Blog

When Volatility is Rising, Boring is Beautiful: Part II…

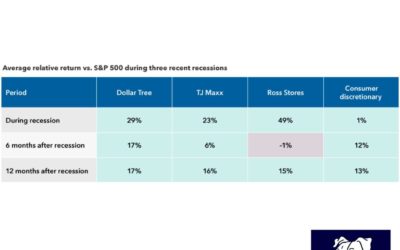

In last week’s email on “….Boring is Beautiful: Part I,” we covered the railroad industry. This week we are covering well-run treasure hunt retailers.

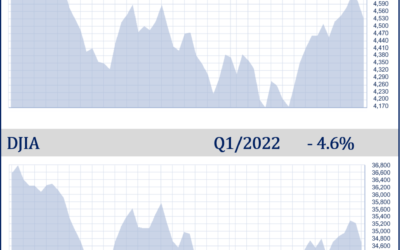

Market Downturns: Uncomfortable But Not Uncommon

After two solid years of strong returns, equity markets are currently experiencing a significant downfall in 2022.

Quarterly Economic Update First Quarter 2022

The past few years have proved the Greek philosopher Heraclitus right when he proclaimed that, “the only thing constant is change.”

Proactive Retirement Strategies Using the SECURE Act

In February of 2022, the IRS and Department of Treasury released 275 pages of proposed regulations to implement the SECURE Act…

Research

Revising Our S&P 500 Target Amid a Storm of Uncertainty | Weekly Market Commentary | April 21, 2025

With little visibility into where tariff rates shake out and the effects on earnings, it’s hard to have much conviction in a year-end S&P 500 target. Given the high degree of uncertainty, we use scenarios and a wider range to get more comfortable with our target and to increase our odds of accuracy (though we recognize these targets are more art than science).

Decent Chance Stock Market Bottom Is in but Far From Certain | Weekly Market Commentary | April 14, 2025

This week was one of the most volatile weeks in the history of the stock market. That excludes the historic two-day decline on Thursday and Friday the week before (April 3–4). The S&P 500 dropped 1.6% on Tuesday, April 8, surged 9.5% on Wednesday, April 9 (the third biggest up day since 1950), fell 3.5% on Thursday, April 10, and jumped 1.8% on Friday, April 11. The S&P 500 ended up nearly 6% for the week.

Tariff Turmoil: Where Do We Go From Here? | Weekly Market Commentary | April 7, 2025

Markets got quite a surprise from the Trump administration last week in the form of tariffs above even the most aggressive forecasts, increasing the risks to economic growth and corporate profits.

Tariff Uncertainty Facing Stocks to Start Clearing Soon | Weekly Market Commentary | March 31, 2025

Wednesday is the big day when the Trump administration will provide more clarity on their tariff plans. The latest news has been a mix of encouraging talk about narrow reciprocal tariffs and deep and biting auto (and auto parts) tariffs. It’s tough to lay out a tariff playbook for investors right now, so our advice is to wait and see. Markets and corporate America will need time to digest the information and figure out their next move. As potential dip buyers, we’re not in a big hurry.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER