Blog

Welcome to 2022!

appy New Year and welcome to 2022! We hope that you and your family had an enjoyable holiday season. We look forward to what this new year has to offer.

For 2022, Let Gratitude Be Your Attitude!

Throughout the year, our goal is to provide our clients a wealth of consistent and pertinent information on financial markets and economic topics.

Proactive Year-end Tax Planning for 2021 and Beyond: Including Key Tax Change Proposals

One of our main goals as holistic financial professionals is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies.

Quarterly Economic Update Third Quarter 2021

Equity markets ended the third quarter with mixed results. The quarter started with strong earnings reports lifting many large U.S. stocks during the summer…

Research

Earnings Season Recap: Strong Growth, Big Upside, Now What? | Weekly Market Commentary | March 3, 2025

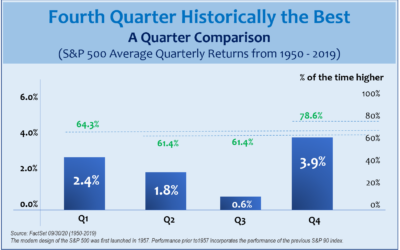

Fourth quarter earnings season is nearly complete, and it has been a good one. S&P 500 companies grew profits more than 18% year over year, according to FactSet data, with mega cap technology and financial companies doing most of the heavy lifting (about seven points of growth came from each). The Magnificent Seven grew earnings by an average of 37% and financials earnings jumped 50%.

Refinancing ZIRP | Weekly Market Commentary | February 24, 2025

The U.S. Treasury market is entering a significant transition period in 2025, facing both structural adjustments and all-too-familiar policy discussions. As the Federal Reserve’s (Fed) shift from a zero interest-rate policy (ZIRP) coincides with a substantial $7.5 trillion refinancing cycle, markets are also preparing for another round of debt ceiling negotiations.

Tariffs Ignite a Metals Melt-Up | Weekly Market Commentary | February 18, 2025

Stocks continued to climb the wall of worry last week and shrugged off tariff headlines, inflation volatility, and signs of a slowdown in retail spending.

Key Pillars of the Bull and Bear Cases in 2025 | Weekly Market Commentary | February 10, 2025

Expected continued steady economic growth should enable corporate America to grow profits at or near a double digit pace in 2025.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER