Blog

Quarterly Economic Update Second Quarter 2024

Equity and bond markets began the second quarter of 2024 with a rough start, thanks to the Federal Reserve’s decision not to reduce interest rates due to stubbornly high inflation rates. However, during the quarter, strong performances from companies tied to...

Converting 529 Plans to Roth IRA

A significant benefit has come to fruition on December 29, 2022. President Biden signed the “Consolidated Appropriations Act of 2023”, which included the “SECURE 2.0 Act of 2022”. Well, now, starting from January 1, 2024, any remaining funds in a 529 account can be...

Common Investing Mistakes

Whether someone has $50,000 or $5,000,000 to invest, there are several investment pitfalls that any investor can fall into. One of our goals as financial professionals is to help clients avoid these pitfalls, which could be very costly. We have come across many...

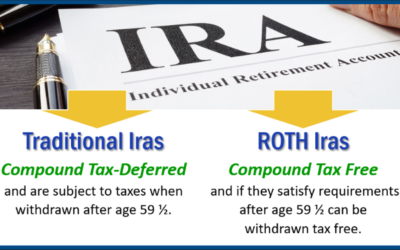

Using ROTH and Traditional IRAs as Strategies for Building Your Retirement in 2024

Everyone saving for retirement knows being proactive is very important. Having healthy retirement savings can help you live comfortably in your golden years. As stewards of our clients’ wealth, we get great satisfaction helping parents and grandparents contribute to...

Research

Key Themes for Bonds in the Second Half of 2024 | Weekly Market Commentary | July 22, 2024

The first half of the year was a challenging environment for a lot of fixed income markets, especially higher-quality markets.

Quarterly Economic Update Second Quarter 2024

Equity and bond markets began the second quarter of 2024 with a rough start, thanks to the Federal Reserve’s decision not to reduce interest rates due to stubbornly high inflation rates. However, during the quarter, strong performances from companies tied to...

Key Themes for Stocks in the Second Half of 2024 | Weekly Market Commentary | July 15, 2024

With the release of the LPL Research Midyear Outlook 2024: Still Waiting for the Turn, in this week’s commentary we pull out key themes from the publication and add some context for our views given stocks have continued to rally — with Thursday a glaring exception as stocks sold off, somewhat surprisingly, after a good consumer inflation report.

Double-Digit Earnings Growth on Tap | Weekly Market Commentary | July 1, 2024

LPL Research believes stocks have gotten a bit over their skis, but earnings season may not be the catalyst for a pullback in the near term given all signs point to another solid earnings season and stocks have mostly performed well during the peak weeks of reporting season in recent years.