Blog

Foundational Information That Successful Investors and Savers Understand!

Like many other savers and investors, you may be worried that we are headed toward more challenging economic times.

Quarterly Economic Update Second Quarter 2022

The first half of 2022 has been a nightmare for even the most seasoned of investors.

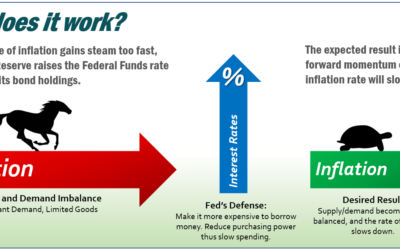

Understanding Rising Interest Rates

During the last few years, borrowers and spenders have enjoyed historically low interest rates.

DANIEL S ROMERO, CFP® RECOGNIZED IN FORBES AS A 2022 BEST-IN-STATE WEALTH ADVISOR

Daniel S. Romero, CFP® of Romero Wealth Management was recently ranked No. 60 in California in Forbes’ 2022 Best-In-State Wealth Advisors list.

Research

Market Update: Tariff Pause Boosts Sentiment, Fed Steady | Weekly Market Commentary | May 19, 2025

In just a matter of hours last week, investors apparently decided that stocks were on sale, and it was time to buy. But nothing materially changed as consumers were still pessimistic about the future, firms were on the sidelines waiting to deploy capital amid tariff uncertainty, and the Federal Reserve (Fed) remained committed to their “Wait and See” stance.

Bulls Are on Trial | Weekly Market Commentary | May 12, 2025

Earnings continued to come in better-than feared, but “tariff uncertainty” continued to get flagged on most conference calls. The Federal Reserve (Fed) kept rates unchanged and stuck to its patient approach with monetary policy, despite notable downgrades to economic growth estimates and rising recession probabilities since their last meeting.

Finding Value Among the Muni Market Malaise | Weekly Market Commentary | May 5, 2025

The municipal bond market faced significant volatility in April, driven by spillovers from a turbulent Treasury market. Treasury yields were pressured higher by rising inflation expectations; the Federal Reserve’s cautious policy stance, reduced foreign demand; hedge fund deleveraging, portfolio shifts toward cash, and structural illiquidity.

Softer Tone on China Is Encouraging, but Some Caution Still Advised | Weekly Market Commentary | April 28, 2025

The softer tone toward China from the White House, President Trump’s pledge not to fire Federal Reserve (Fed) Chair Jerome (Jay) Powell, and renewed optimism about Fed rate cuts all helped drive a strong market rebound last week.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER