Blog

Key Tax Policy Differences: House vs. Senate Finance Bills

As lawmakers shape the next chapter of U.S. tax policy, notable differences have emerged between the House and Senate Finance Committee proposals. Financial professionals and investors should be aware of several key distinctions that could influence long-term planning:

FORBES RECOGNIZES DAN ROMERO AS A BEST-IN-STATE WEALTH ADVISOR

[Orange, CA] — [April 2025] – Daniel S. Romero, CFP® an independent LPL Financial advisor in Orange, CA has been recognized in this year’s list of the Forbes/SHOOK Best-in-State Wealth Advisors for his track record of success in the financial services industry....

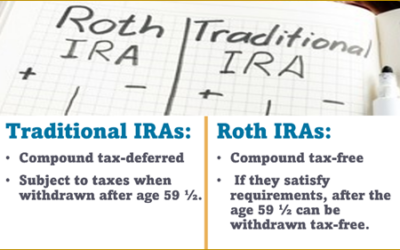

ROTH and Traditional IRAs – Strategies for Building Your Retirement in 2025

Retirement savers understand the importance of being proactive. Having healthy retirement savings can help you live comfortably in your later years. As stewards of our clients' wealth, we take great satisfaction in helping them prepare for retirement. We also enjoy...

Understanding the SECURE Act’s Impact on IRAs Left to Trusts

In 2019, the SECURE Act introduced significant changes to retirement accounts, and in 2022, the IRS provided proposed regulations that surprised many financial professionals. Now, in 2024, the IRS has finalized these rules, and they have a big impact on how IRAs left...

Research

Strategic Time Horizon Supports Allocation to Non-U.S. Equities | Weekly Market Commentary | June 30, 2025

With investor focus now squarely back on U.S. equities as new all-time highs are in sight, we dig into why strategic allocations should still consider, despite recent outperformance and multiple expansion, diversification into international equities

China’s Equity Market Diverges: A Shares vs. H-Shares | Weekly Market Commentary | June 23, 2025

Chinese equities have been a major focus for investors in recent months, with catalysts ranging from DeepSeek’s artificial intelligence (AI) advancements to tariffs and trade negotiations.

Inflation’s Importance to Financial Markets Cannot Be Overstated | Weekly Market Commentary | June 16, 2025

Inflation’s effects on the economy, monetary policy, and the financial markets are wide-ranging. Higher inflation can constrain economic growth, tighten financial conditions, drive interest rates higher and even restrain stock valuations — higher inflation dampens the present value of future earnings and, historically, correlates with lower stock valuations.

Q1 Buybacks Boost Stocks Amid Market Recovery | Weekly Market Commentary | June 9, 2025

Corporate buybacks, arguably one of the less-discussed catalysts, likely provided an additional boost to the market’s quick recovery. In this week’s Weekly Market Commentary, we explore recent repurchase activity, including who is buying back stock, how much, and how buyback companies have historically performed.