Blog

Proactive Year-end Tax Planning for 2023 and Beyond

One of our main goals as holistic financial professionals is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies. Staying current on the ever-changing tax environment is a key component...

Traditional and ROTH IRAs – Strategies for Building Your Retirement

Everyone saving for retirement knows being proactive is very important. The concept of not preparing and relying on a government-sponsored retirement is a risky and unreliable practice. Having healthy retirement savings can help you live comfortably in your golden...

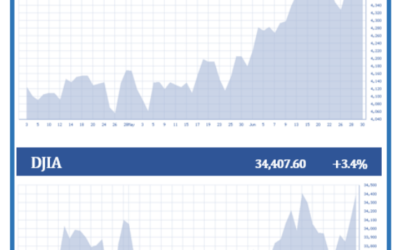

Quarterly Economic Update | Second Quarter 2023

The second quarter of 2023 tested even the most seasoned of investors. It was a quarter that included the U.S. reaching a debt ceiling agreement, the Federal Reserve pausing their aggressive interest rate hikes, and bank failure fears starting to subside. During the...

Ideas to Help Prepare for a Recession

For the last several months, talk of a recession has been making news headlines. Analysts and investors have been speculating if, when, and how bad of a recession the U.S. could experience. News sources have resembled Paul Revere proclaiming, “a recession is coming!”...

Research

Grand Ideas at the Grand Tetons | Weekly Market Commentary | August 25, 2025

As central bankers, economists, and policymakers gathered last weekend in Wyoming’s Grand Teton National Park for the 2025 Jackson Hole Economic Symposium, the Federal Reserve (Fed) found itself at a critical juncture marked by political pressures, personnel changes, and internal divisions over monetary policy direction.

Earnings Season Delivered | Weekly Market Commentary | August 18, 2025

As we wrote on August 11, companies have done a good job overall adjusting to tariffs so far, which was evident during earnings season. While several factors have helped mute the recent tariff effects, companies will experience more cost pressures in the months ahead.

Stocks Sailing Smoothly Through Policy Crosscurrents So Far | Weekly Market Commentary | August 11, 2025

We have been pleasantly surprised by how well stocks have handled the sharp increase in tariffs. Since the market low from the early April tariff scare, the S&P 500 Index has gained more than 28%.

Seven Takeaways From a Dizzying Week For Markets | Weekly Market Commentary | August 4, 2025

Last week was one for the ages in terms of the number and magnitude of events and data points for investors to digest. A Federal Reserve (Fed) meeting, the monthly jobs report, and the peak week of earnings season would be enough to qualify as a busy week.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER