First quarter earnings season kicks off this week with several big banks reporting this Friday, including sector bellwether JPMorgan Chase (JPM). This quarter will seem quite similar to the fourth in terms of growth and drivers, with mega cap technology leading the way. But importantly, the point when the “493” will start contributing to overall profits is drawing closer (the 493 refers to the S&P 500 minus the seven mega cap technology stocks). Here we preview first quarter earnings season, which will benefit from an improving economic environment and continued strength in technology.

BAR NEITHER HIGH NOR LOW

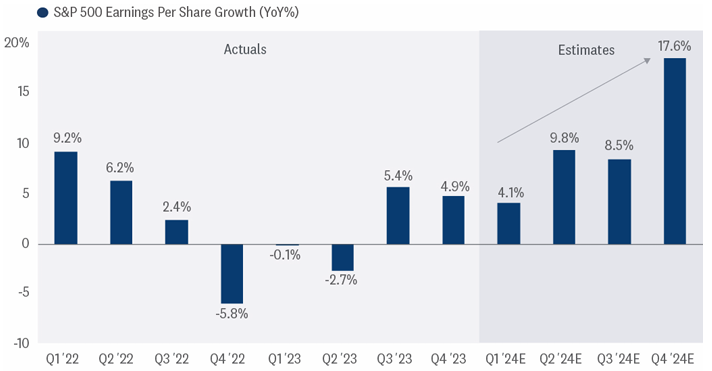

Heading into the last reporting period, the consensus earnings estimate for the fourth quarter came down quite a bit, falling 6.8% between October and December. That low bar helped drive a solid average upside surprise of nearly 5% for S&P 500 constituents. The picture is different this quarter, with just a 2.5% cut to Q1 numbers from January through March, so the bar isn’t as low.

The good news is that the economic environment has been supportive enough that the typical three to four percentage points of upside to current estimates (+3%) is probably reachable, potentially putting S&P 500 earnings per share (EPS) growth for the first quarter at around 6%.

WATCH MOVEMENT IN EXPECTATIONS FOR LATE-2024 EARNINGS RAMP DURING EARNINGS SEASON

Source: LPL Research, FactSet 04/04/24 Indexes cannot be invested in directly. Estimates may not develop as predicted.

Most of the data is consistent with a resilient U.S. economy. Since the start of this year, Bloomberg-tracked consensus gross domestic product (GDP) growth has increased from 0.5% to 2.0%. The manufacturing Purchasing Managers’ Index (PMI) from the Institute for Supply Management (ISM) jumped from 47.1 in December to a mildly expansionary 50.3 in March (highest since September 2022). The widely-followed Citigroup Economic Surprise Index has jumped from a slightly negative reading in January (-2.4) to a solidly positive 39 on April 1 (no foolin’). And some green shoots are emerging in Europe and China.

Also, consider that sticky inflation supports revenue (inflation is pricing power). Revenue grew 4% year-over-year in the fourth quarter and may match that in Q1. Some inflation also helped via higher commodity prices, as West Texas Intermediate (WTI) crude oil jumped 17% during the quarter and copper rose 3.5%, which should help mitigate earnings declines for the natural resources sectors — though offset some by the double-digit decline in natural gas prices. Artificial intelligence (AI) investments will provide a tailwind again.

But it won’t be easy. The biggest challenge may be the strong U.S. dollar, which rose nearly 3% during the first quarter and will clip non-U.S. earnings. Other challenges include wage pressures, the cumulative effects of inflation and rising interest rates on consumers’ spending power, shipping disruptions from the Baltimore bridge collapse (though late in the quarter on March 26), and the increasing difficulty exceeding expectations as the economic cycle matures.

Putting all of this together, our best guess is about 3% upside and 6% earnings growth. During reporting season, we’ll be watching the ramp in earnings growth reflected in current estimates to identify any movement. A material move downward could remove valuation support for stocks and be a catalyst for a pullback — though likely a modest one that we would expect to be bought based on the supportive macro backdrop.

ONE THING IS CLEAR: IT’S ALL ABOUT BIG TECH

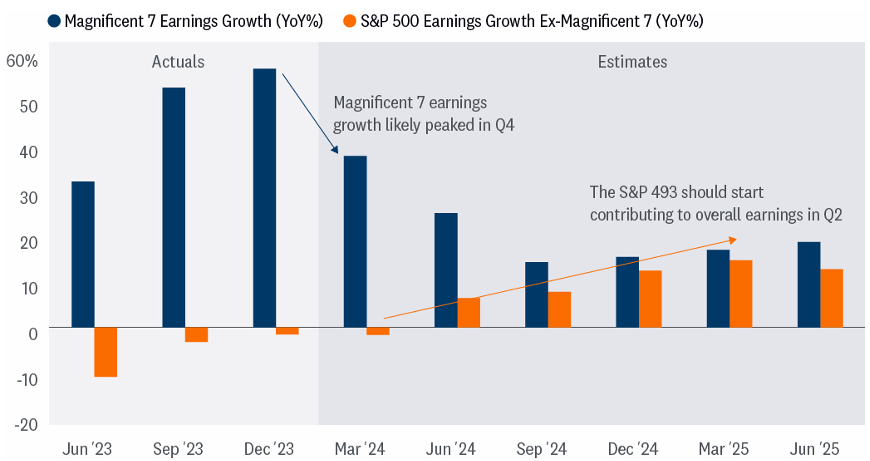

One thing that hasn’t changed from the fourth quarter to the first is that the big technology companies will again do the heavy lifting. Based on current consensus estimates, the five “Magnificent 7” stocks that are expected to report earnings growth in the first quarter are expected to drive all — more than five percentage points — of the increase in S&P 500 EPS for the quarter. Those five are Alphabet (GOOG/L), Amazon (AMZN), Meta (META), Microsoft (MSFT), and NVIDIA (NVDA), while Apple (AAPL) and Tesla (TSLA) are both expected to report earnings declines.

As a group, the Mag 7 are expected to report earnings growth near 40% year over year, while the rest of the S&P 500 — the 493 — will need to deliver some healthy upside just to match the earnings from the year-ago quarter.

BIG TECH STILL DOMINATES EARNINGS GROWTH, BUT HELP IS ON THE WAY

Source: LPL Research, Bloomberg 04/04/24

Indexes are unmanaged and cannot be invested in directly.

Magnificent 7 includes Alphabet (GOOG/L). Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NDVA) and Tesla (TSLA).

Estimates may not develop as predicted.

WHAT ABOUT MARGINS?

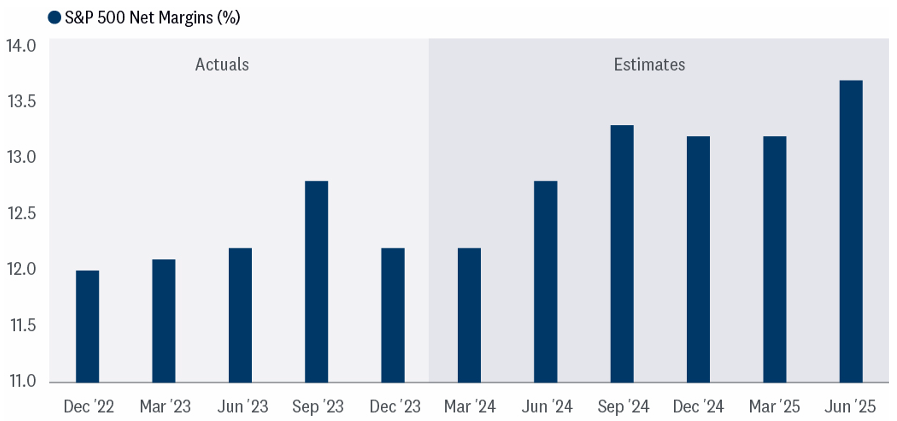

Big tech will certainly play a key role if corporate America is going to deliver upside to the consensus S&P 500 EPS estimate. But margin improvement may also help. Net margins for the S&P 500 are sitting at around 12.2% currently, but consensus is calling for 13.3% in Q3 2024 — just two quarters away. If companies can effectively control costs while revenue continues to rise, consistent with the growing U.S. economy, margins should rise this year. A healthy two point difference between the consumer price index and the producer price index is indicative of a favorable margin environment, while elevated borrowing costs, rising commodity prices, and wage pressures from a tight labor market are among key risks to margins.

MARGINS POISED TO TAKE A BIG STEP FORWARD IN COMING QUARTERS

Source: LPL Research, Bloomberg, 04/04/24

Indexes are unmanaged and cannot be invested in directly.

Estimates may not develop as predicted.

TRAJECTORY OF 2024 ESTIMATES IS KEY TO DECLARING THIS SEASON A SUCCESS

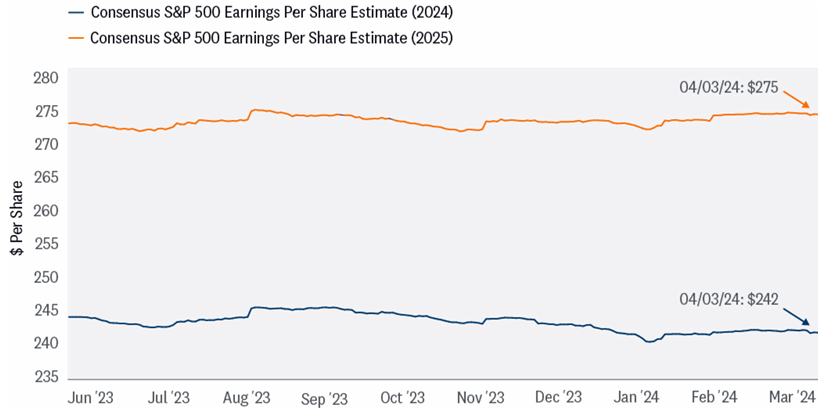

It’s the case every quarter, but we will watch company guidance closely throughout earnings season to help us gauge just how much earnings growth corporate America might be able to produce in 2024.

Estimates have been remarkably resilient over the past several quarters as the economy has surprised to the upside. Given the continued resilience of the economy, executives are unlikely to find much of a reason to cut their outlooks — especially after holding estimates in January and February, a logical time to lower the bar at the start of the new year. If estimates hold up again this quarter, markets are likely to react positively to results. AI spending should help prop up estimates, though currency headwinds have stiffened.

So, for now, we’ll keep our 2024 and 2025 S&P 500 EPS estimates at $235 and $250, respectively, both reflecting growth in the mid-to-high single digits and below current Wall Street consensus estimates at $242 and $275. However, we recognize that corporate America could do better, and our bias is to likely raise those forecasts pending final results. Earnings growth rates are getting a boost from inflation-driven pricing power, ongoing fiscal stimulus, healthy job growth, AI investment, and easy comparisons in the healthcare and natural resources areas.

EARNINGS ESTIMATES CONTINUE TO HOLD UP VERY WELL

Source: LPL Research, FactSet, 04/04/24

Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. Estimates may not develop as predicted.

CONCLUSION

The economic environment and AI investment remain supportive of corporate profits, so downside surprises this earnings season seem unlikely. Expectations for economic growth have firmed recently while earnings estimates have remained steady, an indication that the bar is not too high or too low. The big tech companies will generate strong profit growth again, while the rest of the market, the so-called “493”, is moving in the right direction.

Bottom line, expect corporate America to produce typical upside relative to expectations in the quarter and deliver S&P 500 earnings growth of around 6%. Estimate cuts are probably not in the cards, though currency headwinds may temper companies’ outlooks a bit.

TACTICAL ASSET ALLOCATION INSIGHTS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equities stance tactically despite the strength of the latest stock market rally and the likelihood a pullback may soon materialize. The improved economic and earnings outlook this year has kept the risk reward trade-off for stocks and bonds fairly well balanced, perhaps with a slight edge to bonds over stocks currently. Strong year-to-date stock market gains may have pulled forward some potential gains from Federal Reserve rate cuts, which may be delayed, potentially leaving limited upside over the balance of 2024.

Within equities, the STAAC continues to favor a tilt in the Tactical Asset Allocation (TAA) toward domestic over international equities, with a preference for Japan among developed markets, and an underweight position in emerging markets (EM). The Committee recommends a very modest tilt toward the growth style after reducing its overweight position in mid-March, in favor of adding small caps to remove that underweight position. High-quality small cap stocks are attractively valued, and the technical analysis picture has improved. Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-0001000-0324 | For Public Use | Tracking #562547 (Exp. 04/2025)