Blog

Key Tax Policy Differences: House vs. Senate Finance Bills

As lawmakers shape the next chapter of U.S. tax policy, notable differences have emerged between the House and Senate Finance Committee proposals. Financial professionals and investors should be aware of several key distinctions that could influence long-term planning:

FORBES RECOGNIZES DAN ROMERO AS A BEST-IN-STATE WEALTH ADVISOR

[Orange, CA] — [April 2025] – Daniel S. Romero, CFP® an independent LPL Financial advisor in Orange, CA has been recognized in this year’s list of the Forbes/SHOOK Best-in-State Wealth Advisors for his track record of success in the financial services industry....

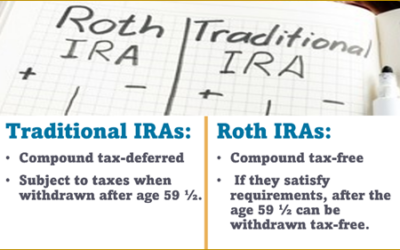

ROTH and Traditional IRAs – Strategies for Building Your Retirement in 2025

Retirement savers understand the importance of being proactive. Having healthy retirement savings can help you live comfortably in your later years. As stewards of our clients' wealth, we take great satisfaction in helping them prepare for retirement. We also enjoy...

Understanding the SECURE Act’s Impact on IRAs Left to Trusts

In 2019, the SECURE Act introduced significant changes to retirement accounts, and in 2022, the IRS provided proposed regulations that surprised many financial professionals. Now, in 2024, the IRS has finalized these rules, and they have a big impact on how IRAs left...

Research

The Productivity Advantage: Powering Economic Growth in 2026 | Weekly Market Commentary | January 26, 2026

Productivity growth is the key mechanism that allows the U.S. economy to expand above its long‑run trend without reigniting inflation.

Earnings Preview: Double-Digit Streak Likely to Continue | Weekly Market Commentary | January 12, 2026

Fourth quarter earnings season unofficially kicks off this week with a dozen banks and asset managers in the S&P 500 slated to report.

Evaluating Our 2025 Forecasts: Equity, Fixed Income, and the U.S. Economy | Weekly Market Commentary | January 5, 2026

With 2025 behind us, it’s a good time to celebrate some of our better forecasts from last year while also reviewing some misses we can learn from. In our view, we got more right than wrong last year, but there were some misses among our tactical asset allocation recommendations. For the second straight year, as the bull market marched on, the most impactful decision we made was probably to recommend investors stay fully invested in equities at benchmark levels throughout the entire year despite elevated valuations.

Navigating Neutral: Fed Policy Key for Fixed Income Markets in 2026 | Weekly Market Commentary | December 22, 2025

Our 2026 fixed income outlook calls for a rangebound rate environment, cautious Fed policy, and a modest increase in spreads within corporate credit markets.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER