Blog

Quarterly Economic Update First Quarter 2024

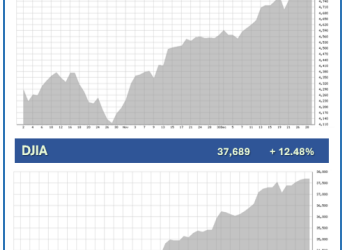

The first quarter of 2024 continued to reward investors who stayed the course and enjoyed strong returns in 2023 as the momentum of 2023’s year-end rally took another step forward. Both equity and bond markets performed well after the Federal Reserve confirmed that...

Proactive Planning: Sunsetting Estate Tax Law

Communication and planning have always been essential when attempting to transfer wealth efficiently. Tax planning can also play a significant role for larger estates. Currently, the federal estate tax laws are very generous, however, when the 2017 Tax Cuts and Jobs...

Special Tax Report

Helpful Information for Filing 2023 Income Taxes and Proactive Tax Planning for 2024 Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to identify as many tax saving opportunities...

Quarterly Economic Update Fourth Quarter 2023

2023 is in the books and the last quarter left investors looking forward to a bright and happy new year. Historically, equities typically have advanced in the fourth quarter, and we can now add 2023 to that statistic. We entered the fourth quarter with strong...

Research

Happy Anniversary Bull Market | Weekly Market Commentary | October 13, 2025

Year three of this bull market was a strong one. After a bit of a slow start — the S&P 500 rose 21.4% during the first year of this bull compared with the average first-year gain near 40% — year two was a catch-up year with a 32.2% gain vs. a second-year average of 12.4%. Then in year three, a year that had produced an average gain of only 5.2% historically, the S&P 500 rallied 16.1% (through October 8, 2025, before Friday’s sell-off). As noted in the “After a Strong Third Year, This Bull is Ahead of Schedule” chart, the nearly 89% gain in the S&P 500 since this bull market began on October 12, 2022 (excluding dividends), is well ahead of the average and median three-year advances for all bull markets since 1950.

Q3 Earnings Season Preview: Little Suspense | Weekly Market Commentary | October 6, 2025

Earnings season is usually predictable quarter to quarter in the absence of economic inflection points.

Client Letter | Stock Market Fundamentals Outweigh Shutdown Drama | October 01, 2025

The October 1 deadline has passed, and the U.S. government has shut down. While political gridlock is never ideal, history suggests that shutdowns tend to be short-lived and have minimal sustained impact on the economy or the stock market. They are largely about...

Equity Market Melt-Up Cools as Government Shutdown Looms | Weekly Market Commentary | September 29, 2025

U.S. equity markets have bucked the weak September seasonality trend (thus far) and rallied to fresh highs this month, with the S&P 500 holding onto a 2.8% monthly gain as of September 26.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER