Investors typically include equities in their long-term plans with the expectation of generating a positive return. Historically, over longer periods of time, this strategy has helped many investors achieve their desired goals. While it would be accommodating if equity markets presented a simpler way to generate investor returns, that is not the case. To produce equity returns, an investor needs to understand that many factors, including interest rate movements, inflation, economic activity, geopolitical events, and corporate earnings, can affect the daily, monthly, and even annualized rate of equity returns. Considering these uncertainties, a qualified financial professional will customarily meet with clients to understand their personal situation, timelines, and objectives. At that point, a long-term strategy can be outlined so an investor can prepare for the potential dips and dives that equity investing can include.

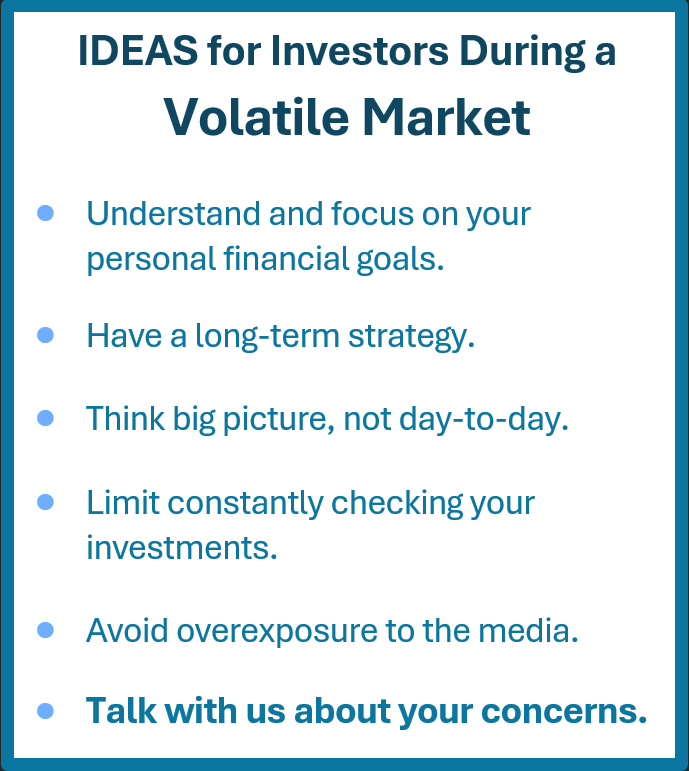

The equity markets recent volatility, or rapid changes in equity prices, have presented an opportunity for us to reinforce that, while investors cannot control equity market movements, they can control their behavior and the decisions they make when this type of turbulence occurs.

This year, there has been a considerable volume of uncertainty in the economic environment. Despite this, the stock market has managed to overcome numerous challenges. The Federal Reserve is currently facing the arduous task of steering the economy toward an economic recovery with a hopeful soft landing. However, there are worries that the U.S. may not achieve this soft landing and could instead experience a period of recession. As a result, market volatility has increased significantly in recent weeks.

There is great concern that the Federal Reserve has been slow to respond to signs of a weakening economy and may need to cut interest rates quickly.