Blog

Quarterly Economic Update Second Quarter 2024

Equity and bond markets began the second quarter of 2024 with a rough start, thanks to the Federal Reserve’s decision not to reduce interest rates due to stubbornly high inflation rates. However, during the quarter, strong performances from companies tied to...

Converting 529 Plans to Roth IRA

A significant benefit has come to fruition on December 29, 2022. President Biden signed the “Consolidated Appropriations Act of 2023”, which included the “SECURE 2.0 Act of 2022”. Well, now, starting from January 1, 2024, any remaining funds in a 529 account can be...

Common Investing Mistakes

Whether someone has $50,000 or $5,000,000 to invest, there are several investment pitfalls that any investor can fall into. One of our goals as financial professionals is to help clients avoid these pitfalls, which could be very costly. We have come across many...

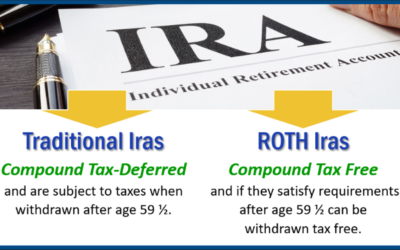

Using ROTH and Traditional IRAs as Strategies for Building Your Retirement in 2024

Everyone saving for retirement knows being proactive is very important. Having healthy retirement savings can help you live comfortably in your golden years. As stewards of our clients’ wealth, we get great satisfaction helping parents and grandparents contribute to...

Research

AI Infrastructure: A New Pillar of Economic Growth | Weekly Market Commentary | November 10, 2025

AI-related business investment is rapidly becoming a cornerstone of U.S. economic growth, marking a structural shift in how expansion is financed and sustained. In the first half of 2025, investment in information-processing equipment and software — largely driven by AI infrastructure — is a small yet mighty slice of the economy, yet contributed a majority to economic growth during that period.

From Micro to Macro: A Busy Week of Market-Moving Data | Weekly Market Commentary | November 3, 2025

The S&P 500 is over halfway through Q3 earnings season, and results have been impressive. Of the 318 companies that have reported results, 83% have surpassed earnings per share (EPS) estimates, notably above the 10-year average beat rate of 75%, according to FactSet.

Halloween Special: What Could Spook Markets | Weekly Market Commentary | October 27, 2025

With the stock market in record-high territory and up about 35% off the April lows, market participants clearly haven’t been too scared lately. But that doesn’t mean there aren’t plenty of things to worry about. Just because risks haven’t affected markets much lately — subprime auto loan bankruptcies notwithstanding — doesn’t mean they won’t in the future. In that “spirit,” as Halloween approaches, we discuss what scares us about the economy and financial markets.

Cockroaches, Canaries, and Credit Markets | Weekly Market Commentary | October 20, 2025

Corporate credit markets represent a vital component of the global financial system, providing businesses with essential capital for operations, growth, and strategic initiatives. These markets can, in general, be segmented into four distinct categories: investment-grade bonds, high-yield bonds, bank loans, and private credit.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER