Blog

Welcome to 2024!

Happy New Year and welcome to 2024! We hope that you and your family had an enjoyable holiday season. We thank you for giving us the opportunity to help you pursue your financial goals. We are excited to see what the new year will bring us. Overall, 2023 was a good...

Outlook 2024: A Turning Point

In 2024, we believe markets will make a definitive turn to a more recognizable place. En route, the transition will be marked by meaningful shifts in a few key areas. Inflation is going down. The risk of a recession is bubbling up again as the effect of post-pandemic...

Can Money Determine Your Happiness?

In 1964, Paul McCartney and John Lennon of the Beatles co-wrote the hit song “Money Can’t Buy Me Love” but, could it bring you happiness? In 2010, Princeton University conducted a study which found that day-to-day happiness rose as annual income increased, but then...

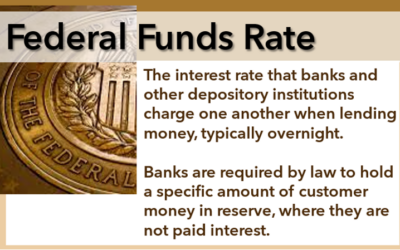

The Federal Reserve and Interest Rates

The Federal Reserve left interest rates unchanged at their meeting on November 1st. They continued to state that they are closely tracking inflation and the health of the economy to determine their future decisions. During this session, the central bank voted...

Research

No Risk-Free Path | Weekly Market Commentary | September 22, 2025

At its September meeting, the Federal Open Market Committee (FOMC) cut the federal funds target range by 25 basis points to 4.00%–4.25%, marking the first rate reduction of the year after eight months of holding steady.

The Intersection of Political Uncertainty and Global Debt Markets | Weekly Market Commentary | September 15, 2025

While much has (rightfully) been made of the ongoing debt and deficit spending here in the U.S., the fiscal positions of major developed economies reveal profound disparities in debt management and long-term trend sustainability. Mounting government obligations could have significant implications on economic stability and monetary policy flexibility if not remedied.

Stocks Are Following the Market’s Playbook | Weekly Market Commentary | September 8, 2025

The S&P 500 has gained more than 30% since its low on April 8, 2025, and is up 5% since the index fully recovered its early-year correction losses on June 27, 2025 (with a close of 6,144).

Calm Before the Storm: Can This Rally Continue in September? | Weekly Market Commentary | September 2, 2025

The end of Labor Day weekend often arrives with a bittersweet tone — it’s a final salute to summer’s warmth and leisure before the cool air of fall arrives for much of the country.

CONTACT US

Romero Wealth Management, Inc.

2582 N. Santiago Blvd, Suite A

Orange, CA 92867 (map it)

Phone: 714 547-8787

Fax: 714 547-8080

DOWNLOAD THE APP

APP COMING SOON!

SIGN UP FOR OUR NEWSLETTER