Blog

Anticipating Rising Interest Rates

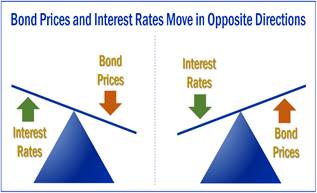

Interest rates play a crucial role in the American economic system. They influence the return on savings, the costs of borrowing and can have a bearing on the direction of many investments.

Focusing on Factors You Can Control

Every investor normally has personal goals in mind that they would like to achieve.

Quarterly Economic Update: Second Quarter 2021

In the first half of 2021, investors welcomed a new administration in the United States of America, saw the reopening of many countries, experienced volatility in equity markets…

Embracing Fiduciary Excellence

Our firm was founded on the principles of integrity, professionalism and exceptional client service. We are also deeply committed to continuous improvement.

Research

U.S. Exceptionalism: Is It Still Intact? | Weekly Market Commentary | February 3, 2025

With China’s DeepSeek pressuring investors to take a closer look at the current environment of artificial intelligence (AI) development within the U.S., some are taking a moment to question the accuracy of a much larger idea — American Exceptionalism.

Is the Bond Market Worried About Inflation? | Weekly Market Commentary | January 27, 2025

The Federal Reserve (Fed) cut interest rates last September and, to date, the central bank has lowered rates by 1%. But over the same period, long-term Treasury yields are higher by 1% (per the 10-year Treasury yield).

New Year, Same Bull Market? | Weekly Market Commentary | January 13, 2025

As the new year officially gets underway, there’s the usual sense of renewed optimism and excitement over new opportunities.

Evaluating Stock and Bond Market Predictions From 2024 | Weekly Market Commentary | January 6, 2024

With 2024 fully behind us, it’s a good time to celebrate our winning calls from last year while also reviewing some mistakes to learn from them and improve our process. The good news is we got more right than wrong last year, but there were some misses. Some course corrections helped. Perhaps the most impactful decision we made was to recommend investors stay fully invested in equities at benchmark levels throughout the entire year despite expecting a stock market pullback around Election Day.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER