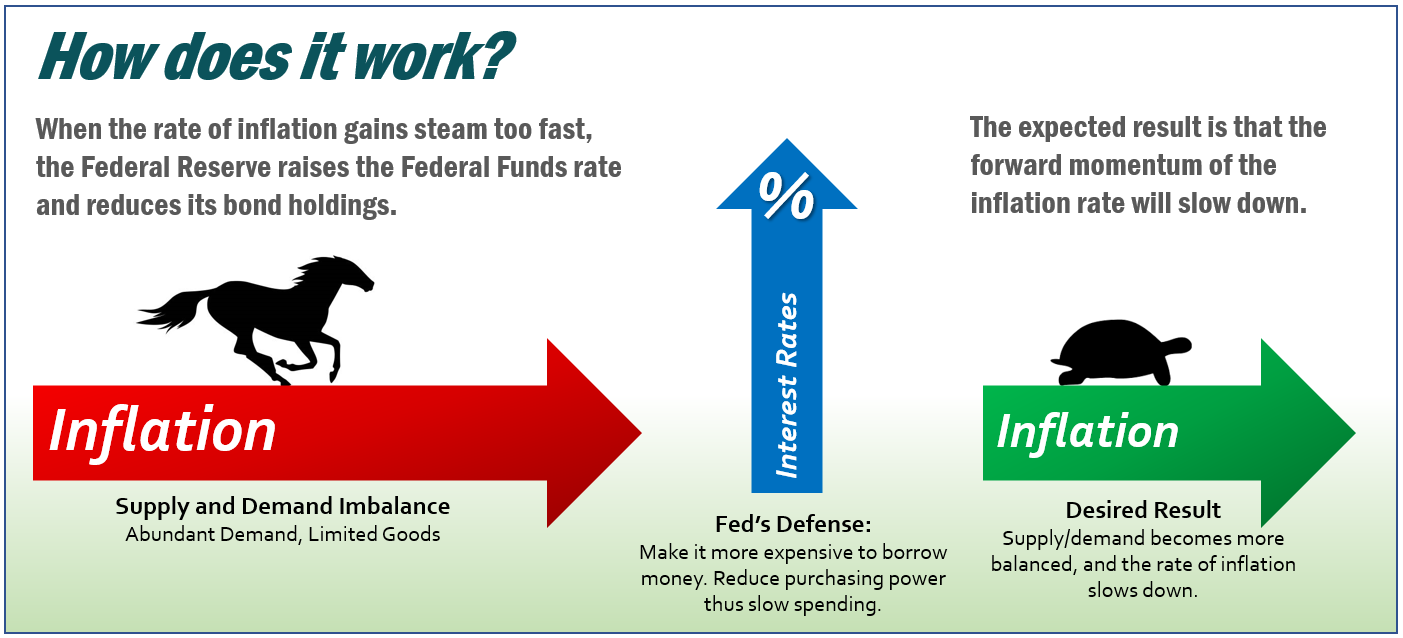

At a Wall Street Journal conference, Chairperson Powell stated, “What we need to see is inflation coming down in a clear and convincing way. And we’re going to keep pushing until we see that.” (Source: www.apnews.com, 5/17/22)

He continued that the Fed needed to see, “evidence that inflation pressures are abating and inflation is coming down. And if we don’t see that, then we’ll have to consider moving more aggressively. If we do see that, then we can consider moving to a slower pace.”

Although the Fed does not set interest rates on credit cards, mortgages, or personal loans, when the Federal Funds rate rises, consumer interest rates also rise. With an economic outlook that is uncertain, it is very important to revisit your financial situation to see if you have considered any potential moves that can help shield you against the effects of rising interest rates.

Your finances will more than likely be affected in one way or another. Overall, here are some major areas that are being affected by rising interest rates.

Bond yields will likely increase; thus, bond prices will more than likely fall.

Bond prices and interest rates move in the opposite direction. Bonds can be a good option for a conservative, balanced portfolio, as they are considered more stable than stocks. Interest rate increases help new bond investors but hurt existing bond holders. On June 14, 10-year Treasury yield rates reached an 11-year high of 3.48% and 30-year Treasury yields reached 3.45%.

During periods of rising rates, those considering bonds often consider shorter term bonds, because they are less sensitive to interest rate increases.

Credit cards, variable rate loans, and anything with an interest rate tied to it will increase.

We’ve all heard the saying, “cash is king” and this especially applies when interest rates rise. Paying off any credit cards or loans that charge variable rates of interest is a very prudent exercise that should be practiced regularly.

In times of rising interest rates, it can be wise to maintain liquidity for all short-term needs. Think about any major expenses you may incur over the next few years and consider keeping a larger than typical liquid pool of assets for these purchases.

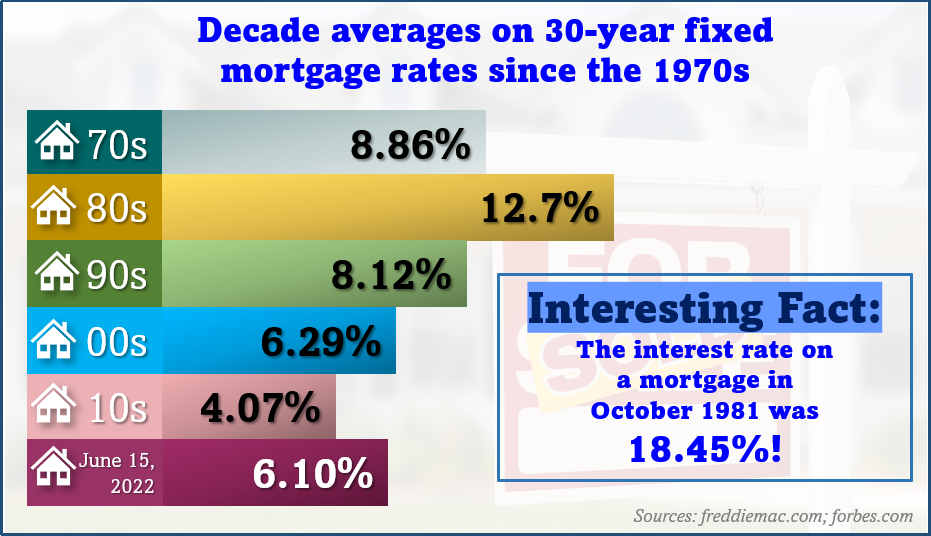

Mortgage rates are increasing which could also cause housing prices to level out or decrease.

While the Federal Reserve does not set mortgage rates, it influences them. Mortgage rates are typically determined by considering many factors including the inflation rate, economic growth, and the Federal Reserve’s monetary policy. Although there is no federal mortgage rate, the rate that is used for Federal Funds is considered when lending institutions set their rates for long-term loans, including mortgages. Many potential homebuyers may consider pushing the pause button on purchasing a home. Even if home prices stagnate or potentially decrease, prices in many markets are still high. Many prospective homebuyers might reconsider their purchase of a home with both high prices and high mortgage rates. In June, the average 30-year fixed mortgage rate hovered in the low 6% range. This reflects an over 50% increase in just six months.

The good news for prospective home buyers is that a recent housing market forecast report anticipates that the home growth price in the U.S. will fall back closer to the historical average toward the end of 2022.

College will be more costly.

Have family members planning on going to college? For the 2022-2023 academic year, effective July 1, interest rates for new undergraduate federal student loans are set to increase to nearly 5%. That’s up from 3.73% last year and 2.75% in the 2020-2021 academic year. Graduate loans are set to be even higher, increasing to 6.54% for graduate direct loans. (Source: Nerd Wallet, 5/24/2022)

Savings rates will rise.

Rising interest rates have some positive aspects. Investors and savers with savings accounts and certificate of deposits (CDs) can benefit from better returns because of higher interest rates.

Be prepared: volatility in equity markets is expected to continue.

Inflation reports in May 2022 showed some of the highest increases in 40 years. That is one of the driving factors towards the Federal Reserve’s aggressive path to raising interest rates. Immediately during Chairperson Powell’s rate increase announcement, equity prices dropped, but they finished the day’s session at higher levels. Whether a rebound in stocks, if at all, is anything more than temporary, is unknown, as fears of slower economic growth continue to pressure equity markets. Making emotional decisions that are not in alignment with your long-term goals during market declines can be costly. One of our primary goals is to help clients avoid that.

This is a good time to review your financial plan. As the stewards of your wealth, we strive to keep your portfolio in sync with your timelines, risk tolerance and personal financial goals. Please remember – market volatility is uncomfortable, but not uncommon. Market fluctuations are expected and are a part of the investment experience. Developing your strategy to weather these fluctuations is a key factor when reviewing your overall financial plan.

Conclusion

Interest rates can be a multifaceted subject for many investors. As your financial professional, one of our goals is to keep a watchful eye on any interest rate changes that could affect your situation. We stay apprised of any moves the Fed makes so we can adjust your portfolio as needed in a timely and educated manner.

Here are seven items we feel you should review to help minimize the impact of rising interest rates:

1.Pay off all non-essential interest-bearing debt.

2.Forecast any short-term purchases (2 years) and plan for these purchases.

3.Review the duration of your bond portfolios.

4.Consider locking in fixed mortgage rates.

5.Review all income-producing investments.

6.Review your portfolio periodically, not obsessively.

7.If you have questions about your situation or plan, schedule a meeting with us.

As always, we are here to help! We are available to review your investment portfolio and overall financial picture with you. We understand that each client has a unique financial situation and will consider your distinctive needs and goals when providing any recommendations.

We pride ourselves in offering:

- consistent and strong communication,

- a schedule of regular client meetings, and

- continuing education for members of our team on the issues that affect our clients.

A good financial professional can help make your journey easier. Our goal is to understand our clients’ needs and then try to create plans to address those needs. While we cannot control financial markets, inflation, or interest rates, we keep a watchful eye on them. We can discuss your specific situation at your next review meeting or you can call to schedule an appointment. As always, we appreciate the opportunity to assist you and your financial matters.