Blog

Special Tax Report

Helpful Information for Filing 2023 Income Taxes and Proactive Tax Planning for 2024 Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to identify as many tax saving opportunities...

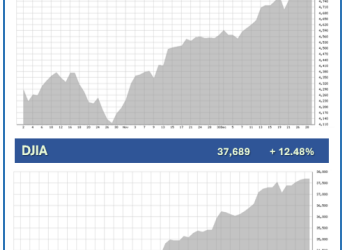

Quarterly Economic Update Fourth Quarter 2023

2023 is in the books and the last quarter left investors looking forward to a bright and happy new year. Historically, equities typically have advanced in the fourth quarter, and we can now add 2023 to that statistic. We entered the fourth quarter with strong...

Welcome to 2024!

Happy New Year and welcome to 2024! We hope that you and your family had an enjoyable holiday season. We thank you for giving us the opportunity to help you pursue your financial goals. We are excited to see what the new year will bring us. Overall, 2023 was a good...

Outlook 2024: A Turning Point

In 2024, we believe markets will make a definitive turn to a more recognizable place. En route, the transition will be marked by meaningful shifts in a few key areas. Inflation is going down. The risk of a recession is bubbling up again as the effect of post-pandemic...

Research

It’s Go Time for the Federal Reserve | Weekly Market Commentary | August 26, 2024

A soft landing looks achievable, barring any shocks. Disinflation while preserving labor market strength is only possible with anchored inflation expectations, so an independent and credible central bank is key. One of the best concepts in the speech for investors to understand is the current data shows an evolving macro landscape. The jury is still out on if the Fed can successfully manage the risks to both sides of their dual mandate.

Stock and Bond Market FAQs From the Field | Weekly Market Commentary | August 19, 2024

Every year as the summer months draw near their end, LPL Financial hosts its annual conference for financial advisors. While the conference is an excellent opportunity for advisors to expand upon professional interests, discover ways to enhance their impact on clients, and connect with industry experts — learning is a two-way street.

Pullbacks Are Common but Painful | Weekly Market Commentary | August 12, 2024

Like a stubbed toe, pullbacks in the market are inevitable, something investors tend to forget during periods of low volatility.

Thoughts on Global Selloff and the Dollar’s Path to Decompressing | Weekly Market Commentary | August 5, 2024

After the sharp August 5 decline, equities are nearing an attractive entry point. LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, while actively monitoring signs of bottoming. LPL Research continues to preach patience before buying this dip. Bottoming is a process.