Happy New Year and welcome to 2024! We hope that you and your family had an enjoyable holiday season. We thank you for giving us the opportunity to help you pursue your financial goals. We are excited to see what the new year will bring us.

Happy New Year and welcome to 2024! We hope that you and your family had an enjoyable holiday season. We thank you for giving us the opportunity to help you pursue your financial goals. We are excited to see what the new year will bring us.

Overall, 2023 was a good year for investors. Interest rates continued to rise, but at a much slower and less consistent pace than in 2022 and recession worries continued to make headlines, however investors still experienced strong positive returns in the major indexes in 2023. Notably, the year ended on a high note in December as the Federal Reserve decided for the third straight time not to raise interest rates. They also indicated that interest rate cuts were forecasted to start in 2024. Equity markets responded favorably, and investors are seeing the light at the end of the pandemic-induced tunnel. While equities are looking brighter, this year brings a presidential election which could bring major changes. 2024 could prove to be a very interesting year.

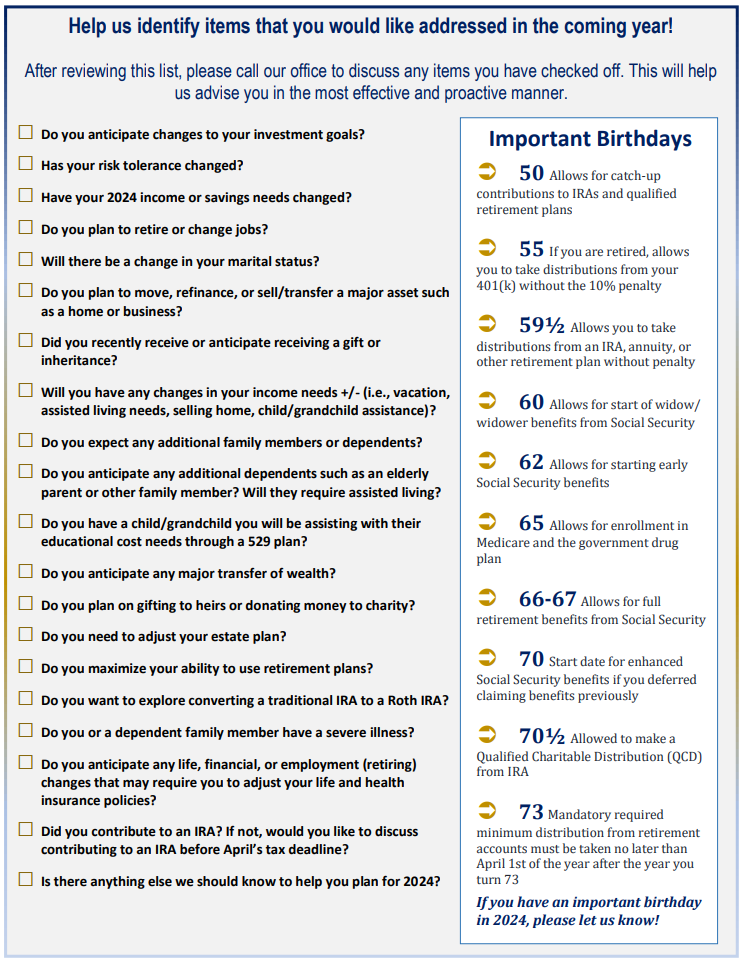

Heading into this new year, we will continue to stand by our commitment to helping you on your financial goals journey. We believe a proactive approach that anticipates the needs of our clients is optimal. To assist us with this, we have included in this communication a 2024 checklist that will help you identify items that you may want to address with us over the next year.

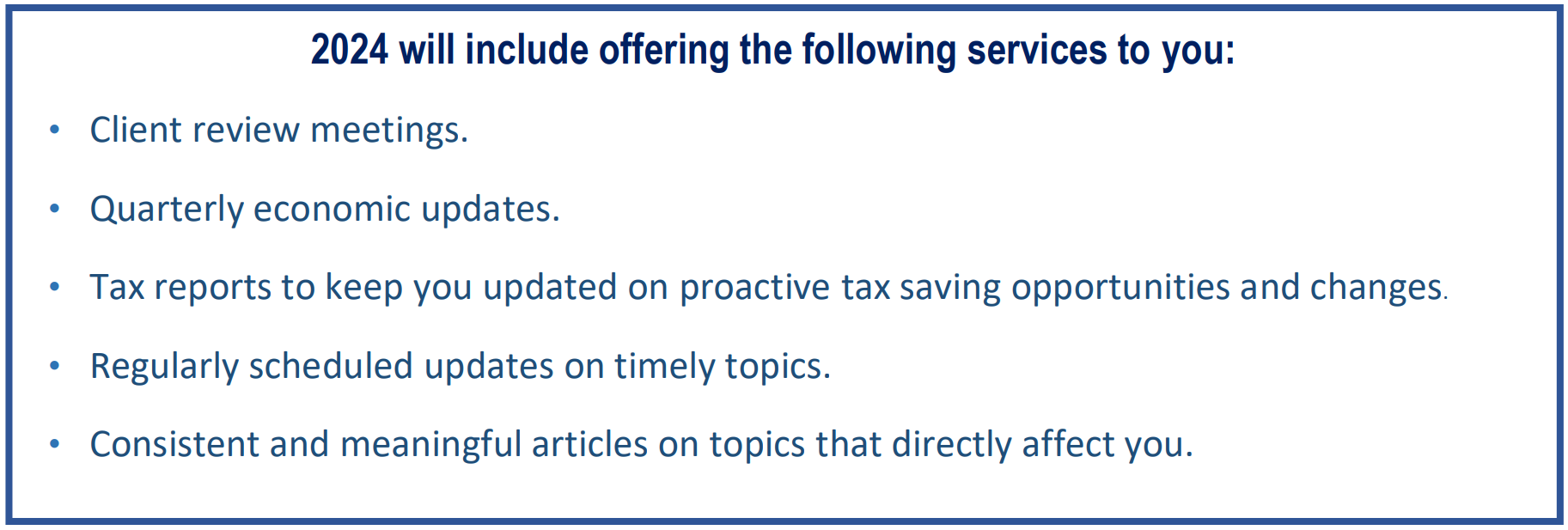

One of our goals in 2024 is to exceed your expectations and provide you with first-class service. We take pride in our ability to understand and effectively respond to your needs and enjoy providing timely information and holistic service to you.

Looking Ahead to 2024

While there are many aspects to overall financial planning, the following are some specific topics we will continue to watch carefully as we head into the new year.

- Interest Rates: Interest rate movements continue to be critical for investors. Since 2022, the Federal Funds Rate rose from a range of 0 – 0.25% all the way up to 5.25 – 5.50% by the end of 2023. Federal officials have indicated this may be the end of rate increases and are watching key indicators to assess if, when, and how much movement we will see in the federal interest rate range in 2024.

- Inflation: Inflationary concerns are important for investors. We saw a significant overall slowdown of inflation in 2023, however, there is still more to be done to reach the Fed’s 2% target range. We will continue to monitor inflation numbers as the 2024 data becomes available.

- Recession Risk: While many analysts think we are out of the woods for a recession, there is still a possibility that one could just be delayed. The good news is the likelihood that a potential recession will be severe is low. The economy and employment remain strong, but we will continue to stay apprised of the direction of recovery efforts and how they are affecting the economy.

- Stock Market Valuations: Valuations are used as key predictors of equity returns. While we cannot predict long- and short-term valuations, we will continue to help you identify your risk tolerance and time horizons. We also understand that market volatility is a normal part of the investment experience and can help you use practical behavior when making financial decisions.

- Your Personal Situation: Your personal situation is always our highest priority. We are here to help you with any financial moves or concerns you have throughout the year. We understand that each individual and household has different goals and needs. We will continue our tradition of keeping you informed of any changes that we think may affect your personal situation.

We enter 2024 with the continued mantra of “proceed with caution”. Having a solid foundation and strategy is critical to the outcome of your financial plans. Revisiting your plan and keeping it current is also a sound practice we feel should be conducted on a consistent basis. Our mission is to provide you with guidance and support on your journey toward your financial goals.

As always, we are here for you! If you have any questions or concerns, please call our office and we would be happy to assist you!

We look forward to helping you pursue your financial goals in 2024!

Securities and advisory services are offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

The views expressed are not necessarily the opinion of LPL Financial and should not be construed, directly or indirectly, as an offer to buy or sell securities mentioned herein. All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. This article is for informational purposes only. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. For specific advice about your situation, please consult with a lawyer or financial professional. Past performance is no guarantee of future results. This article provided by The Academy of Preferred Financial Advisors, Inc. ©2024